As Warren Buffett prepares to put the finishing touches on his eagerly awaited annual letter toBerkshire Hathawayshare holders, the CEO has much to address.

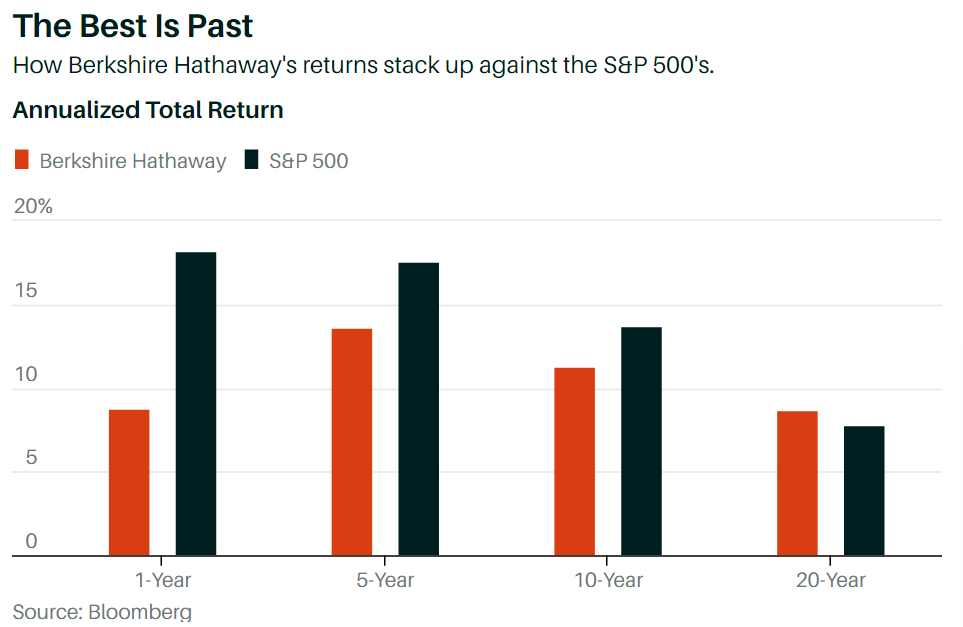

They include the underperformance of Berkshire(ticker: BRK.A and BRK.B) shares over the past one, five, and 10 years, Buffett’s cautious approach to new investments, and the spotty record of Berkshire’s acquisitions over the past decade.

Yet that letter—due out on Feb. 27, along with the annual report and fourth-quarter earnings—can help write Berkshire’s next chapter. All it would need is an announcement of the initiation of a dividend.

A dividend of 2% would be a good start, representing about 40% of projected 2021 earnings. It would probably lift the stock by broadening the base of potential investors to those who want or need dividends.

Berkshire has stepped up its share repurchases, buying back $15.7 billion of stock in the first three quarters of 2020, or about 3% of the shares outstanding. But with $146 billion in cash and projected earnings this year of $25 billion, it has the ability to pay a dividend as well as to buy back stock.

“Berkshire should pay a dividend; this would increase the appeal of the shares to investors who want current income,” says David King, co-manager of the Columbia Flexible Capital Income fund. “Given Berkshire’s size and financial strength, the company is unique in paying no dividend and that should be changed.”

Berkshire hasn’t paid a dividend for over 50 years. Why? Buffett’s view has been that a dollar in his hands is better than one in the hands of shareholders. That was long the case as Buffett worked his investment and acquisition magic, but it has been less true in recent years. Buffett declined to comment for this article.

In his 2012 annual letter, the CEO addressed the dividend issue, arguing that the better, and more tax-efficient, approach would be for investors who want income to sell a small portion of their Berkshire stock each year.

“First, dividends impose a specific cash-out policy upon all shareholders. If, say, 40% of earnings is the policy, those who wish 30% or 50% will be thwarted,” Buffett wrote. “Our 600,000 shareholders cover the waterfront in their desires for cash. It is safe to say, however, that a great many of them—perhaps even most of them—are in a net-savings mode and logically should prefer no payment at all.”

In 2014, Berkshire holder soverwhelmingly rejected a proxy proposalon dividends.

Yet Berkshire’s cash has more than doubled since then, notes Edward Jones analyst James Shanahan, who favors a dividend. “A dividend is a good idea if only because the cash balance has grown so much,” he says, adding that significant repurchases at Berkshire are more difficult than at other big companies because there is less liquidity in its stock.

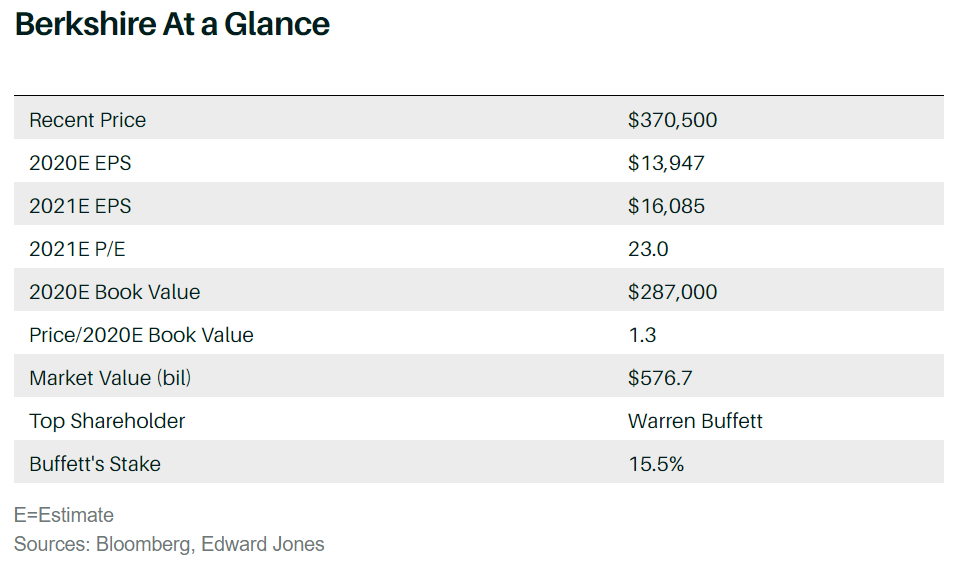

Berkshire’s class A shares have lagged behind theS&P 500 indexby 40 percentage points since the end of 2018. They now look appealing at around $368,000, less than 1.3 times estimated year-end 2020 book value of around $287,000 and about 23 times projected 2021 earnings. Its class B shares trade around $243.

Berkshire has traded at closer to 1.4 times book value in the past five years, and earnings are set to climb in 2021, thanks to businesses with exposure to an improving economy, like the Burlington Northern Santa Fe railroad.

Still, the past decade has been one of missed opportunities for Buffett—with the stake inApple(AAPL) the notable exception.While the recently disclosed big purchasesinVerizon Communications(VZ) andChevron(CVX) made waves, Berkshire was likely a net seller of about $9 billion of stocks last year. The company also failed to capitalize on the market turmoil and make any big acquisitions.

So what else might Berkshire shareholders hope to see in the annual letter? More disclosure would help. It’s hard to know exactly how well Precision Castparts and other major Berkshire businesses are doing because the company doesn’t break out their results.

There is also the question of succession, with Buffett turning 90 last August. Buffett could give up the CEO job to Berkshire’s vice chairman, Greg Abel, while remaining chairman and continuing to oversee Berkshire’s investment portfolio, including $270 billion of stocks.

Berkshire hasn’t named an heir apparent to Buffett, but it’s widely assumed to be Abel, 58, who oversees Berkshire’s vast noninsurance operations, including Burlington Northern.

That would give Abel important experience while Buffett is still on the scene, allowing Abel to take new steps, like potentially holding Berkshire’s first investor day.

And whether it is Abel or someone else, a dividend would take pressure off Buffett’s successor to reinvest Berkshire’s earnings torrent and align the conglomerate with most other giant companies.