S&P 500’s core outlook remains bullish

The S&P 500 index is performing at a far different rate than the “average” stock. This has been going on for a while and is not necessarily a bull market “killer,” but it is certainly not the healthiest of environments.

The S&P,the NASDAQ-100 and the Dow Jones Industrial Average are all at or near all-time highs. But the Russell 2000 is lagging behind, reflective of the poor internal strength of the overall market. The internal measurements show fairly heavy put buying, poor breadth on many days, and even more new 52-week lows than new highs.

What is propelling SPX and the narrow-based indexes is a relatively small number of large-cap tech stocks.

Similar stories have unfolded many times in the past – some with dire market results and some not so bad. But it is extremely difficult to keep a bull market going with the majority of stocks lagging behind.

Two rather notable, but certainly not recent, occurrences were 1) the “Nifty Fifty” stocks of 1973 that seemed to “defy gravity” and kept going up while the rest of the market was stumbling; eventually that situation deteriorated into a raging bear market in 1974, and 2) the “stealth bear market” of 1994, where small-caps went down for most of the year, yet SPX was essentially flat during that time; there neverwasmuch of a decline in that index until an unrelated scandal (the Orange County debacle) took it down briefly late in the year.

This situation is not irreversible. It could “right” itself if breadth were to improve. That is still a possibility.

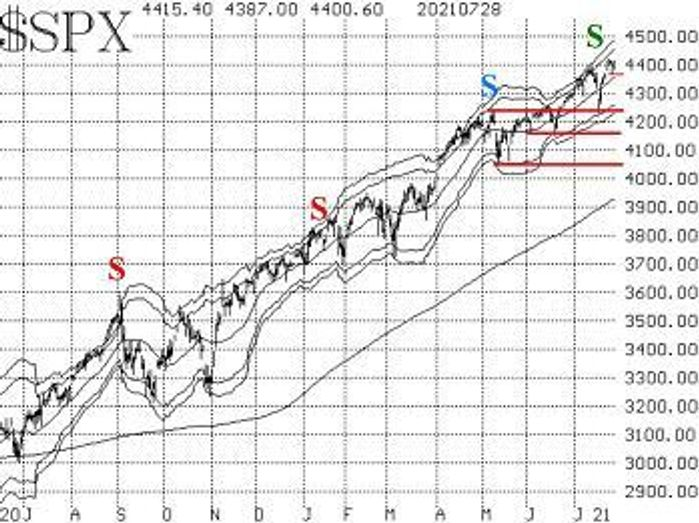

The SPX chart is still in a bullish mode, as it is rising and above support. There is minor support at this week’s lows, near 4370. Then there is more important support below that at 4233 (the July lows). As long as SPX remains above that level, the chart will still have a bullish appearance. Further support levels at 4160 and 4060 were well-tested, but are so far below current levels as to be of little use.

As noted on the accompanying SPX chart, a McMillan Volatility Band (MVB) sell signal is place (green “S” on the upper right of the chart). In addition, there is now a realized volatility sell signal in place, too, as the S&P’s 20-day historical volatility has risen above 11%.

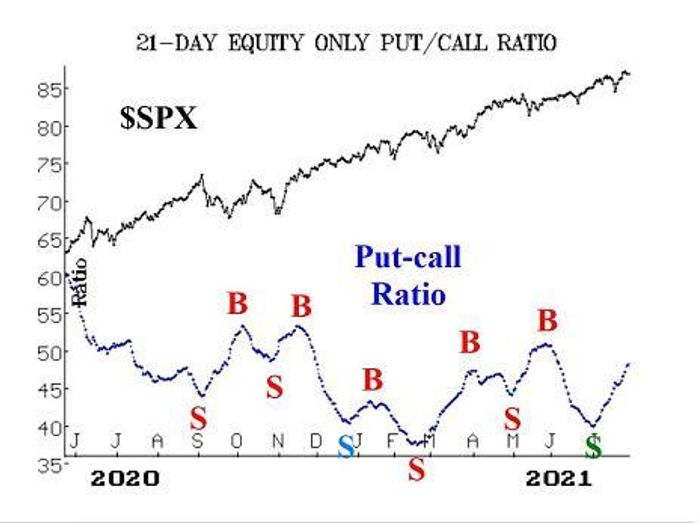

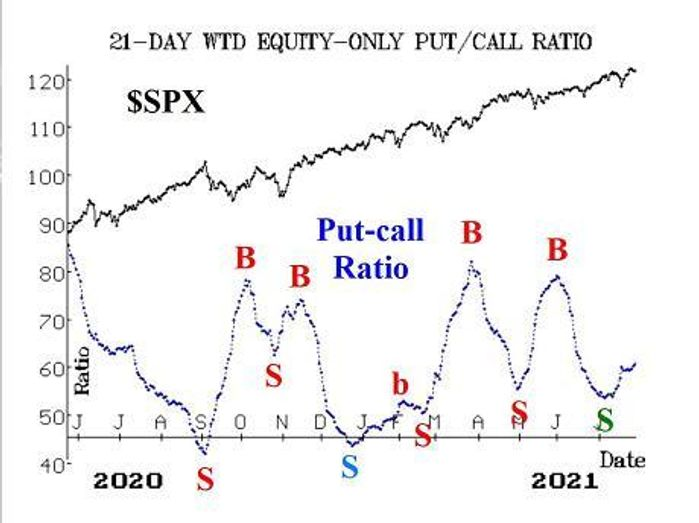

Equity-only put-call ratios remain on sell signals, as they are still rising. This is indicative of relatively heavy put buying over the past month. As one can see from the accompanying charts, the standard ratio is rising faster than the weighted ratio – but both are rising.

Breadth has been the most prominent indicator of the internal troubles that the current market is experiencing. It has been negative on many days when SPX was making new all-time highs. As a result, our breadth oscillators are lagging behind the market. Yes, they are on buy signals, but are nowhere near the positive levels that one would expect to see with the NASDAQ-100, S&P 500 and Dow industrials at or near their highs.

There was one small ray of improvement here on Wednesday, though, when the broad market was flat-to-down on the day, yet breadth was positive. We have not seen that much recently, but if it should continue, that would be bullish for stocks.

The cumulative breadth oscillators continue to lag, and that is the “official” measure of a negative divergence. The cumulative breadth indicators made new all-time highs on 10 of 13 trading days leading up to and including June 11. Since then, they have not made a single new all-time high. Meanwhile, SPX has made new all-time highs on 13 separate trading days since that date.Thatis a negative divergence.

It can be overcome by an improvement in the cumulative breadth indicators – something which was accomplished earlier this year. But, for now, this negative divergence remains as a warning sign to stay alert and not become complacent.

Over the past week, new 52-weeks lows were more numerous than new 52-week highs in terms of NASDAQ data and in terms of “stocks only” data. However, it is the NYSE that we use for our indicator, and new highs managed to cling to a narrow lead over new lows there. Thus, this indicator – while weakening – is still in a bullish state.

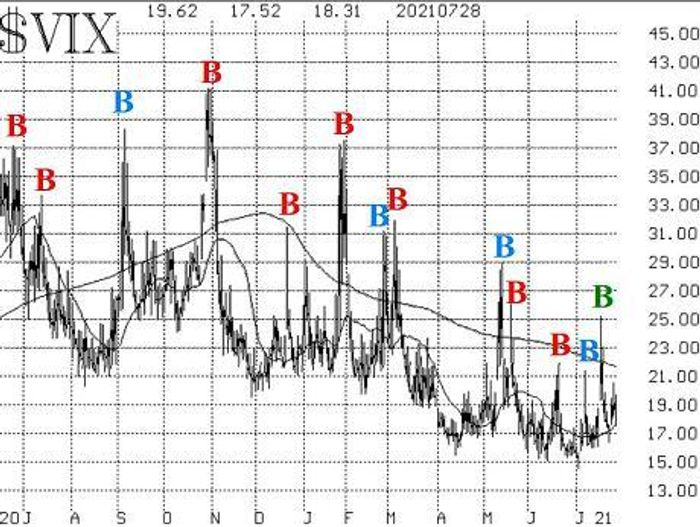

The one area of the market that has not shown these negative tendencies is implied volatility – VIX and its trading products. The VIX “spike peak” buy signal of July 20 is still in place. In fact, there has been a continuous “spike peak” buy signal in place since May 21, except for two trading days. Moreover, the trend of VIX remains downward as the 200-day moving average is still declining, and it is well above the VIX 20-day moving average.

The construct of volatility derivatives remains positive for stocks. The front-month August VIX futures are trading at a rather large premium to VIX, and the VIX futures term structure slopes upward. Also, the CBOE Volatility Indices term structure slopes upward. These add up to a bullish scenario for stocks. Any danger for the broad market would be signaled by the August VIX futures trading at a higher price than the September VIX futures, but that it is not imminent.

So, the “core” outlook for the market remains bullish due to the trends of SPX and VIX. Yes, the internals are warning against complacency, so we can take sell signals against this “core” bullish position, but as long as SPX remains above support at 4233, the bulls remain in charge.

New Recommendation: D.R. Horton

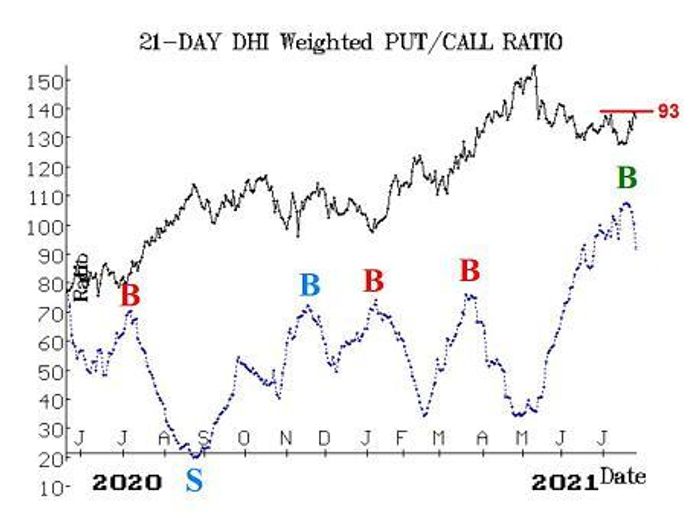

D.R. HortonDHI,+0.50%has a new buy signal from its put-call ratio chart, but we want that to be confirmed by an upside breakout as well. From the chart below, one can see the local maximum at an extremely high level on the put-call ratio chart (the green “B”), and that is an example of extreme pessimism toward this stock, even though its pullback since the beginning of May has not been all that steep.

Put-call ratio signals are contrary in nature, so if the public is extremely pessimistic, we want to be optimistic. That would materialize in the form of a call buy, but only if DHI can close above resistance at 93.

IF DHI closes above 93,

THEN buy 2 DHI Sept (17th) 92.5 calls

DHI is currently trading above 93, but we want to see it close there before taking a long call position.

That is the only new recommendation. There has not been a lot of takeover rumor activity recently except forCerner Corp.CERN,+1.38%However, we only recently exited a position in Cerner, as the takeover rumors had been around so long that they extended beyond the length of the expiration date of our calls.

Follow-up action

All stops are mental closing stops unless otherwise noted.

Long 3 DUK Aug (20th) 100 calls:Raise the trailing stop to 102.

Long 4 DBX Aug (13th) 30.5 calls:Raise the trailing stop to 30.20.

Long 1 RAPT Aug (20th) 30 call:The stop yourself remains at 26.

Long 1 SPY Aug (20th) 431 call:This position was bought in line with the VIX “spike peak” buy signal of July 20. Continue to hold for 22 days from that date. The position would be stopped out if VIX were to rise 3.00 points or more within any three-day period, using closing prices. If it is stopped out, then re-enter with an at-the-money call on the ensuing buy signal.

Long 2 HOLX Sept (17th) 65 calls:Raise the trailing stop yourself to 68. Furthermore, if the stop trades at 75, then roll up to theSept (17th) 75 calls.

Long 1 SPY Aug (20th) 433 put and short 1 SPY Aug (20th) 408 put:This spread was bought in line with the equity-only put-call ratio sell signals. Those sell signals are still in place, so continue to hold this spread. We will update the situation weekly.

Long 0 AVCT Aug (20th) 5 calls:These calls were stopped out when American Virtual Cloud TechnologiesAVCT,-1.30%closed below 5 on July 26. The stock had begun to weaken on news of debt reduction and then fell sharply after the company filed to sell more shares.

Long 5 STAR Aug (20th) 22.5 calls:Raise the stop to 22.20.

Long 5 MGI Aug (20th) 10 calls:Hold this position without a stop initially to see if a takeover bid can materialize.