There’s clearly only topic of conversation for the financial markets this week. The announcement of the omicron variant of the COVID virus put investors into a panic and sent the S&P 500 to its largest single day loss since February and the Russell 2000 to its largest single day loss since June of last year. The reveal of a potentially more mutated and more highly contagious version of both the original COVID strain and the delta variant brought investors back to the early days of the pandemic when businesses, schools and other groups were suddenly forced to shut down.

Is it going to be as big of a deal as the markets fear it might be? It’s too early to know for sure (although the South African Medical Association seems to be downplaying the severity of it), but global governments appear to be taking no chances. Several countries have shut down their borders to people from South Africa and neighboring countries. New York has already declared a state of emergency despite no reported cases of the omicron variant. Of course, there’s still much to learn about the risk level of this COVID strain, but it’s clear that nerves are a bit frayed.

In my opinion, Friday’s sharp equity pullback looks like a classic overreaction. Yes, there’s a distinct possibility that it may not be the bottom and equities could sell off further, but given how investors have been prolific dip buyers over the past year and expectations for the taper and future interest rate hikes turned immediately dovish, per the Fed Funds futures market, I think investors will quickly conclude that the omicron variant will likely not be as bad as anticipated and, even if it is, the Fed will quickly step in, whether it’s via a delayed taper or no rate hike until 2023, to support risk asset prices. If I’m going out on a limb, I think there’s a chance the S&P 500 could recapture its all-time high (it’s currently about 2.3% below it) by the end of this week.

Market internals had already been softening leading up to last week. Breadth within the Nasdaq 100 has been getting weaker - 30 of the 100 components have pulled back at least 20%. Small-caps have been underperforming for weeks and leadership has rotated away from cyclicals and back into tech and consumer discretionary. Treasuries are looking strong again and even gold has been seeing some action.

Fear is high in the markets right now and that presents opportunity. Keep a level head and watch for panic signs (e.g. the number of articles talking about how stocks could pull back 30% from here) and words from the Fed that hint at what the central bank might do. Remember, in 2020 after the initial bear market, stocks rebounded quickly as soon as the Fed and the government stepped in. If Powell pivots to a more dovish stance, U.S. equities could quickly move higher again.

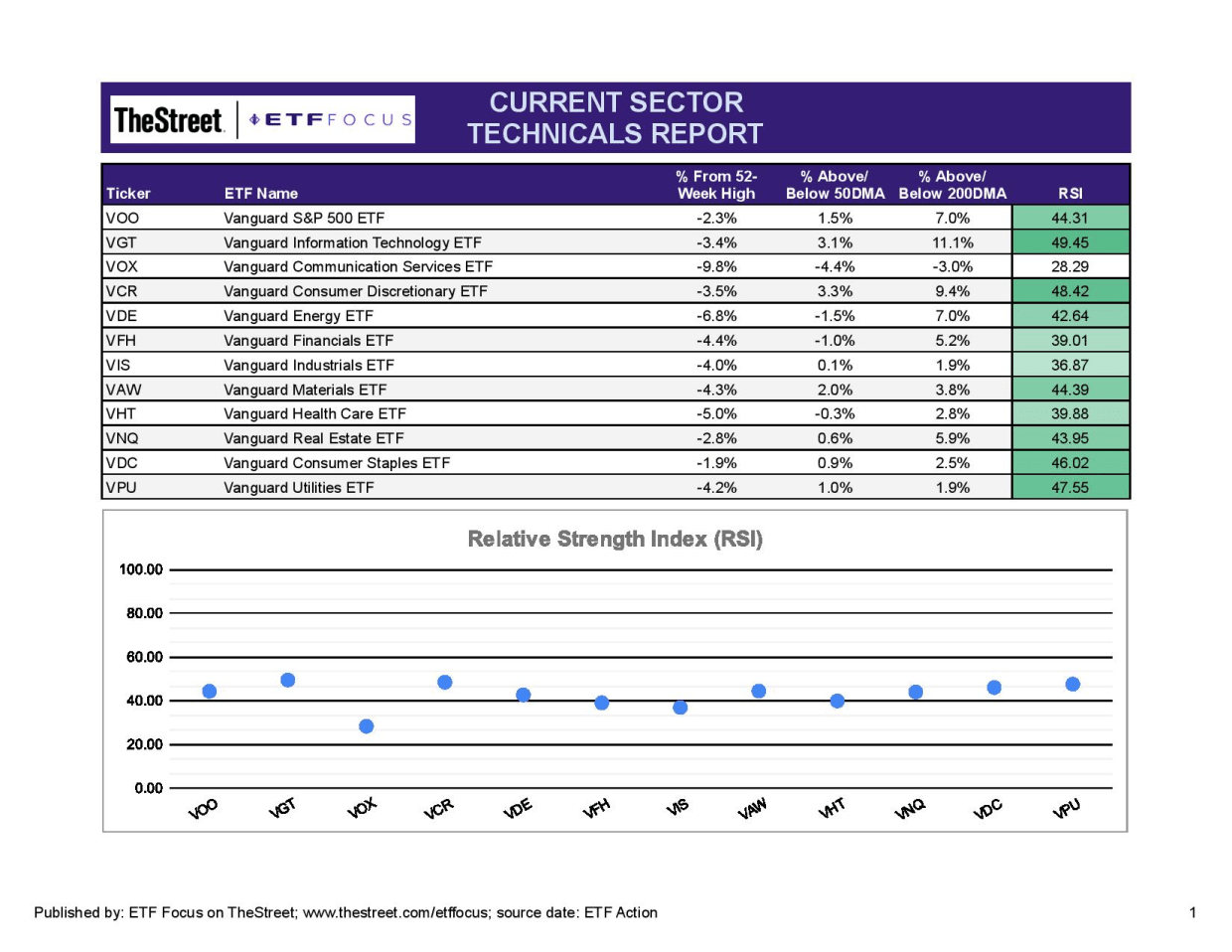

Let’s start our weekly review by taking a look at the primary market sectors.

Not surprisingly, there’s little short-term strength in equities right now. Communication services remains the worst-looking of the 11 major sectors, but cyclicals are not that far behind. Energy stocks were down 4% on Friday as crude oil prices dropped more than 10%, but still managed to gain more than 1% on the week as a whole. Financials are weaker on falling interest rates, but industrials and materials are similarly well off recent highs.

As I mentioned above, tech and consumer discretionary have been the beneficiaries of rotation trades lately. Tech had become a steady outperformer before last week’s correction, while discretionary stocks have gained but remained volatile. Four of the 11 GICS sectors are now trading below their 50-day moving averages, which could be an indication that short-term momentum has run its course and it may be time for defensives to take over.

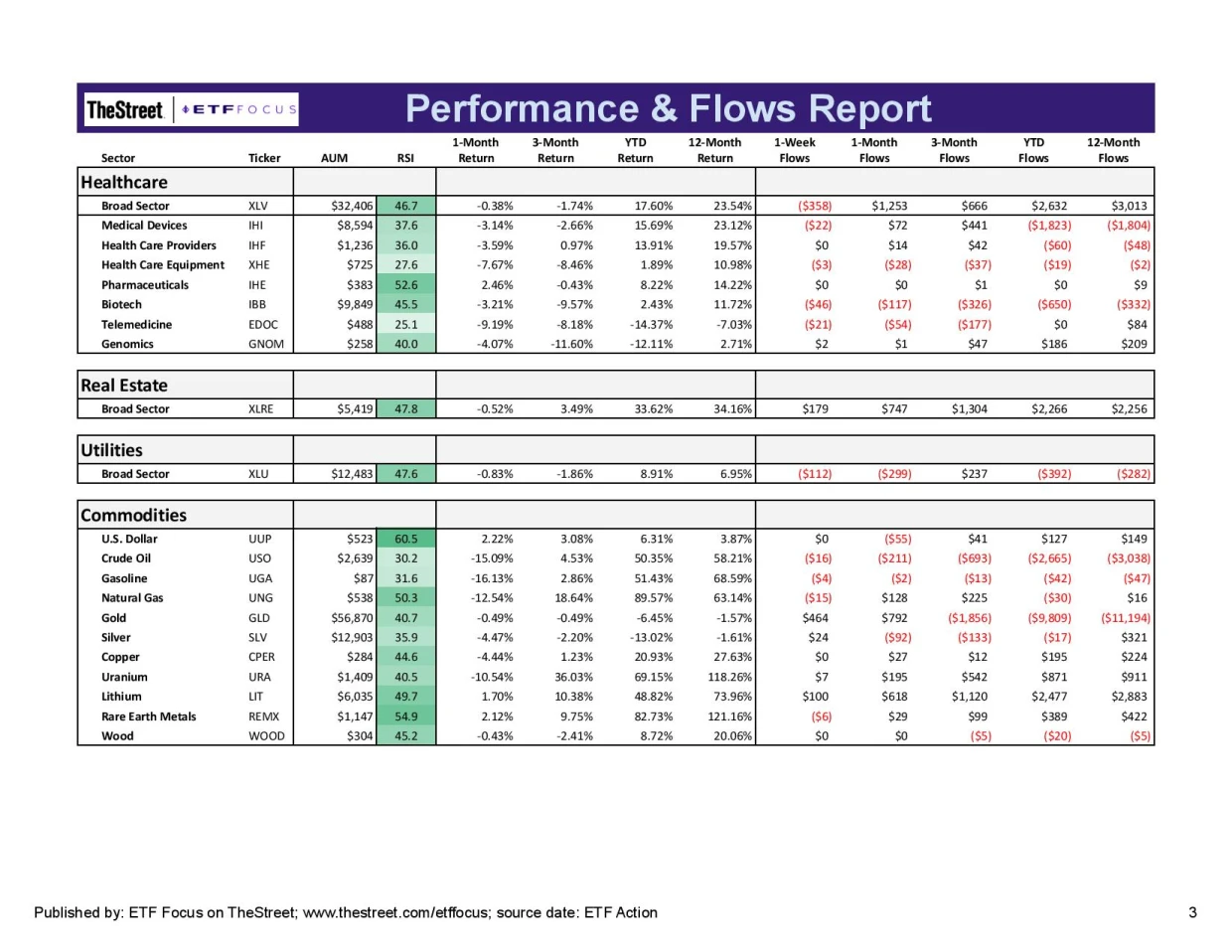

The performance of small-caps, Treasuries and cyclicals point to more conservative positioning even before Friday. Utilities and consumer staples did relatively better as expected, but it’s been a while since either group had an extended run. This week will be telling, I think, in determining where investor risk tolerance is really at. If omicron looks like it will keep drawing out people’s fears, there might be room for defensive sectors to perform relatively well. Keep in mind that it’ll be all about business and social restrictions. If the economic impact is limited mostly to the leisure and travel sectors, the longer-term damage could be minimal.

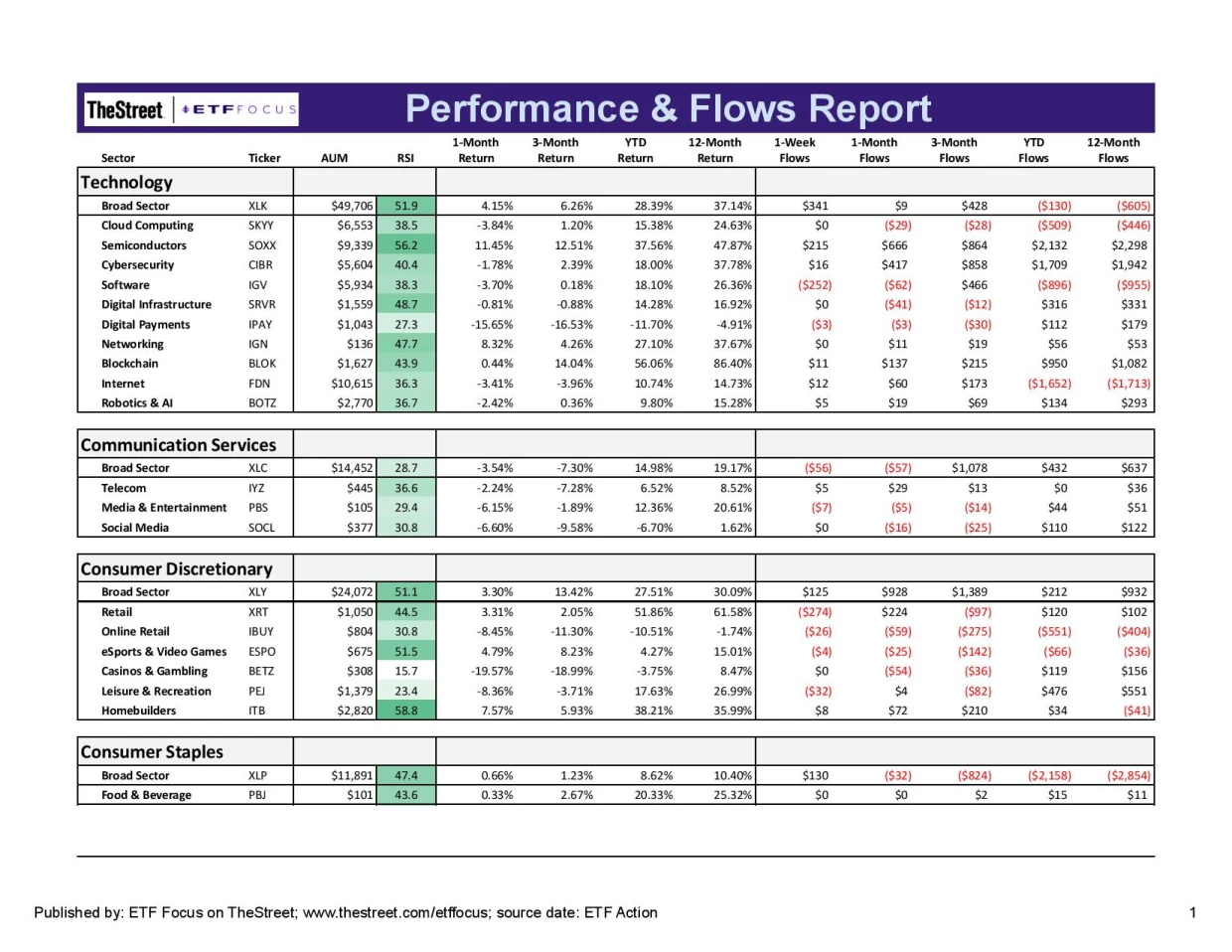

Short-term strength has fallen pretty much across the board, but with a few exceptions. Semiconductor stocks had a rough week along with the rest of the tech sector, but they remain one of the best performing groups throughout 2021. Homebuilder stocks continue to build on the strength in the housing, which, despite some stops and starts in sales, demand and commodity prices, been pretty consistent.

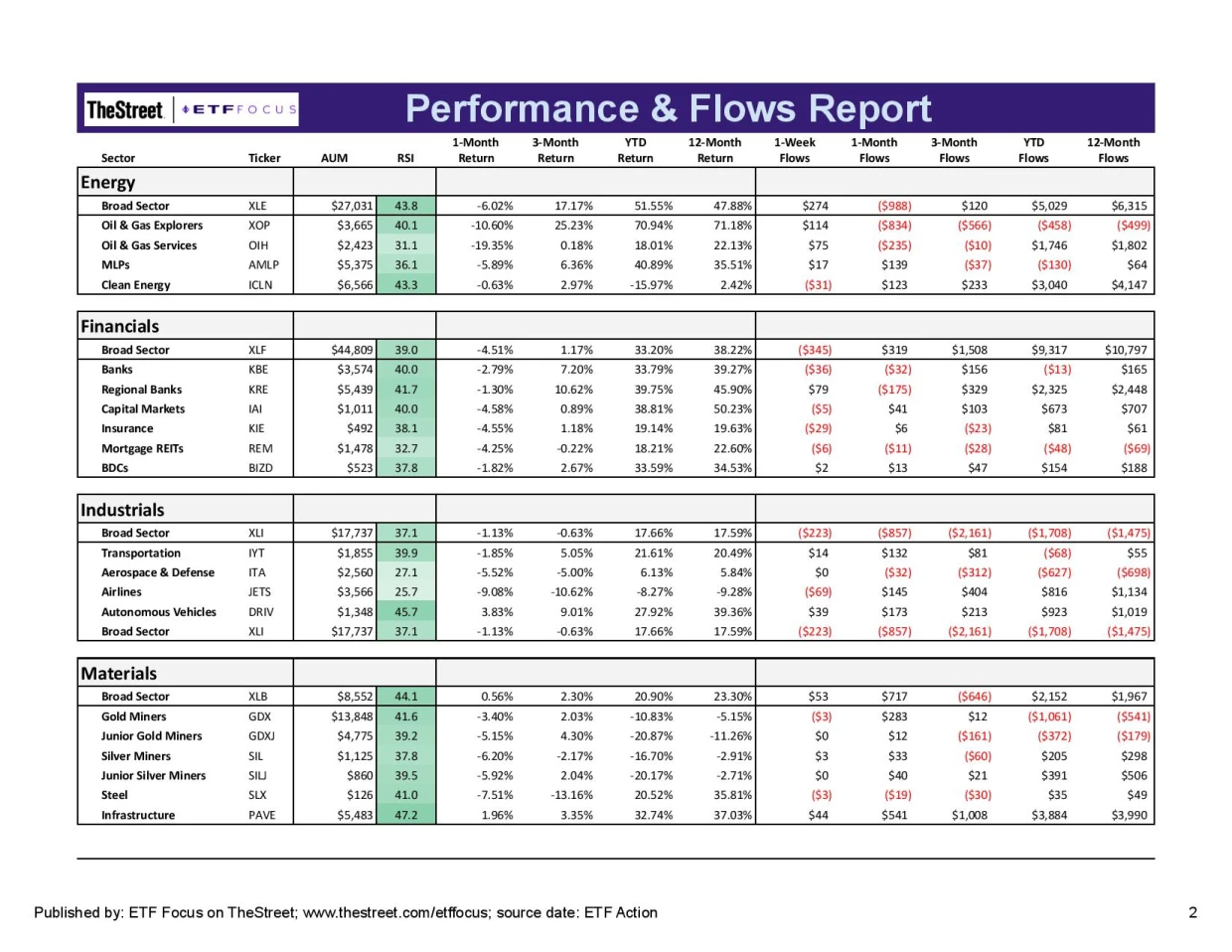

No surprise that the casino, leisure and recreation stocks are getting hit the hardest. These, of course, are the first to get hit in an environment like this. New travel restrictions are already being put in place and we’re very likely to see even more in the coming weeks. As we’ve seen with New York, there’s been little hesitation so far to put mitigation efforts in place. Oil prices and energy demand forecasts have taken a hit adding to the pressure.

No major changes in the communication services sector. We’re still seeing weakness throughout, including the social media stocks, which continue to have a hard time reversing sentiment. The traditional telecoms were virtually changed this past week and could actually become a source of support should prices continue falling here.

Oil prices got hammered last week, which led to 5-6% losses for the explorers and servicers. The broader energy sector did comparatively better, but even clean energy posted a loss of 4% indicating little support across the board. Short-term sentiment for this sector has largely disappeared and the huge returns of earlier this year have long since been forgotten. This will be an especially omicron-dependent sector this week, so expect some above average volatility. Flow numbers show that investors are abandoning ship.

Just like the leisure sector, the airlines are especially weak here, but there’s really no group within the cyclicals that’s doing OK. The gold & silver miners had a moment in the sun, but with gold prices appearing to have lost their momentum again, they’ve been back on the downswing. Infrastructure stock returns have largely been a function of the passage of the infrastructure bill, but that momentum it also likely to begin fading.

Healthcare is starting to look a little, well, healthier again. Most of it looks like it’s due to its defensive sector peers starting to draw a little interest again, but any kind of health-related headlines, such as a new COVID variant, tend to produce at least a modest short-term bounce. Both Moderna and BioNTech, the makers of different COVID vaccines, were both up more than 20% last week alone and that’s making the biotech sector look a little stronger than it is. The SPDR S&P Biotech ETF (XBI), which equal weights the sector and gives much less weight to those names, was down 4% last week. There is some money moving back into this space, but I don’t think it’s a compelling move just yet.

Not much doing on the commodities side. Crude and gasoline prices have plummeted, but natural gas prices have held their ground. I suspect that there’s some mean reversion in energy prices following Friday’s overreaction. The dollar remains very strong against the basket of global currencies although we’ll have to see if the omicron variant impacts that. Its strength has come on the back of comparatively higher interest rates and better economic growth readings. The plans for tapering and rate hikes may be pushed back now, which could bring the dollar back down.