GOLD, CRUDE OIL, COMMODITIES – TALKING POINTS

- Gold prices eye Friday’s US non-farm payrolls report for direction

- NFP print key to Fed’s economic outlook, Jackson Hole in view

- Crude oil prices trade down to support at key moving average

The price of gold is largely unchanged this week despite a lackluster US Dollar. Last week, gold prices rallied after Fed Chair Jerome Powell tempered hawkish expectations for tapering later this year. The Fed Chief cited the labor market specifically, which seemed to imply that for now, inflation data will be thrown to the wayside. That makes sense after months of driving home the transitory narrative. Now that the markets appear to have capitulated on that view, Fed commentary is more keenly focused on jobs.

That said, this week’s non-farm payrolls report, slated to cross the wires on Friday, may be of particular importance to commodity prices. According to a Bloomberg survey, analysts expect an addition of 875k jobs in July. That would see 25k more jobs added compared to June’s 850k figure. The same survey sees the unemployment rate dropping to 5.7% from 5.9%.

The Fed’s focus is on jobs, which makes this NFP report of particular importance to gold prices. That may translate to relatively outsized volatility if the data is well off the mark concerning estimates. Beyond the jobs data, markets will turn their eyes to the Jackson Hole Economic Symposium scheduled for August 26-28. Mr. Powell is slated to speak, where many expect a potential signal on the Fed’s taper timeline. With that in mind, a miss on Friday’s numbers could feed the view that the Fed will hold off on announcing such a timeline. Alternatively, a better-than-expected print could fuel hawkish bets, which would bode poorly for gold prices.

Elsewhere,crude oil pricesfell to start the week. The drop comes amid demand-side worries, which were amplified at the start of the week when a purchasing managers’ index (PMI) showed a growth slowdown in Chinese manufacturing activity. That coincided with poor PMI data from other Asian economic hubs, including Thailand and Malaysia.

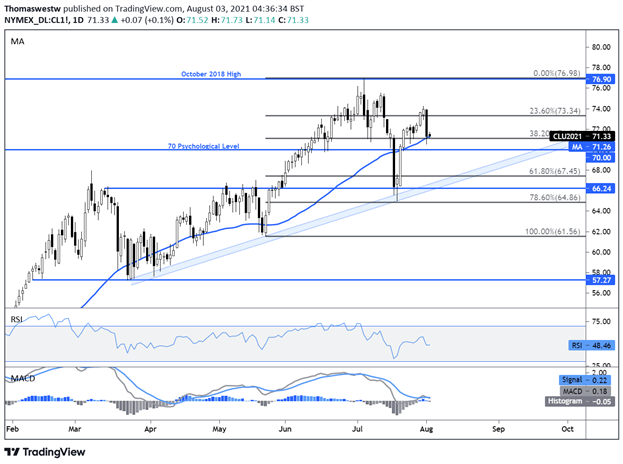

GOLD TECHNICAL FORECAST:

Gold prices are trading closely below the 200-day Simple Moving Average (SMA). An area of congestion, which has affected prices on both the support and resistance side, appears to be proving a degree of support currently. A bullish move would need to clear the 200-day SMA before moving higher. on the downside, a major level could be the psychologically imposing 1800 level.

GOLD DAILY CHART

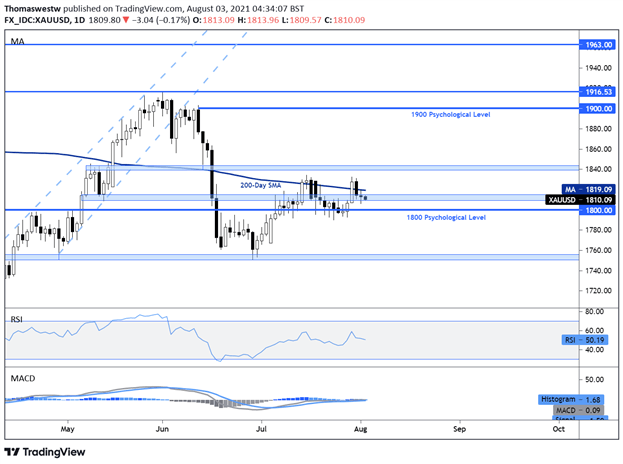

CRUDE OIL TECHNICAL FORECAST

Crude oil prices pulled back to the 50-day Simple Moving Average (SMA), which has offered a level of support earlier in the year. A degree of confluent support from the 38.2% Fibonacci retracement is seen on the daily chart. A move higher would turn the focus back to the 76.90 October 2018 high that price failed to maintain above in July.

CRUDE OIL DAILY CHART