Here are some key takeaways from Fed Chairman Jerome Powell’s press conference Wednesday — what we learned, and what we didn’t, and some of the fun we had along the way.

Some economists said that Powell conducted a master class on communication.

Fed intends to be dovish until data indicates otherwise

The first step for the Fed to pull back its easy policy stance will be to slow, or taper, its $120 billion-per-month in asset purchases. The Fed has said it wants to make “substantial further progress” on its twin goals of maximum employment and stable 2% inflation, but has not defined this much further.

Powell said the 465,000 jobs created in the private sector in February was “a nice pick-up,” but he quickly added “you can go so much higher, though.”

“To achieve substantial progress from where we are is going to take some time — I don’t want to put a pin in the calendar someplace because it’s going to take some time,” he said.

When will the data indicate otherwise? We’ll get back to you on that

“Until we give a signal, you can assume we’re not there yet,” Powell said.

Bad inflation readings this year won’t upset the apple cart

The Fed’s economic forecast and “dot plot” seemed almost designed to hammer home the notion that the Fed won’t be spooked by higher inflation. Despite a forecast of 2.4% headline inflation this year, the Fed ‘s “dot-plot” showed no rate hikes through the end of 2023.

Powell acknowledged prices will go up when Americans decide to go out again and eat in restaurants and go on airplanes as the pandemic wanes. But this will be a one-time bulge on prices that won’t change inflation going forward. Service-sector inflation isn’t like inflation for televisions or other goods.

“You can only go out to dinner once per night,” the Fed chairman said.

Fed officials don’t know how the economy will look in September any more than you do

Powell stressed that the outlook remains highly uncertain. “We haven’t come out of a pandemic before, we haven’t had this type of fiscal support,” he said,

Some of the worst-case scenarios are receding — there had been a concern that workers would be “scarred” without the job skills to find employment after the pandemic. With strong support from Congress, “we probably avoided the worst cases there,” Powell said.

But sometimes, Powell’s innate optimism seemed to leak out.

“The data could get stronger fairly quickly here,” he said.

Weak growth in Europe won’t spill over into U.S.

Powell said he didn’t think the weak European economy would drag down U.S. growth, as happened after the Great Recession. “We’re in a good place,” he said.

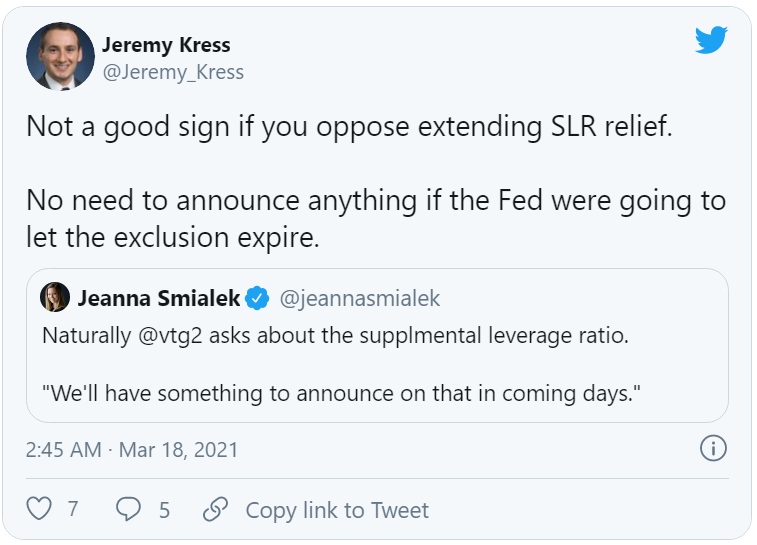

A decision on the SLR (supplementary leveraged ratio) will come soon

In the heat of the pandemic crisis last year, the Fed temporarily excluded Treasurys and deposits at the Fed from the calculation of the supplementary leverage ratio — a key metric on the soundness of a bank. The SLR requires banks to maintain a minimum level of capital against assets without factoring in risks. Some analysts worry that ending the exclusion of Treasurys will, all things being equal,reduce demand for Treasurys at big banks.But other analysts think this is way overstated. Powell wouldn’t touch the issue — he only said that a decision was expected in a few days.

But this disheartened some experts who want the exemption to be ended. After all, if the Fed wanted the exemption to end, it didn’t have to make any announcement at all, noted Jeremy Kress, a former Fed staffer and now an assistant professor of business law at Michigan Ross business school.

Financial markets were glad to see the Fed being so unconcerned about higher inflation.

U.S. stocks pushed higher Wednesday,reversing earlier losses, after Fed policy makers left the central bank’s easy money stance in place, with the Dow Jones Industrial Average closing above 33,000 for the first time.