Summary

- Q3 revenues not expected to show any sequential improvement.

- Cash flow situation needs to improve as interest rates rise.

- Stock falls below 50-day moving average.

While US markets were rallying across the board on Thursday, one name not taking off was aerospace giant Boeing (BA). Reports out in the morning were that the company was facing a new defecton the 787 Dreamliner, with this plane's increasing issues providing a major headwind for the company's results. With the stock also falling below a key moving average today, sentiment is rather poor currently, so investors are hoping that this month's earnings report can be a turning point for shares.

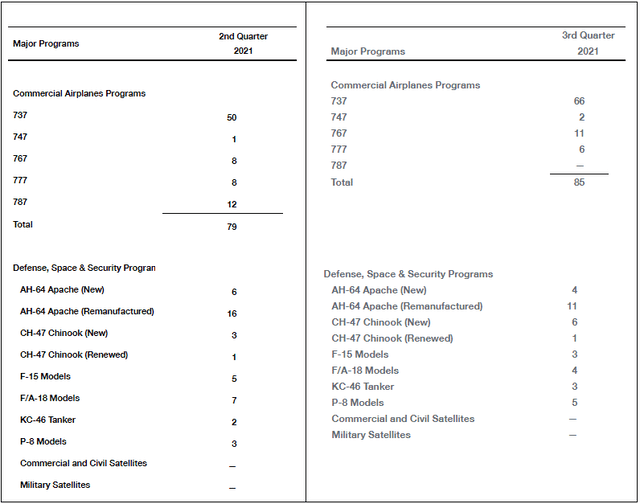

For Q3, total commercial deliveries rose by 6 planes sequentially, as a nice jump in the 737 was mostly offset by the stoppage in 787 deliveries. While the commercial division did show some progress, the defense, space, and security program did not, seeing deliveries decline from 43 to 37. The graphic below shows an overall breakdown of quarterly deliveries.

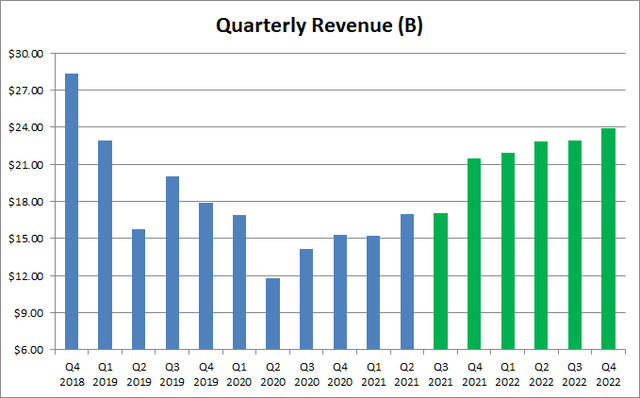

The company is scheduled to report third quarter results on October 27th. Currently, the street is looking for $17.01 billion in revenue, which would be growth of nearly 20.3% over the prior-year period. The problem though is that estimate has come down quite a bit, as going into this year the average Q3 street forecast called for $20.26 billion, and just three and a half months ago the Q3 average was north of $21.55 billion.

Q3 estimates have come so much that the current average basically calls for revenues to be flat as compared to Q2 of this year. As the chart below shows, it's been a slow rebound from the pandemic low, and if the 787's problems aren't fixed soon, we may not get back to Q1 2019 levels until late next year, which is a lot later than many were hoping for in recent quarters.

The company is working its way back to sustainable profitability, but it really needs the top line to take off for that situation to be certain. I will be very curious to hear management's commentary on inflation pressures during the conference call, and how the supply chain is holding up into Q4. Don't forget, Boeing took on a lot of debt to get through the pandemic, so higher interest costs are limiting potential profits as compared to pre-virus levels.

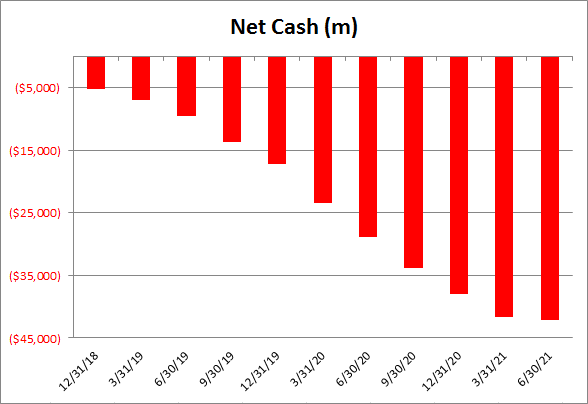

Perhaps one turning point that could help shares if is Boeing is finally able to be free cash flow positive again. Q2's cash burn was the lowest we've seen in a couple of years, but the net debt pile still increased by $562 million for that three-month period. As the chart below shows, Boeing's net borrowings pile has skyrocketed by nearly $37 billion over the last 10 quarters.

The debt situation gets even more interesting with the potential for the Federal Reserve to start tapering next month. While yields have come down the past couple of days, the 10-Year US Treasury yield is still up more than 60 basis points so far this year. Until Boeing can get its debt pile down in a meaningful way, rising interest rates could further add to interest expenses if the company has to refinance its large debts that are coming due overtime at higher rates.

Currently, the average price target on the street is more than $272, implying about 25% upside from current levels. However, the stock has been in a general downtrend in recent months, and it lost the 50-day moving average (pink line below) on Thursday. With the stock below that key technical level as well as the 200-day (purple line), falling moving averages could add some technical selling pressure in the short term.

It's been a rather disappointing year so far for Boeing, so investors are hoping that the Q3 earnings report in a couple of weeks can start to turn things around. Problems with the 787 and 737 programs have led revenue estimates for 2021 to fall by more than $4.5 billion so far this year, pushing back the full revenue recovery timeline deep into 2022. Perhaps Boeing can get back to positive free cash flow soon so that it can start getting its debt pile down in the coming years, which would certainly help efforts to return to sustainable profitability. On Thursday, shares lost the 50-day moving average, only adding to the negative sentiment surrounding the name. Analysts think this stock can rally 25% from here, but Boeing needs a major turning point for that to happen.