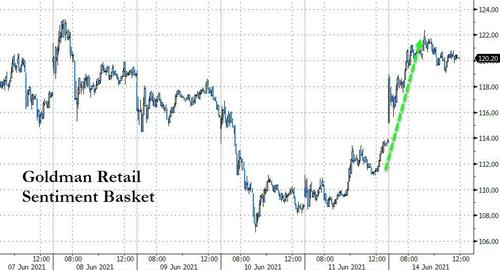

Big-tech was bid as soon as the cash market opened and both Small Caps (Russell 2000) and Big-Caps (Dow Industrials) were dumped with the S&P under water most of the day until the late day panic-bid hit as thegamma-meltup struck...

Lordstown Motors was clubbed like a baby seal today as its CEO/CFO abandoned ship...

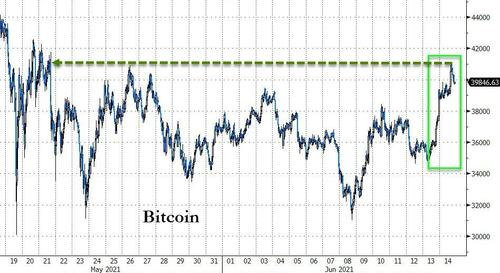

Elon Musk's ability to influence crypto is as evident as ever as he tweeted that he is not full of FUD and bitcoin ripped over 10% higher (helped by PTJ's positive perspective on crypto in an inflationary environment)...

JPM's Dimon spooked bank stocks even further - despite rising yields today...

Uranium/Nuclear-related stocks tumbled on the China Nuke emissions headlines...

VIX jumped back above 17 intraday...

Will The Fed's "most important meeting in years" this week get it moving?

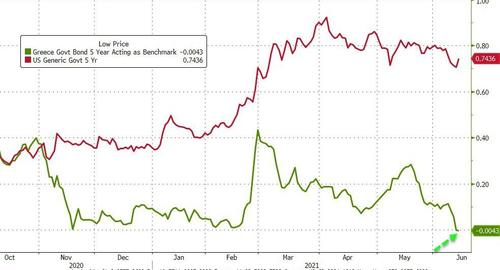

Treasuries were sold today, erasing more of the gains from Thursday's CPI malarkey. The short-end yield rose 1-2bps, the long-end yields rose 4-5bps...

We note that 10Y yields hit 1.50% and the selloff stalled...

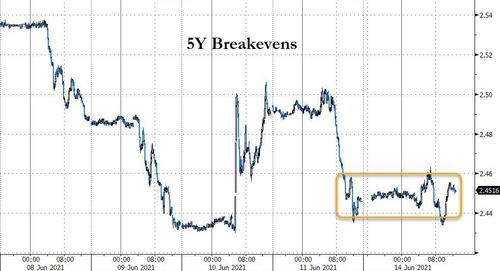

Amid all the chatter on inflation, breakevens went nowhere at all...

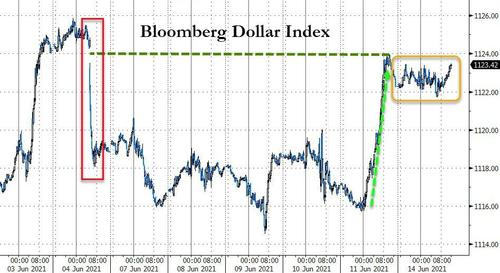

The Dollar trod water after spiking Friday up to fill the payrolls gap down...

Gold ended the day lower despite the dollar going nowhere...