Stock splits are still surprisingly rare — but S&P 500investors applaud when they happen. So it's only natural to guess which high-priced stocks might split next.

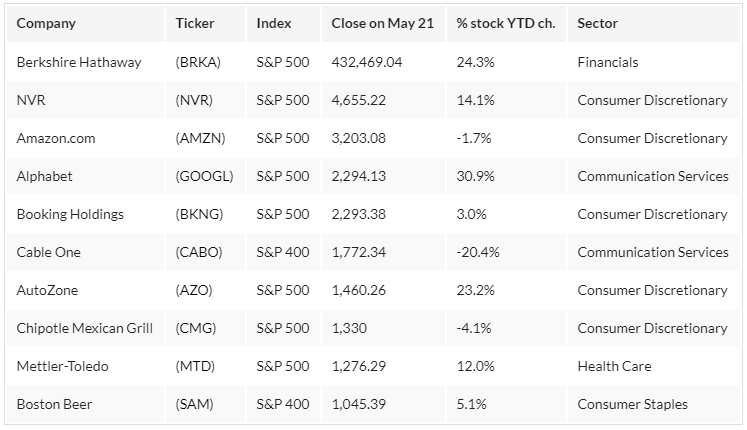

Ten stocks in the S&P 1500 trade for nosebleed per-share prices of more than $1,000 a share, including consumer discretionaryNVR(NVR),Amazon.com(AMZN) andChipotle Mexican Grill(CMG), says an Investor's Business Daily analysis of data from S&P Global Market Intelligence andMarketSmith. And eight of those $1,000-plus stocks are in the S&P 500.

There's no guarantee any will split. And stock splits don't make any financial difference to the value investors' holdings. But it turns out, investors love splits.

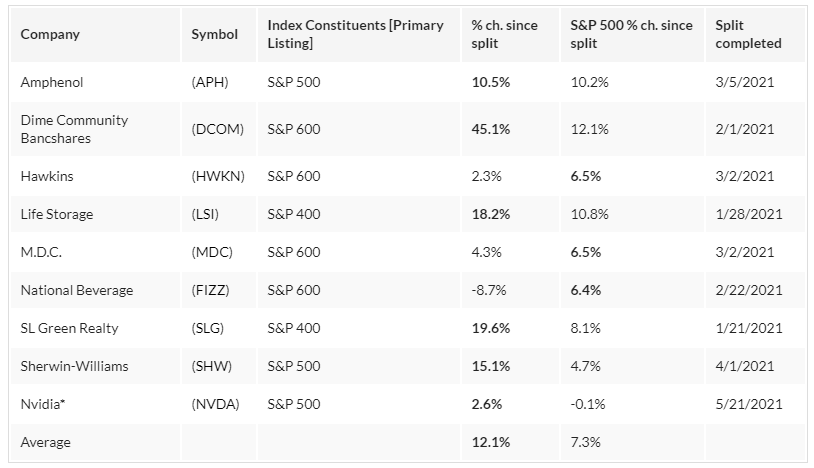

Information technology giant andLeaderboard memberNvidia(NVDA) reminded S&P 500investors what they're missingon May 21. The computer-chip maker announced plans for a 4-for-1 stock split. Investors celebrated — sending the stock up 2.6% to 599.67 — as the news came just days ahead of the company's quarterly profit release.

And it's just the latest example.

Stock Splits Shrivel Up

Splits are much more rare than they were a decade ago

S&P 500 Investors Rejoice Rare Splits

Stock splits are practically unicorns on Wall Street. And that's a surprise — as per-share stock prices aredouble from a year ago.

Just nine S&P 1500 companies announced splits this year so far, roughly in line with the 18 in all of 2020. And just three S&P 500 stocks split this year. That's only on pace with last year. Splits are a fraction of where they were in 2013. That year, 48 S&P 1500 stocks split their shares.

Not seeing splits is surprising, too. Stock prices are up considerably from this point last year. S&P 1500 stocks now have a median per share price of 62.50. That's up more than 60% from the median per-share price of 37.29 a year ago. Meanwhile, roughly a third of the stocks in the S&P 1500 trade for 100 a share or more.

And splits remain popular with investors.

Shares of the nine S&P 1500 stocks to split this year are up 12% since the split. That's well above the 7.3% average return of the S&P 500 during the same time. Take paint makerSherwin-Williams(SHW) as an example in the S&P 500. Its shares are up more than 15% since it announced a 3-for-1 split on April 1. That tops the 4.7% gain in the S&P 500 in that time.

Historically, companies split their share prices when they start moving toward 100 a share. Following a split, the per-share stock price falls, but investors get additional shares. The value of the company is unchanged, but a lower per-share price is theoretically more affordable. Splits, though, can makeoptions contracts more affordable.

Hooray For Splits

S&P 1500 stocks that split this year are outperforming

Looking At S&P 500 High-Priced Stocks

Warren Buffett, a long-timecritic of stock splits (and Bitcoin), continues to tip the scale on the S&P 1500 when it comes to high-priced stock. But he's far from alone.

His Berkshire Hathaway class A shares trade for more than 432,000 a share. That more than any other stock. In fact, the per-share price is so unusually high, it threatened to short-circuit the Nasdaq's pricing and trade reporting system. But pressure isn't on the company to split as the company's class B shares trade for a much more palatable 287.92 each.

But there's no shortage of other high-priced stocks. Homebuilder NVR closed Friday at 4,655.22 a share. That's the highest per-share price outside of Berkshire. But high per-share prices are also common with a number of high technology stocks. Amazon.com closed at 3,203.08 a share on Friday. And then there's Google parent, Alphabet, which closed at 2,293.38 a share.

The question, though, is will more companies follow? There's plenty of room to do it.

S&P 1500 Stocks With The Highest Per-Share Prices