Banks' Q3 earnings to reflect reserve releases, weak loan activity, analysts say

seekingalpha2021-10-11

- Banks start reporting their Q3 results on Wednesday, and they're likely to benefit from another quarter of loan loss reserve releases and increased stock buybacks as loan growth remains tepid, analysts said.

- Traditional banking operations remained under pressure in the quarter as they lose market share to competition, loan activity has been weak, and margin pressure persists, writes Odeon Capital Markets analyst Dick Bove in a note to clients.

- Consumer loan activity is expected to show improvement, though it's still below prepandemic levels. "Loan growth isn't this quarter's story, but inflection likely comes by year end," said Morgan Stanley analyst Betsy Graseck in a note.

- She expects stronger guidance for net interest income as 10-year Treasury 12M-forwards moved up ~40 bps from the Aug. 3 trough.

- On the capital markets side of the business, merger and acquisition activity has been "unusually strong", underwriting results are "mostly positive", and trading activity has been "disappointing," Bove said.

- CFRA analyst Kenneth Leon expects standout Q3 results from Goldman Sachs(NYSE:GS), JPMorgan Chase(NYSE:JPM), and Morgan Stanley(NYSE:MS)on capital market and asset/wealth performance.

- Leon notes that Q3 is usually the weakest quarter of the year for banks. Q3 net interest income for large banks are expected to be in the flat to low-single-digit gains, he adds.

- "We are likely to see low to moderate credit risk for credit cards, commercial and industrial loans, commercial real estate, and trading/counterparty losses," Leon said in a note.

- Analysts' picks:Going into earnings season, Morgan Stanley's Graseck likes JPMorgan Chase (JPM) as she expects improvement in card loan growth and sees potential for the bank to boost its net interest margin by reinvesting some excess liquidity in longer dated paper.

- She also notes Synchrony Financial(NYSE:SYF)on the expectation that loan growth turns positive in the quarter and consumer credit quality continues to stay strong.

- State Street(NYSE:STT)stands to gain as it's one of the most rate-sensitive names in Graseck's coverage.

- Jefferies analysts increase their Q3 EPS estimates for Goldman (GS) and Morgan Stanley (MS) to reflect strength in investment banking, particularly M&A, and "still-healthy, but moderating trading (below 1H21). Inflows and positive markets should contribute to durable streams."

- Their Goldman (GS) estimate increases 10% to $9.72 Morgan Stanley (MS) estimate by 12% to $1.71.

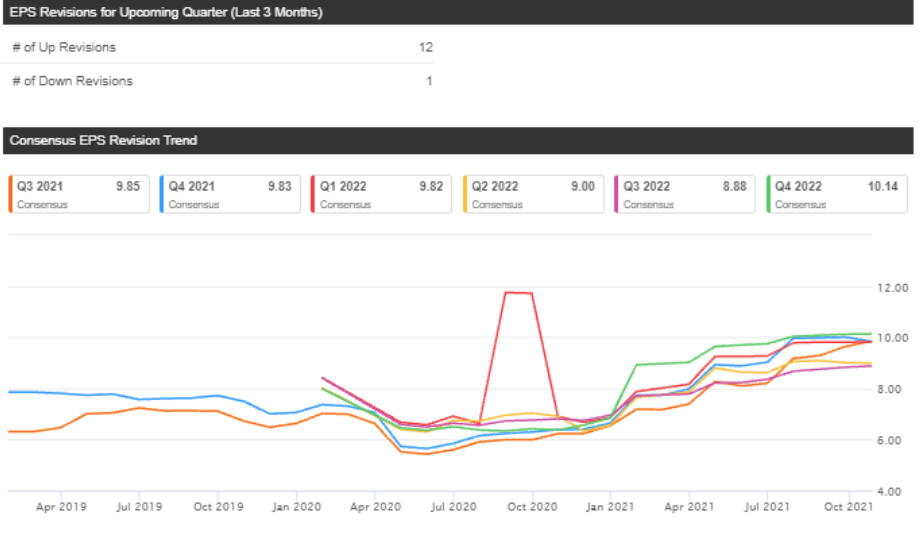

- Other analysts have been boosting quarterly EPS estimates for Goldman as seen in the chart below.

- Looking at regional banks and specialty finance, "Outlooks will be key, and we expect positive management comments on peaking card payment rates and a potential bottoming in line utilization," writes Evercore ISI analyst John Pancari.

- He's constructive on Synchrony (SYF) and KeyCorp(NYSE:KEY). SYF is well positioned to capture market share in consumer lending as Delta concerns fade ahead of holiday season.

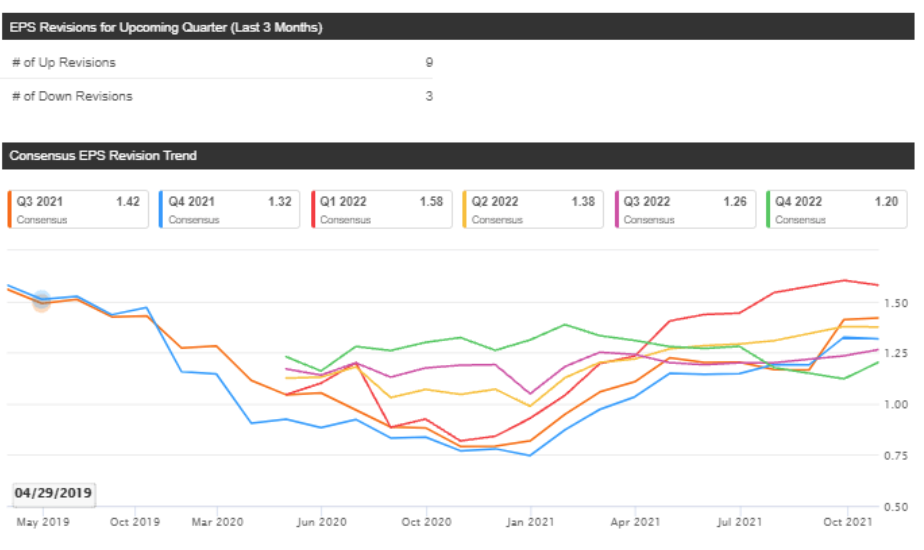

- Note that SA'sQuant rating on SYF is Very Bullish, assigning high grades for Growth and Profitability. In the past three months, analysts have increased its Q3 EPS estimates by 22%. See chart below.

- KeyCorp (KEY) management has commented that loans increased from June to August and momentum was continuing in August, Pancari said. In addition, the bank has observed record backlog in M&A, he added.

- Earnings schedule:Here's when the bigger financial firms are due to report earnings:

- Oct. 13: JPMorgan (JPM) and BlackRock(NYSE:BLK)

- Oct. 14: Bank of America(NYSE:BAC), Citigroup(NYSE:C), Morgan Stanley (MS), Wells Fargo(NYSE:WFC), and U.S. Bancorp(NYSE:USB).

- Oct. 15: Goldman Sachs (GS), PNC Financial(NYSE:PNC)

- Oct. 18: State Street (STT)

- Oct. 19: Synchrony Financial (SYF), Bank of New York Mellon(NYSE:BK)

- Oct. 21: Blackstone(NYSE:BX), KeyCorp (KEY)

- Oct. 22: American Express(NYSE:AXP)

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。