'Inflation has historically been neutral for earnings, but negative for multiples,' says a Deutsche Bank report

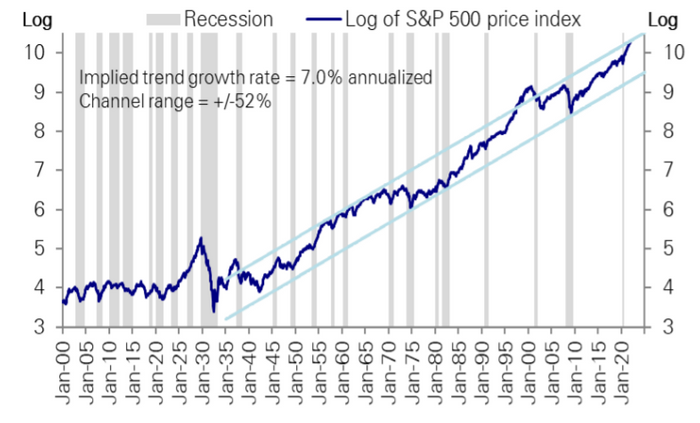

The S&P 500's "extremely high" historical valuation puts the index near the upper bound of a "trend channel of price appreciation" that spans more than eight decades, but the broad equity benchmark still could go higher, according to Deutsche Bank Research.

The U.S. stock index is "near the top of its 85-year trend channel," the bank's strategists wrote in a research report dated Dec. 10. "It was only higher in the late 1930s and late 1990s, when it went above," a chart in the report shows.

The S&P 500 closed Dec. 10 at a record high of 4,712.02 and is on track to gain more than 24% this year, according to FactSet data.

Deutsche Bank's strategists project the index will continue to climb next year, pointing to earnings growth and saying in their report that stock buybacks should help keep S&P 500 returns strong, particularly in the first half of 2022. They have a price target of 5,250 for the S&P 500 by the end of next year, according to their research note.

Deutsche Bank Research is part of the investment banking division. Separately, the chief investment office of the bank's wealth-management division provided a 2022 outlook presentation on Dec. 6 that showed an S&P 500 target of 5,000.

"For the S&P 500, we see 10% earnings growth to $230 in 2022," according to the Deutsche Bank Research note dated Dec. 10, with the strategists referring to their earnings-per-share forecast.

"Inflation has historically been neutral for earnings, but negative for multiples," they wrote, against the backdrop of a surge in the cost of living during the pandemic.

Valuations for the S&P 500 index are "extremely high," according to the Deutsche Bank Research report. "Equity valuations are in the 97-100th percentile on almost any metric excluding the 1990s tech bubble period and well into the 90s in percentile terms even including it," the strategists wrote.

Their 2022 forecast for the S&P 500 implies a trailing 12-month price-to earnings ratio of 22.8, the research report from Dec. 10 shows.

"With earnings having already recovered to levels above trend that often marked cycle peaks and equity valuations historically high, the outlook for equities looks subject to a larger degree of uncertainty and a wider range of possible outcomes than is typical," the strategists cautioned.

U.S. stock indexes closed lower Monday, with S&P 500 ending 0.9% lower, FactSet data show.