Summary

- During the pandemic, SoFi had an increase in customers, but growth is slowing.

- SoFi is not profitable, only on an adjusted EBITDA basis.

- The multiple placed on the company’s growth is unsustainable.

SoFi Technologies, Inc.(SOFI) has entered bubble territory due to overconfidence and excessive market euphoria regarding financial technology companies. Despite the fact that SoFi is successfully expanding its client base, the company has no real earnings, and the stock is highly overvalued.

'Growth' Alone Isn't Enough To Make A Stock Purchase

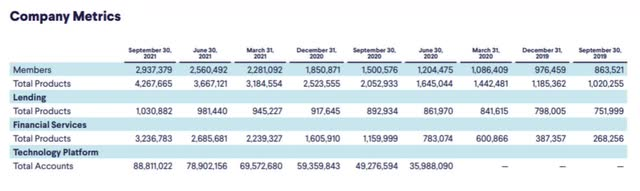

SoFi's user base approached 3 million in 3Q21, representing a 96% YoY growth rate. The increase in customers, on the other hand, is slowing. Most recently, in 2021, the company's growth has slowed, with YoY growth rates falling below 100%, possibly indicating that SoFi's period of rapid growth is coming to an end. As the pandemic fades, SoFi's customer and revenue growth may slow further.

This is not to say that SoFi's achievements in terms of stellar platform growth should be overlooked. SoFi's business model was set on fire by Covid-19, but the risks to growth have increased significantly in 2021.

But first, consider SoFi's phenomenal user growth over the last two years.

Total users increased from less than a million at the end of 2019, just before the pandemic, to 2.9 million in the most recent quarter. Simultaneously, the number of SoFi products increased from 1.2 million in 4Q19 to 4.3 million in 3Q21, demonstrating that SoFi's growth has been directly related to the number of financial products available on its online banking platform, which offers student loan refinancing, private student loans, auto loan refinance, personal loans, mortgage and home loans, insurance products, and investments.

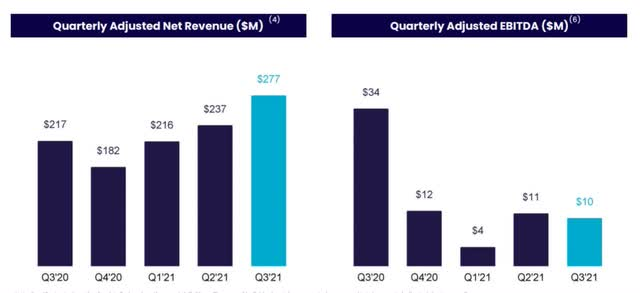

SoFi's user and product growth resulted in an increase in revenue as well: On a rolling four-quarter basis, the company earned $443 million in net revenues in 2019, a figure that has since risen to $871 million in 3Q21.

No Profitability, Unless You Look At Adjusted EBITDA

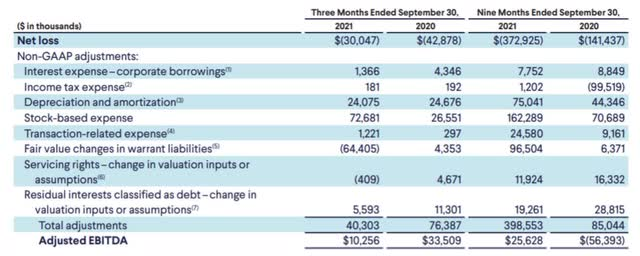

The increase in users and revenues appears to be enticing, but it only tells half the story. SoFi doesn't have any real profits unless you look at adjusted EBITDA, which I believe is a problem. Adjusted EBITDA is not a useful figure to use to evaluate operational performance because it is one of those gimmicky accounting figures that can be manipulated to show profits where none exist.

SoFi earned just $37 million in adjusted EBITDA on $912 million in revenue over the previous four quarters, from 2Q20 to 3Q21. SoFi's adjusted EBITDA increased in 2020, but the level of profitability is still far below what is required to provide investors with competitive capital returns.

According to SoFi's definition of adjusted EBITDA, the company can boost its 'profit figure' in a variety of ways:

Adjusted EBITDA is defined as net income (loss), adjusted to exclude: (i) corporate borrowing-based interest expense, (ii) income taxes, (iii) depreciation and amortization, (iv) stock-based expense (inclusive of equity-based payments to non-employees), (v) impairment expense (inclusive of goodwill impairment and property, equipment and software abandonments), (vi) transaction-related expenses, (vii) warrant fair value adjustments, and (viii) fair value changes in servicing rights and residual interests classified as debt due to valuation assumptions.

Because companies have so many options for classifying or inflating expenses, "adjusted EBITDA" is not a figure to rely on to judge operational performance. SoFi's net-loss-to-adjusted EBITDA reconciliation for the most recent quarter and for 2021, YTD, is shown below. It's worth noting that achieving a positive adjusted EBITDA of $26 million in 2021 YTD would require $399 million in 'adjustments'. Adjustments included a whopping $162 million for stock-based compensation. SoFi's accumulated business losses are $373 million if no adjustments are made. A $373 million loss on adjusted net revenues of $730 million is not insignificant; the platform is highly unprofitable.

SoFi adjusts net revenues to account for changes in the valuation of certain assets, such as servicing rights, to arrive at a figure known as adjusted net revenues. Because SoFi makes a lot of adjustments, it can show a profit on an adjusted EBITDA basis even though its losses are massive. Of course, SoFi's business lost money in 2020 and the previous year as well.

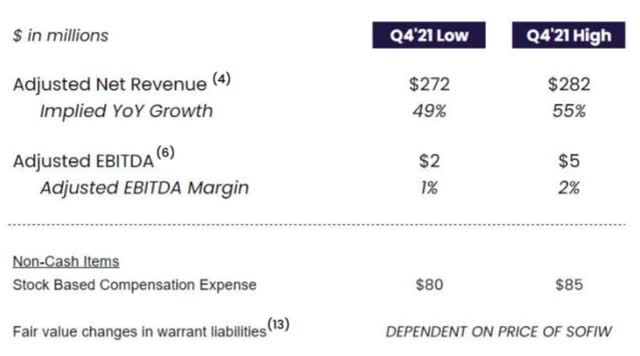

The 4Q21 outlook assumes $2 - $5 million in adjusted EBITDA and $272 - $282 million in adjusted net revenues. The adjusted EBITDA margin is expected to range between 1% and 2%. SoFi will lose money again on a net loss basis. It will almost certainly continue to lose money next year.

So, What Do Sofi's High Multiples Get You?

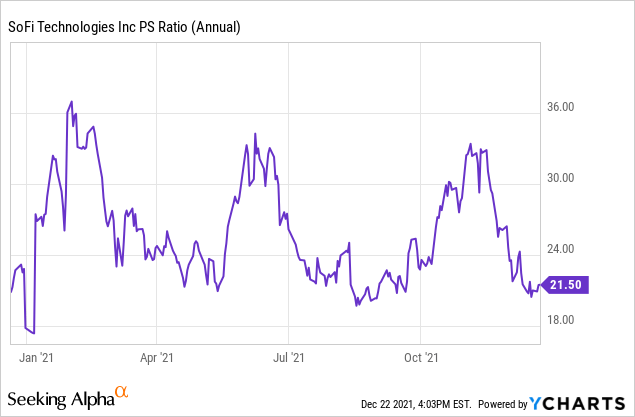

It is undeniable that SoFi's business is expanding. What bothers me is the exorbitant sales multiple that this "growth stock" displays on the board. If you want to be a part of SoFi's growth story, you'll have to pay 20 times sales, even though the stock has already lost 40% of its value in the last month.

Despite the fact that SoFi is increasing its user base and revenue, investors must consider whether the price they pay for this expansion is justified. Today, many investors will buy any stock that makes even a hazy promise of future growth. In the case of this company, SoFi, growth is priced at nosebleed levels, which significantly reduces the stock's attractiveness.

My Conclusion

SoFi is one of those growth stocks that has a wildly inflated sales multiple simply because it grew so quickly during the pandemic. However, SoFi's high multiple does not appear to be sustainable, and a significant contraction can be expected once growth rates slow, which is very likely. Paying 20 times sales for a company with no real profits is illogical, and the inflated valuation suggests that SoFi is in bubble territory.