Apple stock has taken a hit due to reports of a component shortage that could impact iPhone 13 sales. The Apple Maven thinks that long-term investors should not worry much.

The recent news has not been very favorable for Apple and its shares. According to Bloomberg, the iPhone 13 isfacingsupply chain issues. The component shortage could cause the number of Apple devices produced to drop by 10 million this year.

Apple stock has not fallen apart following the report, but it dipped below $140 apiece once again – levels not seen for more than a hot second since the start of July 2021. However, the Apple Maven believes that long-term investors should not worry about the recent developments involving the iPhone.

This seems familiar…

First, it is important for readers to understand that there are different types of Apple stock investors and traders. Many buy shares in hopes of short-term gains, while others bet on the stock for the long haul. Short-term traders may, in fact, have good reasons to be concerned. What if Apple misses iPhone sales expectations in the next quarter, and the stock reacts negatively as a result?

But long-term holders are probably looking at Apple’s business fundamentals further out in the future. There have been enough reports suggesting that demand for the iPhone 13 has been high, probably even better than demand for the already successful iPhone 12.

If enough demand for a product exists, it is reasonable to think that temporary supply chain hiccups will only cause sales to shift from one period to the next. This is exactly what happened in 2020, when the COVID-19 crisis caused the iPhone 12 to be unveiled and launched later in the holiday season.

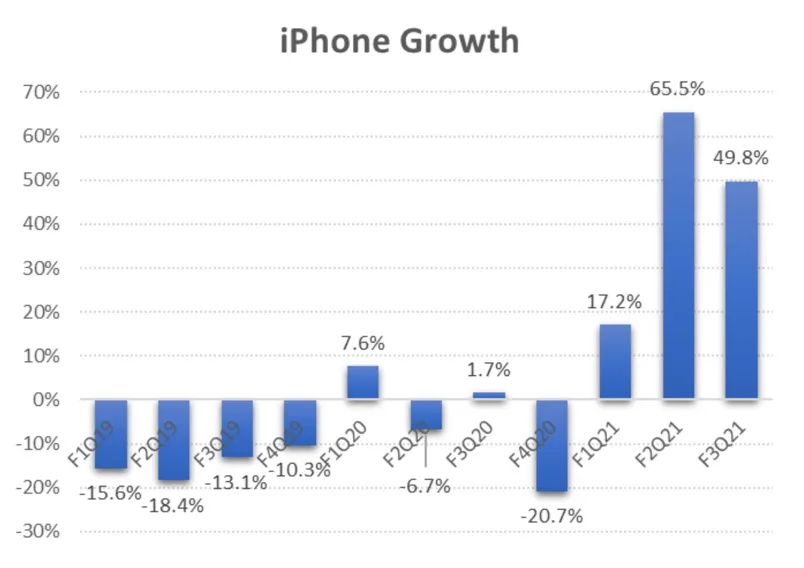

The chart below shows iPhone sales growth in fiscal 2019 and 2020, and in the first periods of the current year. Notice how the painful revenue decline in 2019 seems to have created pent-up demand that was not met in fiscal Q4 of last year, due to the production delays. When those were finally resolved, fiscal 2021 revenues shot through the roof.

Average iPhone sales growth between the start of fiscal 2020 and now turned out to be a healthy 14%, although revenues were very lumpy from quarter to quarter. During the same period, and despite last year’s supply chain problems, Apple stock climbed 90%.

Could the current component shortage cause revenues to merely shift around the calendar once again? I think it is plausible, if not likely.

Apple is a good place to hide

To be clear, the alleged production delays is not an Apple-specific problem. Component shortages in this year of recovery from the pandemic has been well documented and seems to be impacting consumer tech vendors across the board.

Of course, an investor can choose not to commit to the tech sector at all, fearing that the whole industry will underperform as the global economies continue to bounce back. But if money is to be deployed in the space, I think that Apple is a safer-than-average bet due to best-in-class supply chain management.

Last year, I explained in more detail that Apple has become “king of inventory management”under CEO Tim Cook – who is also the Cupertino company’s former COO. Therefore, were I to bet on one company handling supply chain issues well, it would probably be the one with most purchasing power and a solid track record at managing inventory.