Investors may need to consider private equity to capture the returns that publicly traded stocks have provided

Stock prices can’t indefinitely grow faster than the economy. This provides a crucial reality check for U.S. stock-market bulls, many of whom believe stocks can continue outperforming the U.S. economy in perpetuity. Over the past decade, for example, the S&P 500SPX,+0.88%on an inflation-adjusted total-return basis has outperformed real U.S. GDP by an annualized margin of 11.9% to 2.0%.

Going forward, it could be the other way around, according to an argument advanced some years ago by Robert Arnott, founder of Research Affiliates, and William Bernstein, co-principal at Efficient Frontier Advisors. They pointed out that a portion of economic growth is attributable to non-public companies, such as startups and the like — a category they refer to as “entrepreneurial capitalism.”

By definition, economic growth that non-public companies generate will not show up in the stock market— which only reflects the performance of publicly traded corporations. Arnott and Bernstein estimate that share prices historically have grown about two annualized percentage points slower than the overall economy.

Such slippage has dire implications for the U.S. stock market’s future return. But I want to first discuss why the stock market’s stunning performance over the past decade was not due to economic growth. Instead, the bulk of that performance was due to three factors:

- Valuation changes: The S&P 500’s price/earnings ratio has doubled over the past decade.

- Increasing profit margins: The S&P 500’s operating margin over the past four quarters has averaged nearly two percentage points higher than it was a decade ago, according to data from Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

- Net buybacks: Over the past decade corporations have repurchased more shares than new shares they have issued. This has reduced the number of shares outstanding, and increased earnings per share.

To appreciate the impact of these three factors, consider that the S&P 500 now would trade below 1,600 if there had been no change at all over the past decade with each of these three dimensions. While the chance of such a perfect storm is so low that you might be inclined to dismiss it out of hand, Bernstein said in an interview that he wouldn’t discount the possibility.

Projecting the future

The picture this analysis paints about the U.S. stock market’s future isn’t pretty, assuming the U.S. economy grows at the same pace over the next decade as the last. In that case, the only way the market can produce annualized returns greater than the low single-digits is for the P/E ratio and profit margins to continue rising or for net buybacks to continue reducing the number of shares outstanding — or for some combination of these three factors to occur.

More likely, these three tailwinds will become headwinds. P/E ratios already are at or near the high end of their historical distribution, and they can’t go up forever. Profit margins also are at or near record levels and,as I argued earlier this week, there are good reasons to expect those margins to decline in coming years. While it’s possible that buybacks will outpace share issuance in coming years, that’s hardly a sure bet. Over the past 12 months, for example, there have been negative net buybacks — i.e. more shares have been issued than repurchased. In fact, Arnott pointed out in an email, for most of U.S. stock market history net buybacks have been negative.

One can also wonder if an even-greater share of economic growth in coming years will accrue to non-public equity. Andrew Karolyi, dean of Cornell University’s SC Johnson College of Business, said in an interview that private equity now plays a much bigger role than in the past. One possible future, he said, is that the growth of the public stock market lags that of the overall economy by an increasing amount.

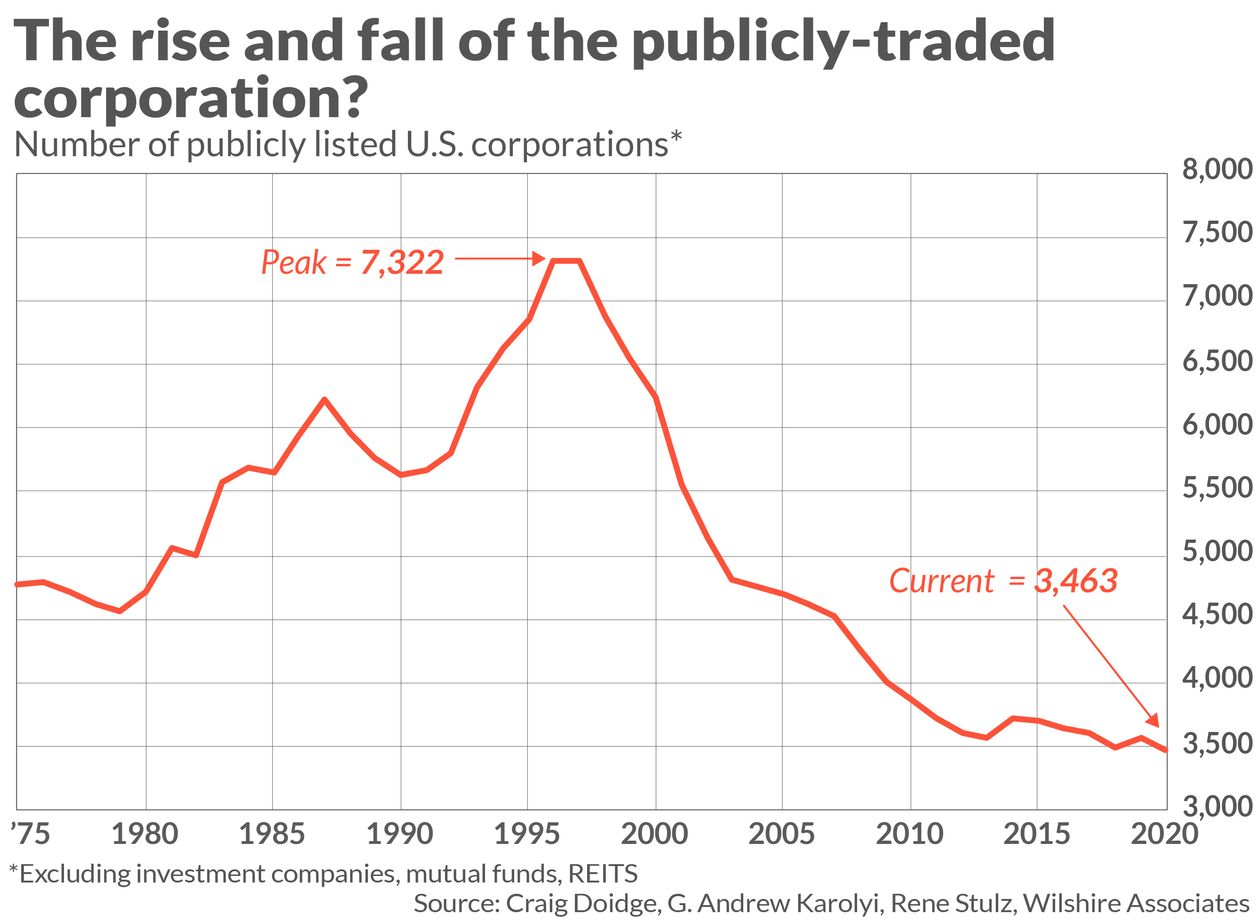

One measure of the declining economic importance of the public corporation is the decreasing number of publicly traded companies, as reflected in the chart below. This decline has been overlooked by many on Wall Street, given their focus on the red-hot IPO market. But, as Karolyi pointed out, even as more companies are coming to market, there have also been an increasing number of delistings.

For example, according to Refinitiv, through the end of May 2021 there was more than $1.6 trillion in domestic M&A activity, almost 50% higher than the previous calendar year that held the record for the most M&A activity for the first five months. We need to focus on both IPOs and delistings, Karolyi argued, just as demographers can only analyze population trends by focusing on births and deaths.

“The role of publicly traded corporations in the overall economy may be changing,” Karolyi said. Their possible life cycle paths are expanding to include many that don’t end in becoming publicly traded, for example, or waiting much longer before doing so. Given the abundant liquidity in the private equity market, he added, it may very well become the preferred exit strategy for many companies that previously would have gone public.

The bottom line? The past decade was extraordinary for publicly traded U.S. stocks. Don’t expect that to continue indefinitely.