Chinese e-commerce giant Alibaba reported disappointing earnings on November 18. The stock reacted poorly, sinking 11%. However, Wall Street experts still believe that BABA is undervalued.

Alibabadisappointed on earnings day. On November 18, the Chinese e-commerce behemoth reported a revenue and EPS miss. The stock has been hurting badly throughout 2021 and is nearly 40% lower year-to-date.

However, Wall Street still sees BABA as a strong buy. After the release of the earnings report, at least three experts have weighed on Alibaba stock. Wall Street Memes takes a closer look at what experts have been saying after Alibaba earnings.

September quarter’s big miss

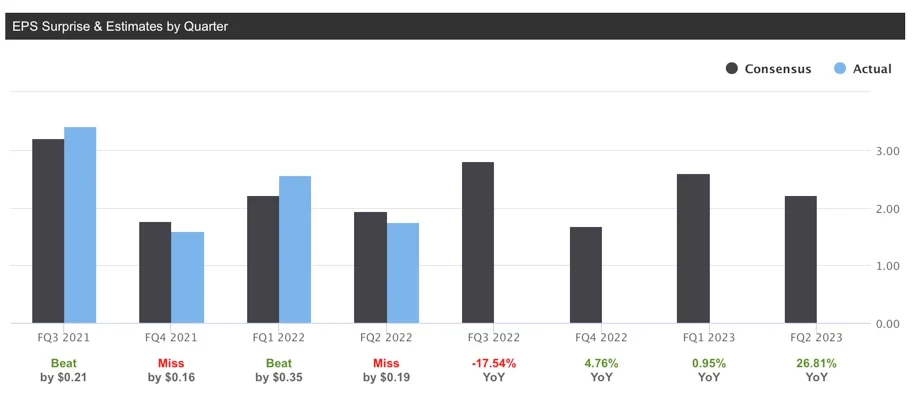

Alibaba reported September quarter earnings below Wall Street estimates. Earnings per share missed by $0.19 and revenue missed by $638.6 million. Not only did the company disappoint on fiscal Q2 results, but it also delivered soft guidance as well.

Weaker-than-expected performance can be blamed on China’s economic slowdown during calendar Q3, in addition to issues like regulations around antitrust and data security. However, Daniel Zhang, Chairman and Chief Executive Officer of Alibaba Group,said that the longer-term growth goals remain on track.:

“ This quarter, Alibaba continued to firmly invest into our three strategic pillars of domestic consumption, globalization, and cloud computing to establish solid foundations for our long-term goal of sustainable growth in the future.”

Alibaba’s gloomy view of macroeconomic conditions and the competitive landscape dictated its fiscal year 2022 revenue guidance of $145 billion (RMB930 billion). Alibaba now expects the top line to grow 20% to 23% year-over-year, quite a bit lower than pre-earnings consensus of 28.5%.

Experts are still bullish

Before the September quarter earnings season, sell-side consensus on BABA looked extremely bullish. Based on 22 analyst rating, the stock was considered a strong buy, with only one neutral and one sell recommendation.

After the earnings report, at least three analysts have weighed on BABA stock. Despite all three having lowered their price targets, BABA still has an average projected price of $221.33 among these analysts, which represents 54% upside potential.

CLSA analyst Elinor Leung maintained a buy recommendation on BABA and lowered the company’s price target to $250 from $273, for a still compelling 74% upside potential. The analyst sees September quarter results as disappointing, but also believes that the company’s strategic investments continue to improve.

Citigroup analyst Alicia Yap also lowered the research firm's price target on Alibaba to $234 from $240 for 63% gain potential, but kept a buy recommendation. Mrs. Yap was not surprised to see Alibaba’s miss, especially following a substantial slowdown in NBS retail data for the past two months.

Lastly, Morgan Stanley analyst Gary Yu maintained his buy recommendation on BABA and set the upside opportunity at 25%. Alibaba’s fiscal 2022 revenue growth guidance cut to 20-23% led the analyst to revisit his model and de-risk the price target. The analyst also said:

"We estimate that slightly less than half of the incremental change of RMB50-70 billion comes from lower customer management revenue (CMR) and some from China Retail Others, given lackluster consumption and competition. 3QF22 industry GMV is tracking only at single-digit growth. NBS online retail sales of goods grew 10.3% yoy in October while Tmall Double 11 GMV grew 8.5% yoy. With merchant support, therefore, we expect CMR to grow 4-5% yoy in 2HF22.”