Summary

- SoFi has traded down by about 35% since it completed its reverse SPAC merger IPO in early June.

- The downward price pressures come as a result of the stock’s lock-up expiration, and management’s soft revenue outlook due to lower student loan refinancing volumes until 2022.

- However, the recent volatility is expected to be transitory, with significant upside realization to resume in the near-term ahead of material catalysts on which SoFi’s long-term growth is built on.

- The anticipated approval of a national bank charter for SoFi is expected to materialize within the next 12 months, which will materially transform the company's overall growth prospects.

- Combined with its cost-efficient multi-product business model and ongoing digital transformation tailwinds for the industry, SoFi is well-positioned for upside realization of as much as 38% in the near-term.

SoFi (Nasdaq:SOFI) has been traded down about 35% since it completed its reverse SPAC merger IPO in early June. The downward price pressures observed in recent months come as a result of the stock’s lock-up expiration, as well as management’s soft revenue guidance issued as a result of lower student loan refinancing volumes for the rest of the year.

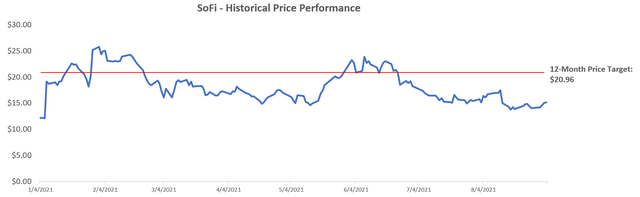

However, the recent volatility is expected to be transitory, with significant upside realization to resume in the near-term ahead of material catalysts on which SoFi’s long-term growth is built on. The advent of innovative technology, combined with COVID-related disruptions experienced in the last 18 months have accelerated the global transition to digital. This makes strong tailwinds for SoFi as it looks to disrupt a long-standing traditional industry like banking. The company’s multi-product business model, combined with the anticipated approval for a national bank charter is expected to further its operations by extending its lending capabilities and financial service offerings. The developments will also allow for greater cost-efficiencies, which underpins greater growth and margin expansion in the long-run. Consistent with our recent coverage on the stock, our outlook remains bullish with a 12-month price target set at $20.96. This represents upside potential of more than 38% based on the last traded price of $15.16 on September 3rd.

Why Did SoFi Stock Plunge?

SoFi closed at almost $23 on June 1stupon its debut on the Nasdaq following the completion of its reverse SPAC merger with Social Capital Hedosophia Holdings Corp. V. The stock’s performance remained range-bound at the $20-level for the month before plummeting by almost 20% in July. This marked the first wave of the stock’s price plunge, triggered by the lock-up expiration on shares held by early investors in the company. According to the stock’s prospectus filing, the lock-up period was equivalent to the earlier of i) 180 trading days for all shares held by early investors, or 2) when the stock trades above $12.50 for 20 of 30 trading days for 33% of shares held by early investors, and when the stock trades above $15.00 for 20 or 30 trading days for an additional 50% of shares held by early investors. Because SoFi traded above both the $12.50 and $15.00 threshold throughout June, it triggered an early lock-up period expiration for 83% of shares held by early investors. This allowed some to offload their positions and realize gains at market value throughout July. And because of the additional SoFi shares pushed into the market, the stock experienced significant price dilution throughout the month before stabilizing at $15 to $16 apiece at the end of July.

The stock plummeted by another 14% from about $18 to $15 in mid-August following SoFi’s second quarter earnings call, despite topping Q2 sales estimates and more than doubling its membership base. This marked the second wave of the stock’s price plunge, triggered by management’s warning of reduced student loan refinancing volumes through the end of the year due to the extension of the U.S. government’s student loan moratorium.

Material Catalysts for a Valuation Boost Ahead

To date, the stock has traded down by approximately 35% since it went IPO three months ago, and has largely remained range-bound at the $14- to $15-level in recent weeks. However, SoFi’s share price is not expected to stay staggered for long. The company’s multi-product business model, combined with the anticipated approval of a national bank charter, are expected to be material catalysts for a valuation boost ahead. The developments are also expected to help SoFi drive higher capitalization on global digital transformation tailwinds, which the broader fintech sector has continued to benefit from.

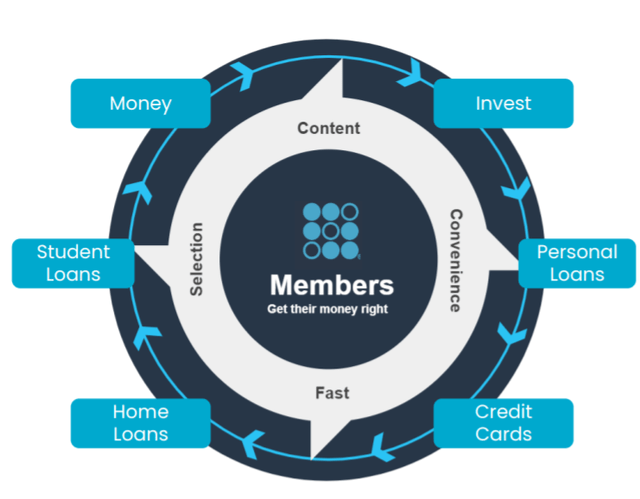

SoFi’s “Financial Services Productivity Loop” Business Model

The company’s multi-product business model has continued to attract new sign-ups and drive surging revenue growth across the business, while maintaining cost-efficiencies to facilitate additional margin expansion. Through its “Financial Services Productivity Loop” (“FSPL”) business model, SoFi is gradually achieving a “flywheel” effect in its operations. The FSPL business model is essentially a multi-product business model that promotes cross-selling opportunities, while minimizing customer acquisition costs. For instance, SoFi’s commission-free investing platform, “SoFi Invest”, may not be making large profits for the company, but it helps to build its membership base and increase engagement. And over time, when SoFi Invest members start to use additional SoFi products, such as its higher-margin lending services, SoFi’s sales will increase while having incurred zero incremental customer acquisition costs. This strategy helps the company generate sufficient funds for reinvesting into further expansion of its offerings, and subsequently lowering costs through scale that can be passed on to customers to attract higher engagement. It also becomes a “self-reinforcing virtuous cycle” for facilitating the company’s continued growth.

The strategy has continued to underpin SoFi’s robust sales and membership growth momentum achieved over the years. SoFi currently serves more than 1.85 million members, up 90% from the prior year, and is expected to reach three million members by the end of the year. And from a sales standpoint, each of its lending, financial services and technology business segments have achieved high double- to triple-digit growth in recent quarters, a testament to the effectiveness of its FSPL business model. SoFi’s most profitable lending segment grew 47% year-over-year during the second quarter, while its lower-margin technology and financial services segments soared 119% and close to seven-fold, respectively.

Circling back to management’s warning of lower student loan refinancing volumes for the rest of the year, the adverse impact that the news had on SoFi’s share price is not expected to persist for long. SoFi’s FSPL business model has continued to propel demand for its other lending products, such as personal loans and mortgages. During the second quarter, the volume of refinanced student loans handled by SoFi had already dropped by more than half compared to pre-CARES Act levels. Yet, the lending segment’s total funded volume across all lending products still grew by 66% to $2.9 billion, resulting in strong double-digit year-over-year growth in the segment’s revenues. Despite management’s expectations to lose out on another $40 million in student-loan refinancing later this year due to the U.S. government’s extension of student loan relief to January 31st, 2022, it is clear that SoFi’s lending business will continue to post unstoppable growth ahead regardless. And this is especially true when student loan refinancing volumes pick up again in 2022, thanks to the self-reinforcing virtuous cycle of growth that SoFi’s FSPL business model has bolstered.

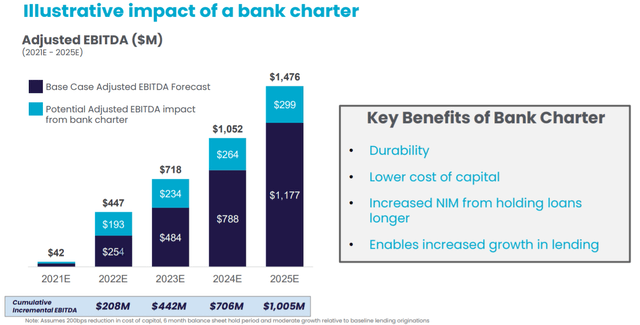

National Bank Charter

SoFi’s announcement to acquire Golden Pacific Bancorp(“GPB”) in March is also expected to accelerate its process in obtaining a national bank charter, which is another key catalyst to boosting the stock’s valuation. For context, SoFi had already applied for a national bank charter last summer, and received conditional approval in October. And the acquisition of GPB, which is expected to close before the end of the year, will likely fast-track the full approval process for SoFi’s national bank charter as soon as this year. A similar strategy has been proven effective for some of SoFi’s fintech peers, including Square and LendingClub, which obtained approval for a national banking charter shortly after their respective acquisitions of smaller community banks.

A national bank charter will be critical to taking SoFi’s growth to the next level, especially for its lending business. SoFi’s lending platform has always been at the forefront of its business, accounting for 86% of the company’s revenues in 2020. It is also currently SoFi’s most profitable business segment, with a contribution margin of close to 54%. A national bank charter will allow SoFi to further its lending capabilities by allowing loans made with member deposits instead of capital borrowed from third-party banks. This accordingly lowers the business’ overall costs of capital, allowing for greater margin expansion over time.

A national bank charter would also be important for expanding SoFi’s financial services business segment, which is currently operating at a loss. The acquisition of GPB, combined with having a national bank charter, is expected to encourage further member deposits through SoFi. This is a critical step to achieving the company’s goal of becoming its members’ “primary bank account”. It would also help SoFi increase its market penetration rate into the 500 million retail personal banking accounts currently housed in traditional American megabanks that have yet to experience virtual banking. The bank charter is expected to help SoFi drive greater membership growth and engagement across its financial services platforms, and enable additional cost-efficiencies and margin expansion through scale in the long-run.

Obtaining a national bank charter would also work hand in hand with SoFi’s payment solutions infrastructure platform, Galileo. Galileo already enables profit-sharing for SoFi, as the payment solutions platform primarily services SoFi’s competition, such as Robinhood. The platform also provides the payment solutions infrastructure for SoFi Money, driving cost synergies through vertical integration. Together with a national bank charter, it would become easier for SoFi to engage in strategic partnerships with other companies to offer additional products such as “sweep accounts, FDIC insurance warehouse facilities, etc.”, and drive greater sales for the business segment going forward.

Having a national bank charter is expected to drive material benefits to SoFi’s financial performance as well. Due to the cost-efficiencies and growth synergies achievable through having a national bank charter, SoFi’s projected adjusted EBITDA in 2022 is expected to jump by 76% from $254 million to $447 million. And over the next five years, obtaining a national bank charter is expected to drive cumulative incremental EBITDA of more than $1 billion for SoFi. This would make a material bump to the company’s intrinsic value, which should be reflected as upside realization for the stock in the near-term.

Digital Transformation Tailwinds

The advent of innovative technology, combined with COVID-related disruptions experienced in the last 18 months, have accelerated demands for convenient and easy-to-use virtual banking platforms. According to Adjust’s global app trends report, fintech app usage grew by 85% year-over-year during the pandemic, and has continued to surge by another 49% in the first half of 2021. More than 45% of fintech app users indicated that their banking habits have “permanently changed” since the onset of the pandemic. This has created a strong foundation of high-growth opportunities within the fintech scene, which SoFi is well-positioned to capitalize on with its multi-product business model. The company’s ability to keep prices at competitive levels compared to traditional banks is also expected to drive greater appeal to the younger generation, which is currently the dominant demographic of virtual banking app users. Out of more than 30% of Americans who either have an account or are planning to open an account with a virtual bank,56% are under the age of 40.

Obtaining a national bank charter also comes at an opportune time for SoFi. The global digital lending industry is expected to grow at a compounded annual growth rate (“CAGR”) of at least 25% through to 2025, and at a CAGR of 5.5% from 2025 to 2030. Meanwhile, the broader digital banking sector is forecasted to keep growing at a CAGR of at least 13.8% up to 29.9% through to 2030. The additional growth opportunities available to SoFi, combined with the cost synergies enabled by a national bank charter, is expected to set the stage for profitability sooner than expected. A national bank charter would also enable SoFi to maximize capitalization on the high-growth opportunities ahead, creating additional upside for the stock in the near-term.

Financial Prospects Recap

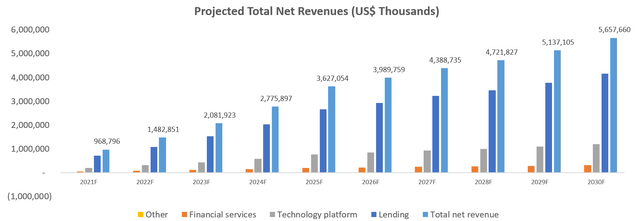

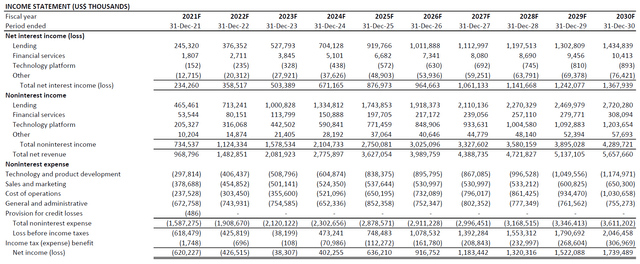

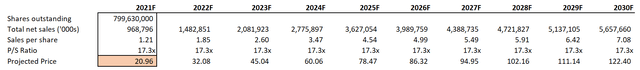

The growth catalysts will underpin SoFi’s financial performance over the next ten years as the global transition to digital continues to take place. As analyzed in detail by business segment in our recent coverage on the stock, SoFi is expected to generate total net revenue of $968.8 million by the end of the year, representing year-over-year growth of 56%. The top-line is projected to experience further accelerated growth at a CAGR of 19.3% towards $5.7 billion by 2030 as a result of increasing adoption of virtual banking channels.

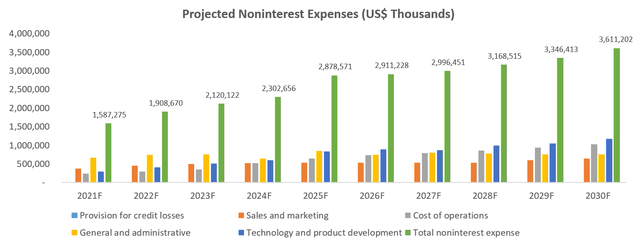

Total non-interest expenses, which consist of technology and product development, sales and marketing, cost of operations, general and administrative, and other nominal spending, are forecasted at $1.6 billion by the end of the year. Related cost items are expected to represent a higher percentage of total revenues through to 2025 to support SoFi’s ongoing growth initiatives, which include further development to its portfolio of service offering and overseas expansion. Yet, these expenses will be partially offset by cost-savings achieved through the FSPL business model and synergies realizable after obtaining a national bank charter, which would accordingly lead to narrowing losses through to 2023.

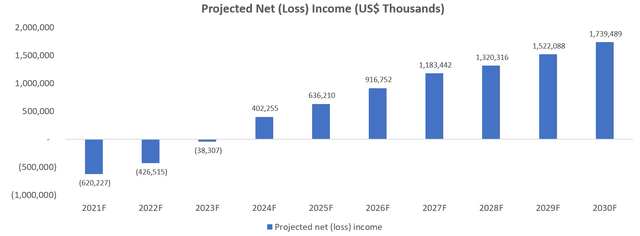

SoFi is expected to generate profits of $402.3 million as soon as 2024, with growth at a CAGR of 27.6% towards $1.7 billion by 2030.

i. Base Case Financial Forecast:

Valuation

Our bullish outlook on SoFi remains unchanged from our previous coverage, with a 12-month price target of $20.96 despite recent price pressures on the stock. This represents upside potential of more than 38% based on the last traded price of $15.16 on September 3rd.

The price target is derived using a multiples-based valuation approach. We have applied a price-to-sales multiple of 17.3x to projected total net revenues per share for 2021 to determine the 12-month price target. The multiple is consistent with those of SoFi’s industry peers, as well as market expectations on the company’s near-term valuation based on its current operating environment, business developments, and growth trajectory.

Conclusion

The stock’s recent pullback makes an attractive buying opportunity. This rings especially true with the anticipated approval of a national bank charter that is expected to materialize within the next 12 months, which will materially transform SoFi’s overall growth prospects. SoFi’s differentiated business model also makes it well-positioned to capitalize on the significant additional growth opportunities ahead as retail customers look to add reliable and affordable virtual platforms to their banking routines.