Although the near-term outlook for cruise lines has become worse, the longer-term prospects have improved due to pent-up demand and more widespread vaccination against the coronavirus than was previously expected, according to UBS.

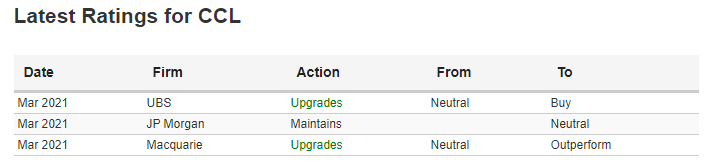

The Carnival Analyst:Robin Farley upgraded Carnival Corp CCL 0.59%from Neutral to Buy and raised the price target from $20 to $42.

The Carnival Takeaways:UBS has raised its 2021 and 2022 estimates for Carnival, but raised projections for 2023, Farley said in the upgrade note.

“Furthermore, given that CCL includes some brands that source primarily from Italy, Germany and the UK, and those countries are likely to allow cruising to restart before the US, we are bumping up CCL estimates to include more relative recovery than previously,” the analyst said.

“We estimate that their older ships have mid-single digit operating margins and thus divesting them can be accretive to companywide margins. We also estimate that newer ships have operating margins of 25-30%. So we believe ship divestitures and new tonnage help CCL margins by 500bps in '23.”

CCL Price Action:Shares of Carnival were rising 0.97% to $29.21 at last check Thursday.