Even before Tesla (TSLA) surprised the crypto markets with news of its $1.5 billion bitcoin (BTC-USD) buy in January, disruption investor Cathie Wood and her team at Ark Invest had been modeling for more companies to use bitcoin as an alternative to cash on the balance sheet.

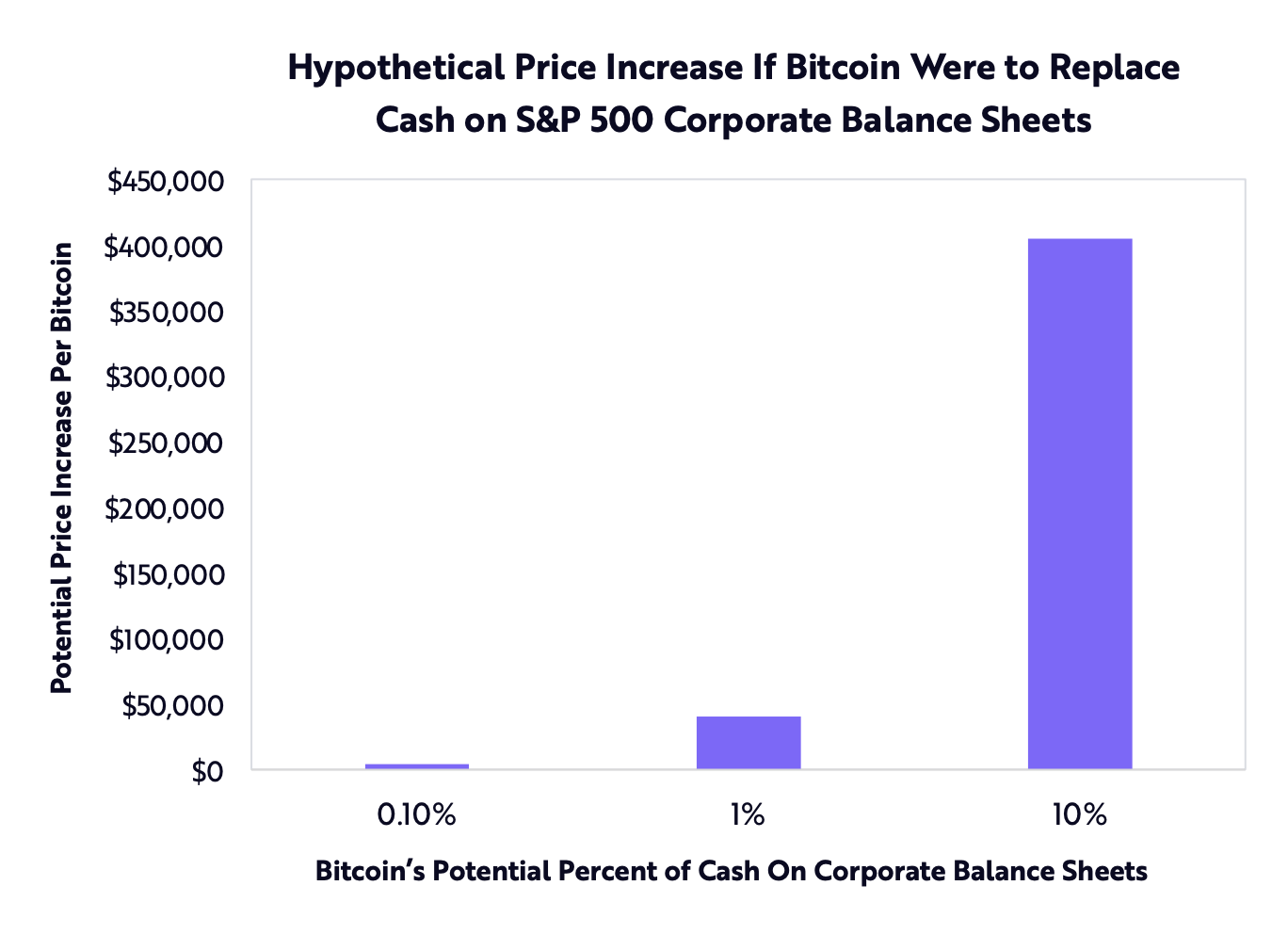

According to Ark’s Big Ideas for 2021, if all S&P 500 companies were to allocate 1% of their cash to bitcoin, its price could increase by approximately $40,000. If those companies moved 10% of their cash to bitcoin, Ark sees the cryptocurrency climbing by $400,000.

Speaking to Yahoo Finance Presents shortly before Tesla became the first non-fintech Fortune 100 company to load up on bitcoin, Wood called Square (SQ) and MicroStrategy’s (MSTR) earlier bitcoin moves bullish for crypto and a roadmap for public companies to deploy bitcoin as a legitimate alternative to cash.

“What surprised me and us generally was to watch MicroStrategy — which has put... all the cash on its balance sheet into bitcoin — even did another equity offering so it could put more cash on its balance sheet. And I think that's a little crazy, because I think the regulators will have something to say about this,” Wood said. “But, then you saw Square put 1% of all of its assets in Bitcoin and I think you're going to see more of that.”

Tesla’s recent bitcoin investment amounts to about 8% of the company’s cash reserves.

Wood’s call for bitcoin to go higher this year has already been proven right. BTC hit an all time high of nearly $48,000 on Tuesday.

“Bitcoin is only [at] roughly a $600 billion market cap,” Wood says. “So even half the size of Apple or Amazon, right now. Doesn't that put it into perspective? And yet, it is a very big idea, I think. A much bigger idea than Apple or Amazon.”