Someone At The Fed Needs To Speak Up To Save Itself From Committing A Major Policy Blunder

Monetary policy in 2021 is actively promoting the fast cyclical growth bounce and even welcoming the uptick in inflation. That's in sharp contrast to how the old generation of policymakers confronted a similar cyclical bounce in 1994. Back then, policymakers worked quickly and aggressively to restrain the cyclical expansion, particularly the uptick in inflation.

Someone at the Fed needs to speak up to save itself from committing a major policy blunder. Institutional rigidities of transparency and predictability are keeping a policy of easy money for longer than is needed. The current approach puts the economy on a course for a hard landing compared to the soft landing the old generation of policymakers engineered in 1995 when faced with a similar scenario in 1994.

2021 vs. 1994

The economy in 2021 has a lot of the same features as in 1994. Both years saw rapid growth and price pressures emerge as headwinds faded. In 2021, the strong rebound reflects the re-opening of the economy helped along with easy money and fiscal stimulus. The catalyst for the rebound in 1994 came from an extended span of easy money and the end of household deleveraging, corporate restructuring, and defense cutbacks.

2021 rapid growth is faster and broader as it followed a record decline in the prior year. Consensus estimates put Real GDP growth in 2021 in the 6% to 7% range, whereas the increase in 1994 came in at 4%. But the big difference between the two years is inflation.

Core consumer inflation runs at a 5% annualized rate through the first five months of 2021, whereas inflation peaked at 3% in 1994. Pipeline inflation is more than three times as fast.Core prices for intermediate materials have increased 17% in the past year versus a peak of 5% in 1994.

The current generation of policymakers thinks that the supply and demand in the product markets will at some point "autocorrect." That implies pipeline inflation pressures will disappear as companies raise production levels to meet the higher level of demand without causing any disturbances in the economy. Of course, in reality, a single or two product markets can readjust. But, it is naive to think of multiple product markets, and housing and many parts of the service economy can do so simultaneously.

Institutional rigidities of transparency and predictability stop policymakers from ending the asset purchase program for housing that everyone agrees is no longer needed. Is that the proper way to conduct monetary policy? Just because policymakers did not tell or inform the financial markets it planned to curtail its asset purchase program, it cannot do so until complete transparency. That makes zero sense.A policy that fuels an unsustainable surge in demand and a rise in house prices that is wrong today will be even more so tomorrow.

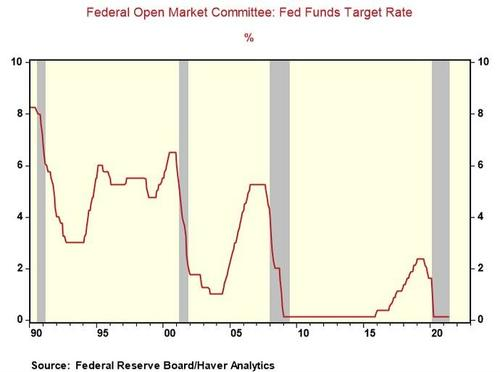

In 1994, the old generation of policymakers saw strong ordering and material price increases as evidence that companies needed more inventories to protect production schedules. There have already been examples in 2021 in which companies had to curtail production because of a shortage of parts. Subduing final demand was seen as a necessary condition to break and shorten the cyclical uptick in inflation. Thus, in 1994 policymakers lifted official rates for twelve consecutive months, doubling official rates from 3% to 6%. That ratcheting up of official rates brought about a soft landing in 1995.