After a relatively quiet couple of months, GameStop stock is back in the spotlight. The videogame retailer-turned –meme sensation is set to report July quarter results after the market closes on Wednesday.

The consensus among the four analysts still covering the stock and providing estimates to FactSet is that the company (ticker: GME) will report a fiscal second-quarter adjusted net loss of 67 cents a share. They forecast sales of about $1.23 billion, down from $1.28 billion in the first quarter but an improvement from $942 million in the second quarter of last year.

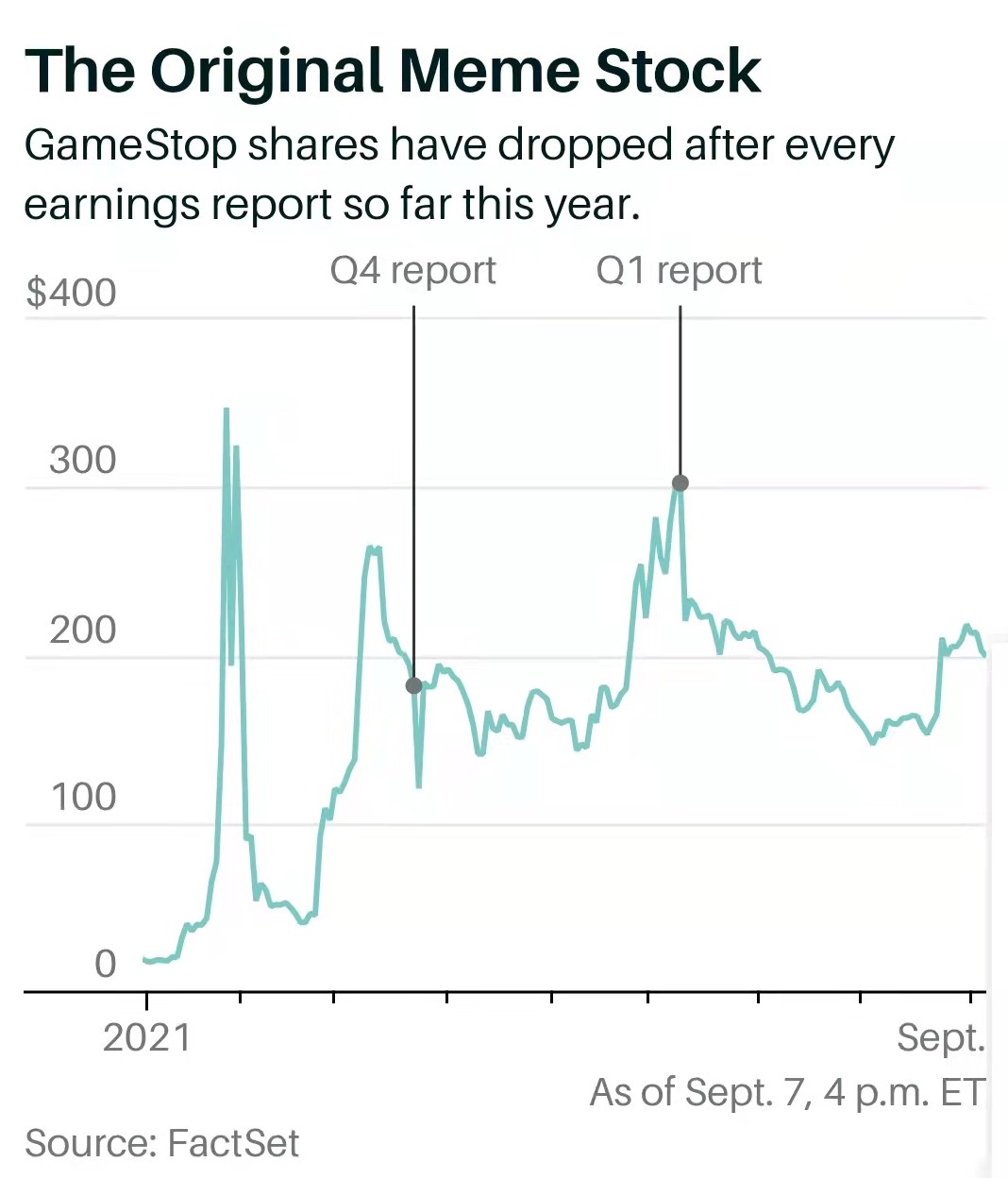

For Wednesday evening’s report, options markets imply a 9% to 12% move, up or down, after earnings. If the past two reports are any indicator, expect volatility.

More important to investors will be updates from the company’s new management team. Activist investor and Chewy co-founder Ryan Cohen joined the GameStop board in January—which kickstarted the stock’s initial surge—and became the board’s chairman in June. CEO Matt Furlong and Chief Financial Officer Mike Recupero—both Amazon.com alums—started in their roles at GameStop on June 21 and July 12, respectively, so this will be both executives’ first earnings report.

Through hiring a swath of executives with substantial e-commerce experience and investing in fulfillment, the company has signaled progress on efforts to revamp GameStop’s digital presence and customer service efforts. Still, Wedbush analyst Michael Pachter told Barron’s the company hasn’t provided any substance to its strategic ambitions.

“They want to be like Amazon,” Pachter added. “I expect them to keep the mystery alive.”

In June, Cohen said he wouldn’t make lofty promises or telegraph his strategy to competitors. Still, he listed goals such as “delighting customers and driving shareholder value for the long-term.” A substantive update, or significant progress on its turnaround efforts, could provide a spark for the stock.

Still, David Trainer, CEO of investment research firm New Constructs, argues shares are trading on meme momentum, rather than fundamentals. He thinks the share price would be closer to $30 if it were trading based on the business’ fundamentals.

“The business results that are implied in GameStop’s current stock price are far, far beyond what any reasonable person might expect the company to achieve,” Trainer says. “Even if GameStop’s management transforms the business into a wildly larger and more profitable enterprise, the stock isn’t likely to move higher because that business momentum is already priced-in.”

With GameStop shares down 1.9% to $199 on Tuesday, the stock was still up 2,500% in the past year and 956% year-to-date. Shares were down 34% from their close on June 7. While it’s difficult to nail down what moves GameStop stock on any given day, short seller activity, options volume, momentum trading, and online chatter are among the nonfundamental factors to consider.

Ihor Dusaniwsky, managing director at short-selling analytics provider S3 Partners, estimates GameStop’s short interest sits at $1.41 billion. His estimate at 6.94 million shares shorted represents roughly 11% of shares available for trading.

“Over the past week we saw significant short covering,” Dusaniwsky says, noting shares shorted decreased by about 306,000 shares, worth $62 million, even as the stock price fell