For best performance, how long should Apple stock be held in a portfolio? The Apple Maven discusses what traders, speculators and investors should expect when betting on AAPL.

The Street’s Jim Cramer has said it repeatedly: own Apple stock (ticker $AAPL), don’t trade it. Today, the Apple Maven revisits this idea to help determine how long one should hold Apple shares.

Below is an analysis of how much one might expect to gain if (1) day-trading, (2) speculating on, or (3) investing in Apple stock. Obviously, since the future is uncertain, the analysis is based on historical data – which I believe can at least provide a blueprint for future share price performance.

#1. AAPL investors: long-term winners

As I mentioned in my recent “Apple Stock 101” article, investors that bought Apple shares in December 1980 (i.e. the IPO date) and held onto them until now realized impressive annualized gains of 19%. Clearly, AAPL has been a good asset to “get and forget” over Apple’s tenure as a publicly-traded company.

But allow me to work with more realistic time frames. For this exercise, I will consider “investors” those who hold AAPL for one year. To be clear, many might consider twelve months a minimum investment horizon to qualify as long term.

Also, I am limiting my analysis to the past 20 years, since the stock used to be much riskier and more volatile in its first couple of decades of existence than it is now. Apple stock’s returns have been even better during this period that begins with the end of the dot-com correction:35% annualized.

The chart below shows the distribution of weekly returns earned by an Apple stock investor, using the parameters described above, if the bet had been made on any give day since May 2001.

- Key observation: if held for one year, and based on historical observations alone (i.e. not on modeled projections for the future), Apple stock can arguably be expected to produce weekly returns of about +0.5% to +1.0%. Rarely has the stock been a big-time winner or loser – say, weekly returns of more than +2% or less than -1% on average – when the investment horizon is one year.

#2. AAPL speculators: higher octane

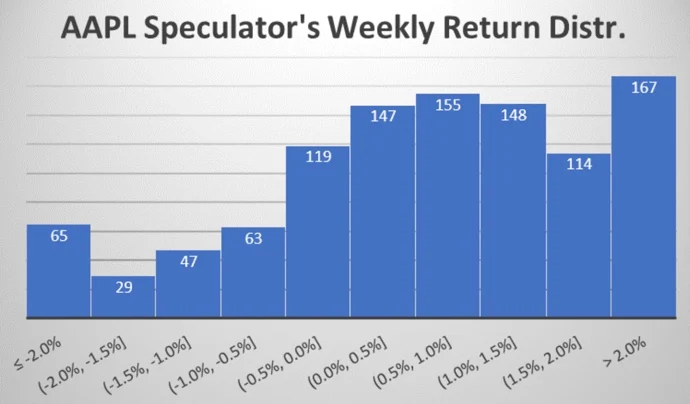

Speculators have had a bit different experience from the above. Here, I characterize as “speculator” someone who buys AAPL and sells it ten weeks later, or roughly two and a half months after the purchase date.

See histogram below. For ease of comparison with the weekly return analysis immediately above, I kept the chart’s scale unchanged.

- Key observation: the distribution above is still somewhat bell-shaped, meaning that a weekly return of between +0.5% and +1.0% is still quite common. However, notice the much “fatter tails”. The probability of larger weekly gains or losses tends to increase when Apple stock is held for ten weeks rather than one year.

#3. AAPL day-traders: buckle up!

Lastly, day-traders that buy Apple stock and sell it within less than a full week have been playing a completely different game. Once again, the histogram below depicts the averageweekly returnin AAPL when the timeframe is compressed to no more than 7 days. The chart scale, again, remains unchanged for ease of comparison.

- Key observation: when buying and selling AAPL in a matter of days, it is most common for the bets to result in much more sizable weekly gains or losses: less than -2.0% or more than +2.0%. Earning long-term average gains of about +0.5% to +1.0%, in these cases, has been a rarity.

What to make of it all

Back to the original question: how long should Apple stock be held? Based on historical analysis, the answer really depends on personal goals. Here is the roadmap:

- If merely seeking long-term capital appreciation that might be market-beating, but probably not by a very wide margin, buying AAPL and holding it for a year or more is highly advisable. Speculative bets of a few weeks here and there (say, selling into strength and buying into weakness based on price action) could help to boost returns, if the trades are well executed.

- If seeking outsized gains, trading AAPL within days would be the best approach. However, this strategy is also the riskiest, as it could lead to outsized losses instead. I believe that day-trading Apple stock is the least advisable approach to most people, but possibly an interesting proposition for a select few.