The countdown to Amazon’s earnings day has begun. The Amazon Maven begins its preview by looking at analyst consensus and historical stock price behavior prior to and after the event.

June is ending along with the second calendar quarter of 2021. Amazon stock(AMZN) is staring at a couple of potential catalysts in July, with earnings season being the most obvious of them.

The Amazon Maven will cover the cloud and e-commerce giant’s earnings event in detail via live blog – dates are yet to be announced by Amazon. In the meantime, our channel will preview second quarter earnings in the next few weeks, starting with a high-level view of consensus expectations.

What Wall Street expects

For second quarter 2021, it helps to think first about last year’s numbers. As the COVID-19 crisis was still in its early stages, Amazon delivered astounding revenue growth of 40% in second quarter of 2020, the highest since 2018. EPS of over $10 beat consensus by the widest margin ever.

When most businesses suffered due to the shutdown of the global economies, Amazon benefited in second quarter 2020 from the trends in digital consumption and cloud adoption acceleration. This year, the Seattle-based company will be facing an uphill battle to produce top- and bottom-line growth.

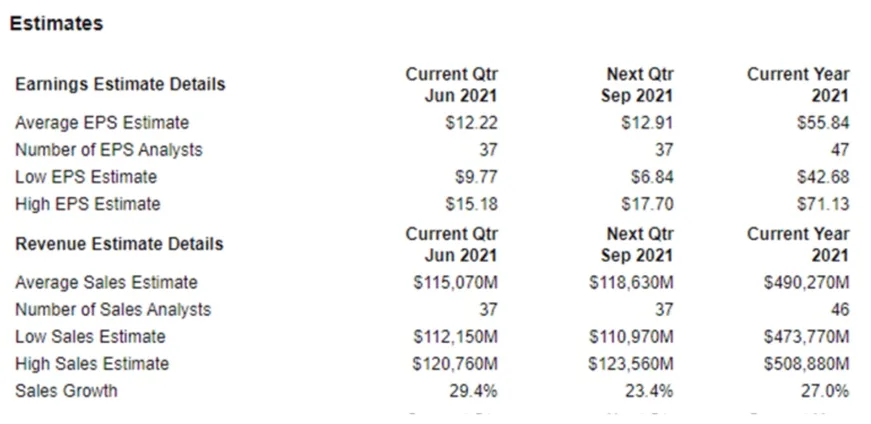

Still, Wall Street is betting on revenue increase of nearly 30% this time – see table below. On earnings per share, $12.22 would represent an increase of nearly 20%. The earnings consensus climbed by over one dollar since two months ago, probably in anticipation for another successful Amazon Prime Day event.

In the next few weeks, the Amazon Maven will dig deeper into what are likely to be the most hotly debated topics of conversation on earnings day.

Amazon stock around earnings

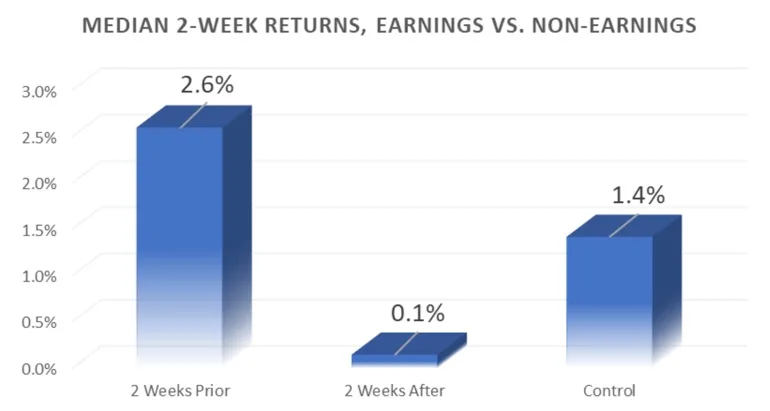

Next, let’s look at the performance of Amazon stock around earnings dates to figure out whether it might make sense to buy AMZN ahead of it. The graph below shows three bars: the median two-week return of Amazon stock (1) before earnings, (2) after earnings, and (3) on any given day.

Over the past 20 earnings seasons, Amazon share price increased by a median 2.6% prior to the event – much better than the 0.1% following earnings day. The consistency is also worth noting: the stock produced positive two-week returnsaheadof earnings 80% of the time vs. only half the timeafterearnings.

The data seems consistent with the idea of “buying the rumor, selling the news”. In other words, it is plausible that demand for AMZN shares rises ahead of the quarterly report, which has often exceeded analysts’ expectations. Once the numbers are in, investors proceed to lock in gains.