One week before Tesla’s Q2 earnings call, here’s what to expect.

While Tesla stock has continued to sell-off, the stock has averaged positive returns the week before the earnings call. Let’s take a look at what we can expect this week in the Macro, Tesla, and Technical world.

Macro Outlook:

The Nasdaq 100 ($NDX) underperformed the Dow Jones Industrial Average Index ($DJI) last week. This movement coincided with an increase in the 10-year bond yield indicating inflation fears for investors. Supporting fears for inflation, the Consumer Price Indexdataannounced on Tuesday, July 13thwas thelargestyear-over-year jump since August 2008. China’s COVID-19 Delta variant outbreak is also a concern. The strain appeared to be isolated to the Guangdong Province which resulted inlockdowns but, has since spread. Expansion of lockdowns into Shanghai may result in the closure of factories.

Tesla Catalysts:

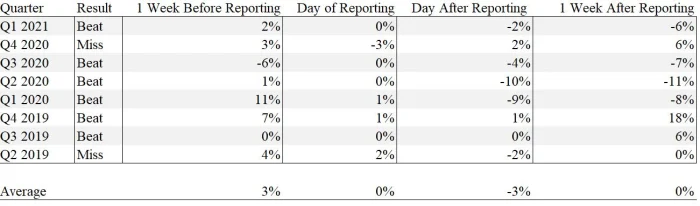

Tesla’s Q2 earnings call is exactly one week away. Historically, Tesla stock has traded positively the week before the earnings call. However, the same cannot be said about the week following despite beating analysts' expectations in six of the last 8 quarters.

The current Wall St.estimate for Tesla's second-quarter is $0.93 EPS and has been revised downward from April’s estimate of $0.97.

Tesla has also released a subscription service for their Full Self-Driving software. The feature starts at $199 per month compared to the up-front purchase of $10,000.

For More information on the FSD SubscriptionCLICK HERE

Technical Outlook:

Friday’s price action resulted in Tesla’s stock price closing at $644.22. Tesla stock remains ~$12 above the 200-day moving. Despite two weeks of downward price action, a reversal toward the upside before earnings would not be a surprise. One would expect upward resistance at last week’s high of $693 and support at the 200-day moving average.

Tesla stock, along with the majorindicesand bond yields are negative before Monday's open. This lower start appears to be driven by the COVID-19 Delta variant news. Overall, COVID-19 cases haverisen70% week-over-week to 26,000 cases in the United States.

Currently, Tesla stock is trading below the 200-day moving average near $629. This is after bouncing off Tesla stock's pre-market low of $626.22.The next support could be at July 8th's low of $620.46.