Markets dismiss central bank guidance amid investor uncertainty over US economic prospects

Traders dialled back their expectations on Thursday for how far the Federal Reserve would be able to lift interest rates, dismissing the US central bank’s own guidance as it tries to rein in inflation during the pandemic.

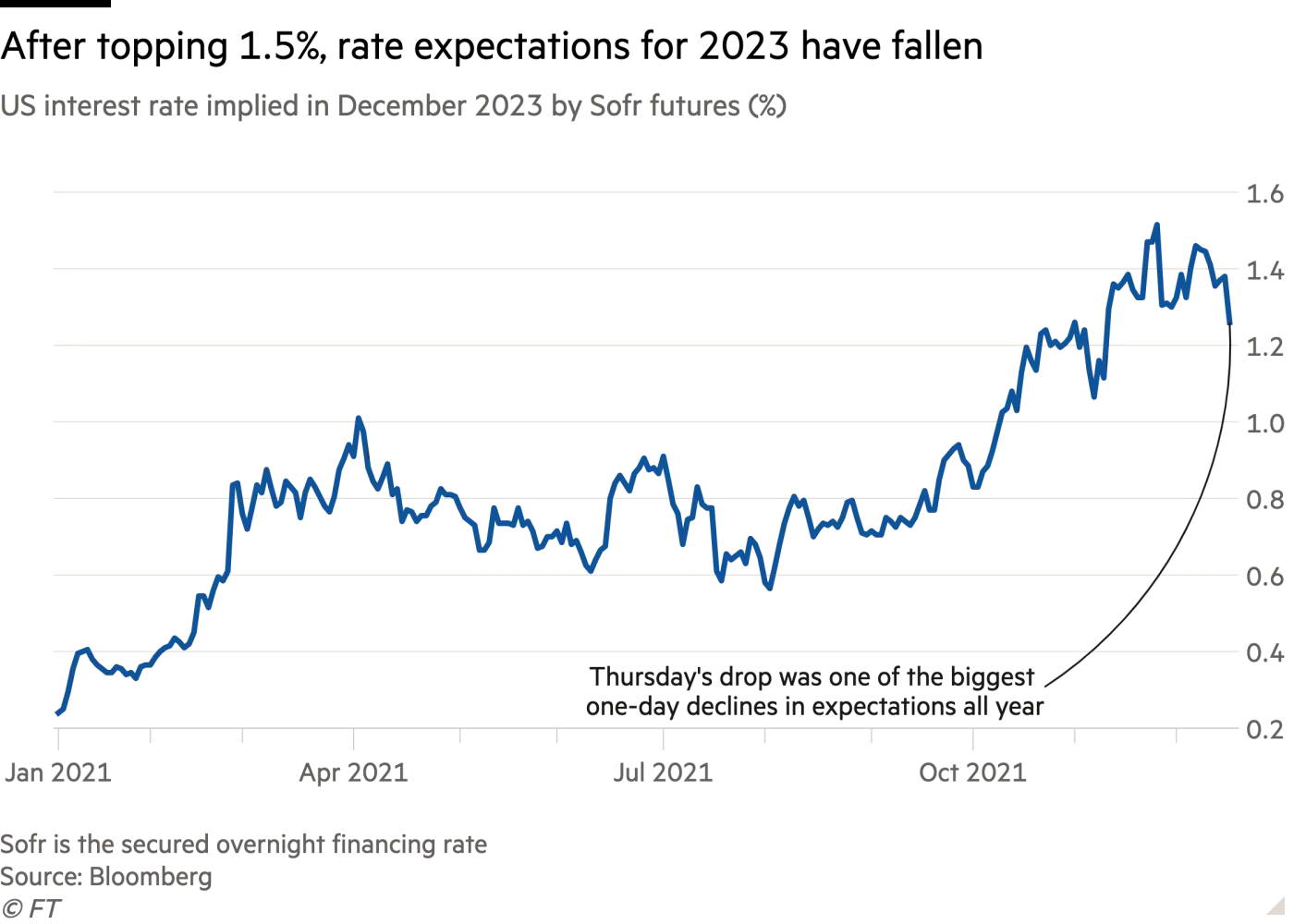

Trading in futures markets, which offers insight into how investors are positioning for changes to Fed interest rate policy in the years ahead, showed that money managers expected the US central bank’s overnight rate to rise to just 1.27 per cent by the end of 2023.

That was a full 0.11 percentage points below the 1.38 per cent rate implied on Wednesday, and compared to Fed policymaker’s projections for 1.6 per cent released yesterday.

Beyond 2023, trading in futures contracts for Sofr (the secured overnight financing rate) and eurodollars suggested the Fed would have trouble lifting rates any higher, in contrast to the views of a majority of Fed officials that interest rates would eventually climb to about 2.5 per cent.

Implied rates on Sofr and eurodollar contracts between 2024 and 2026 topped out at about 1.42 per cent, down from 1.5 a day prior.

The division between the markets and the Fed underlines the uncertainty investors have about the prospects for the US economy in the years ahead, as well as how aggressively the US central bank will need to act to tame inflation that last month rose by its fastest pace since 1982.

The Fed said on Wednesday it would more quickly remove pandemic-era stimulus and is ready to lift interest rates to combat inflation given the recovery in the labour market. Jay Powell, chair of the central bank, said that, with “inflation as high as it is, we have to make policy in real time”.

The so-called dot plot of interest rate predictions from individual Fed governors published on Wednesday showed three quarter-point rate rises in 2022 followed by another three in 2023.

Investors, by contrast, are now betting that a faster tightening cycle in 2022 could lead to fewer rate rises in the years ahead.

“The most logical conclusion is that the market just doesn’t believe the Fed will ever get past 1.5 per cent,” said Tom Graff, head of international fixed income at Brown Advisory. “With the Fed apparently ready to hike in early 2022, the market is determining that will result in fewer hikes total.”

Although a tightening of monetary policy is expected to tamp down inflation, some investors worry it may begin to crimp economic growth, putting a cap on how high the Fed can raise rates. Traders and investors also warned that the rapid shifts prompted by the pandemic, including the quick spread of the Omicron variant, could complicate the Fed’s plans.

“We think the moves may be driven by market concerns over Covid,” Gennadiy Goldberg, US rates strategist at TD Securities, said about the moves in short-term funding markets.

“There has been a significant increase in mentions of returns to offices being put on hold and holiday parties being cancelled, so investors may be concerned about the impact of Omicron on the economic recovery,” he added.

If the Fed’s dot-plot vision is realised, it would also put the US interest rate policy out of sync with some other big economies, most notably the EU. The European Central Bank said on Thursday it had ruled out the possibility of raising interest rates in 2022 despite higher inflation.

“It is hard to reconcile three to four Fed rate increases versus none for the ECB,” said Andrew Brenner, head of international fixed income at NatAlliance Securities.