GameStop Corp. widened its loss and posted revenue growth last quarter as it continued efforts to revitalize its business under a recently overhauled executive team and board of directors.

Despite the lingering pandemic and a shortage of new gaming consoles from Microsoft Corp. and Sony Group Corp., GameStop reported increased hardware and collectibles sales. However, its software sales fell around 2% from a year earlier during the quarter.

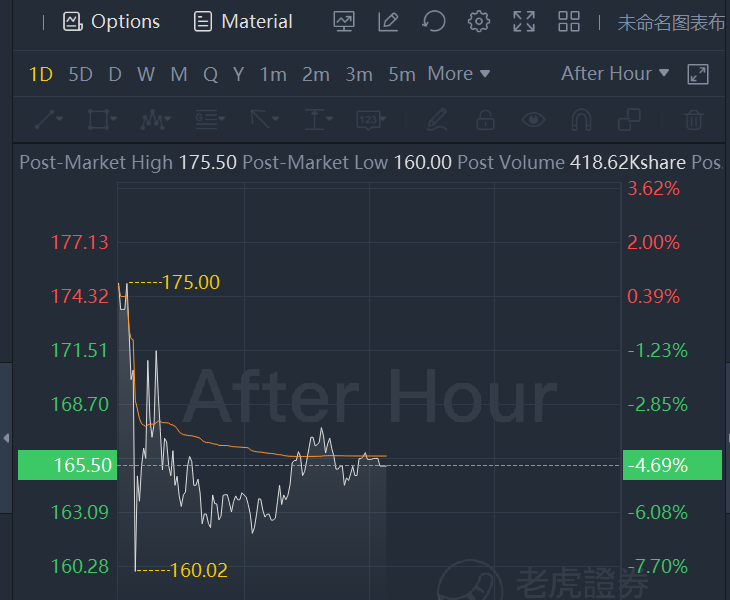

Shares in GameStop fell nearly 5% after the announcement to around $165 in early after-hours trading.

In June, GameStop named former Amazon.com Inc. veterans Matt Furlong and Mike Recupero as its chief executive and financial officers, respectively. Shareholders also voted Chewy Inc. co-founder Ryan Cohen as chairman and elected an entirely new slate of boardroom directors.

At least one of the company’s leadership changes hasn’t worked out. In late October, GameStop said in a securities filing that its operating chief and executive vice president, Jenna Owens, had resigned. She had joined the retailer in late March.

The moves came after a months long, social-media-fueled trading frenzy that helped GameStop’s stock price skyrocket at the start of the year. Shares then plummeted in February only to soar and then fall in March and again in May and June. During the third quarter, the stock’s price fluctuated from a low of about $170 to a high of roughly $220.

GameStop has reported annual losses for three consecutive years, as many console- and computer-game players have moved to downloading games over the internet, instead of buying the hard copies that the company specializes in selling. In addition, more people are downloading games on smartphones and tablets, and publishers are releasing more free games.

Grapevine, Texas-based GameStop on Wednesday reported a loss of $105.4 million in net income for the quarter ended Oct. 30, or $1.39 a share, compared with a loss of $18.8 million a year earlier. Net sales were $1.3 billion, up from $1.01 billion. The retailer said that new and expanded relationships with companies such as Samsung Electronics Co. and Razer Inc. helped to drive the growth.

GameStop has been focusing lately on growing its e-commerce business and improving customer service. In its latest earnings report, the company said it opened new offices in Seattle and Boston, describing the cities as “technology hubs with established talent markets.”

GameStop has also in recent months added new fulfillment centers in Reno, Nev., and York, Pa., and in September the company announced plans to hire up to 500 employees at a newly leased customer-service center in Pembroke Pines, Fla.

GameStop suspended issuing guidance on its prospects in March 2020, citing uncertainty due to the pandemic, and hasn’t resumed the practice since then. The company also hasn’t taken questions from analysts on its earnings calls this year, which remained the case on Wednesday. Mr. Furlong spoke briefly about GameStop’s third-quarter results and emphasized the company’s e-commerce push.

In a securities filing Wednesday, GameStop said that while most of its stores returned to normal operations in the second quarter of this year, some in Australia—its third largest market—have temporarily closed due to a resurgence of Covid-19 cases.