Sports data and technology company Genius Sports has been popular on the discussion boards. Today, Wall Street Memes talks about GENI, a stock that is owned by Cathie Wood’s ARK Invest.

Genius Sports stock(GENI) has been trending among retail investors on Reddit forum WallStreetBets. The stock is backed by famed investor Cathie Wood’s ARK Invest, which owns well over 1 million shares of GENI.

Today, Wall Street Memes talks about GENI stock and the investment opportunity.

Background first

Genius Sport is a $4.2 billion market cap company that collects and processes data from sports events and later sells it to gambling companies like Skillz and DraftKings. Genius is anofficialdata partner of the NFL and also has deals with NASCAR, MLB, NBA and others.

Currently, Sportsradar is a main competitor, although it is not a publicly traded company. Genius went public in April of 2021 through SPAC dMY Technology Group, with an initial share price of $21.60. Currently, the stock is priced a bit over $22.

Recent financial performance

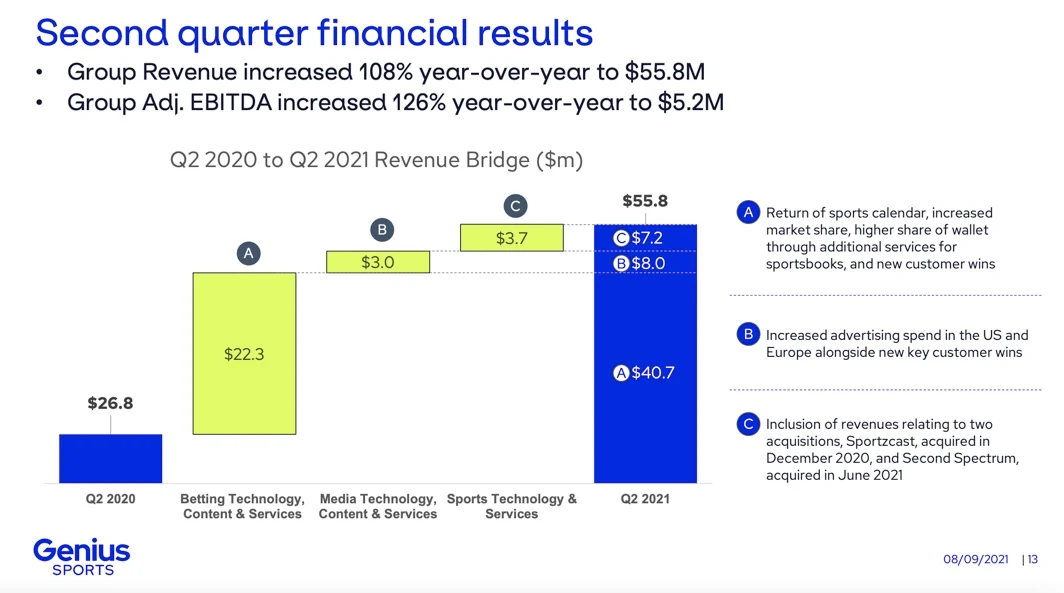

In the second quarter of this year, Genius reported revenues of nearly $56 million that topped consensus by $2 million, for growth of 108% YOY. Adjusted EBITDA increased 126% YOY to $5 million. The company also announced multi-year strategic partnerships with DraftKings, Caesars and WynnBET to provide a full range of official sportsbook data and content.

On the bottom line, the company reported a large EPS miss in Q2, although much of it can be attributed to below-the-line items that should not mean much to the investment thesis. Net loss of $464 million compared to $7 million loss in the same period on the prior year.

Why ARK Invest is betting on GENI

Cathie Wood’s ARK Invest has seen plenty of growth opportunities in online sports betting, since it started to be legalized, in 2018. The New-York based fund’s analyst Nicholas Grous believes in the following:

“According to our research, during the next five years, as the handle for online sports betting scales 10-fold from roughly $18 billion to $180 billion, the three major sports betting categories combined could generate 31% revenue growth at a compound annual rate, increasing the online sports betting category from $9.5 billion last year to $37 billion in 2025.”

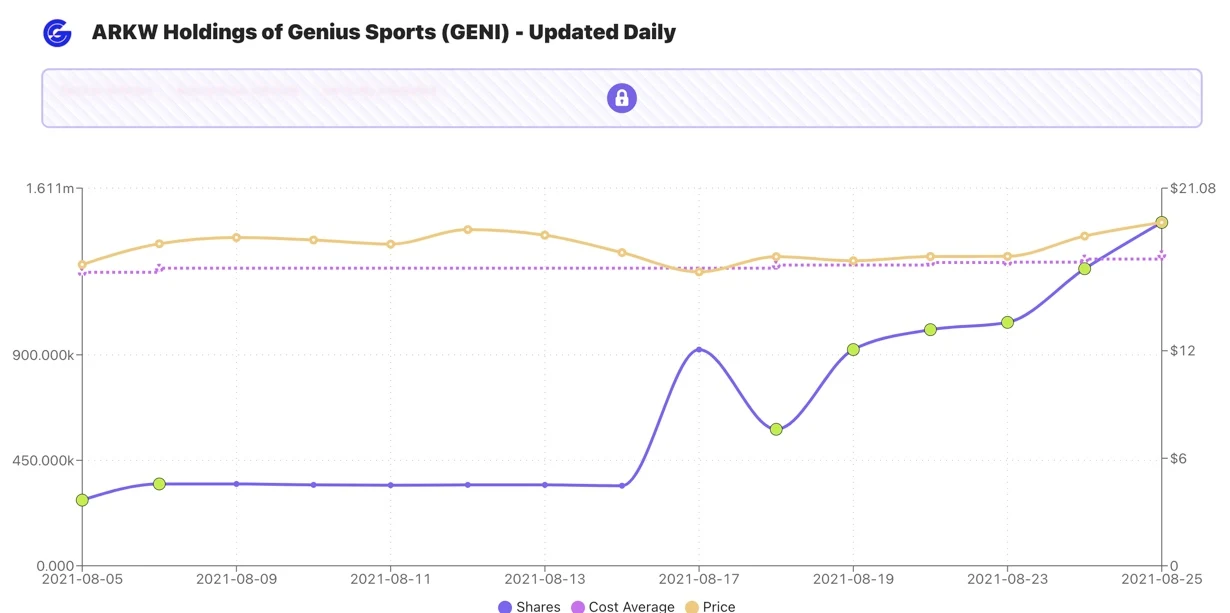

ARK Invest sees Genius Sports as part of the backbone in regulated sports betting. The fund initially bought 280,000 shares for its ARK Next Generation Internet ETF (ARKW) in August 2021 and kept buying more. Today, the fund owns 1.4 million shares. See below:

Wall Street Memes’ final observations

GENI stock differs from “traditional” meme stocks primarily because short interest is low, at less than 5%, and the business fundamentals look solid. The stock’s popularity on Reddit appears to be mainly due to the prospects in sports betting and the opportunities that Genius Sports faces within this emerging industry.

In any case, the ARK fund’s investment in GENI can reinforce retail investors’ confidence in the stock, given the solid track record of Cathie Wood and her team.