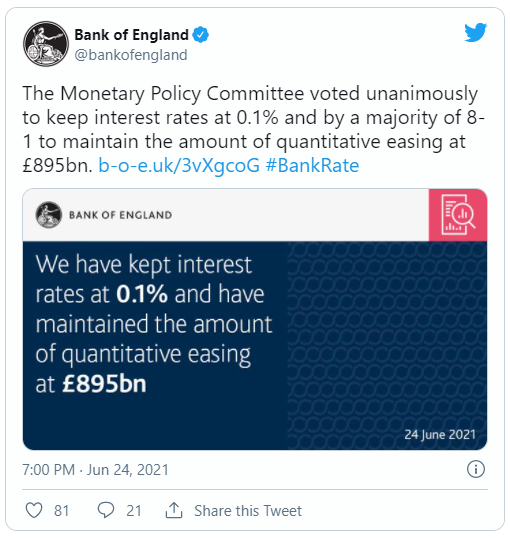

With central banks riding a hawkish wave in recent months, eyes turned toward the Bank of England and its latest monetary policy decision this morning, which however did not surprise as the central bank voted unanimously to keep interest rates at 0.1% and by a majority of 8-1 to maintain the amount of quantitative easing at £895bn, with outgoing chief economist Haldane again dissenting and voting to reduce the asset purchase target in his final vote before leaving the Bank of England.

So with inflation surging in the UK as everywhere else, how did the BOE deflect calls to tighten? Simple, like the Fed it said that while inflation may rise above 3%, it will be transitory, to wit: "CPI inflation is expected to pick up further above the target, owing primarily to developments in energy and other commodity prices,and is likely to exceed 3% for a temporary period"which means June output is expected to be around 2.5% below its pre-Covid level in the final quarter of 2019. For context, the previous inflation peak was projected to be 2.5%, so yet another significant reflationary rethink.

And once said "temporary period" ends, all shall be well, however nobody knows when that will be, just as nobody knows what the"clear evidence of significant progress"toward achieving the 2% inflation target is that the BOE needs before tightening policy.

And while the BOE won't issue a fresh round of forecasts until August, they did revise up their second-quarter projection by around 1.5 percentage points from their May projection of 4.3%.

Some more details from thefull statement:

- Committee’s expectation is that the direct impact of rises in commodity prices on CPI inflation will be transitory.

- Output in a number of sectors is now around pre-Covid levels, although it remains materially below in others

- Developments in global GDP growth have been somewhat stronger than anticipated, particularly in advanced economies

- The Committee does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.

- Spare capacity in the economy was expected to be eliminated as activity picked up, and there was expected to be a temporary period of excess demand, before demand and supply returned broadly to balance.

- Policy should both lean strongly against downside risks to the outlook and ensure that the recovery was not undermined by a premature tightening in monetary conditions.

- Most members judged that the conditions set out in the MPC’s existing policy guidance, which were in any case necessary but not sufficient conditions for any future tightening in monetary policy, were not met.

- Bank staff had revised up their expectations for 2021 Q2 GDP growth to 5.5%, from 4.25% at the time of the May Report. That would be consistent with output in Q2 being less than 4% below its 2019 Q4 level, and projected output in June around 2.5% lower.

- It was possible that a stronger path for demand would close the output gap somewhat sooner than had previously been expected.

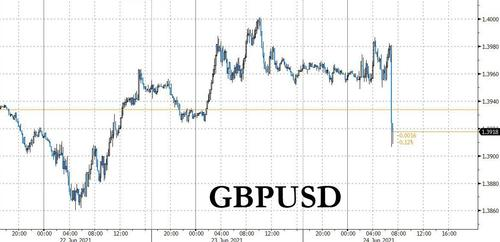

The market response was muted as the decision appeared to come on the dovish side: the pound reversed modest gains as short-term positioning over a hawkish surprise is unwound. Gilts rise, with 10-year yield down by 3 basis points to 0.75%.

According to Bloomberg, in the longer term, and until a shift comes, the pound may stay under pressure especially as it trades below its 21-weekly moving average, a momentum-defining indicator since the pandemic started.

At the same time, EUR/GBP rallied as stops were triggered given the transitory-inflation narrative remains and cable dips toward the $1.39 handle. According to Bloomberg,a 15bps rate hike by the BOE is now pushed back to Aug 2022 from June 2022 just before the decision.It remains to be seen whether this is more interest to trade the pound afresh or is it all down to short-term position rebalancing.

Bottom line: today's somewhat dovish statements puts a lot of attention on to the August meeting when we’ll get a full set of new forecasts and learn more about the BOE's thinking; we should also have a clearer sense of how the virus situation is developing once more people are vaccinated.