Initial Report(Part 3): Sisram Medical (1696.HK), 62% 3-yr Potential Upside (EIP, Wu MeiMei)

6. Valuation

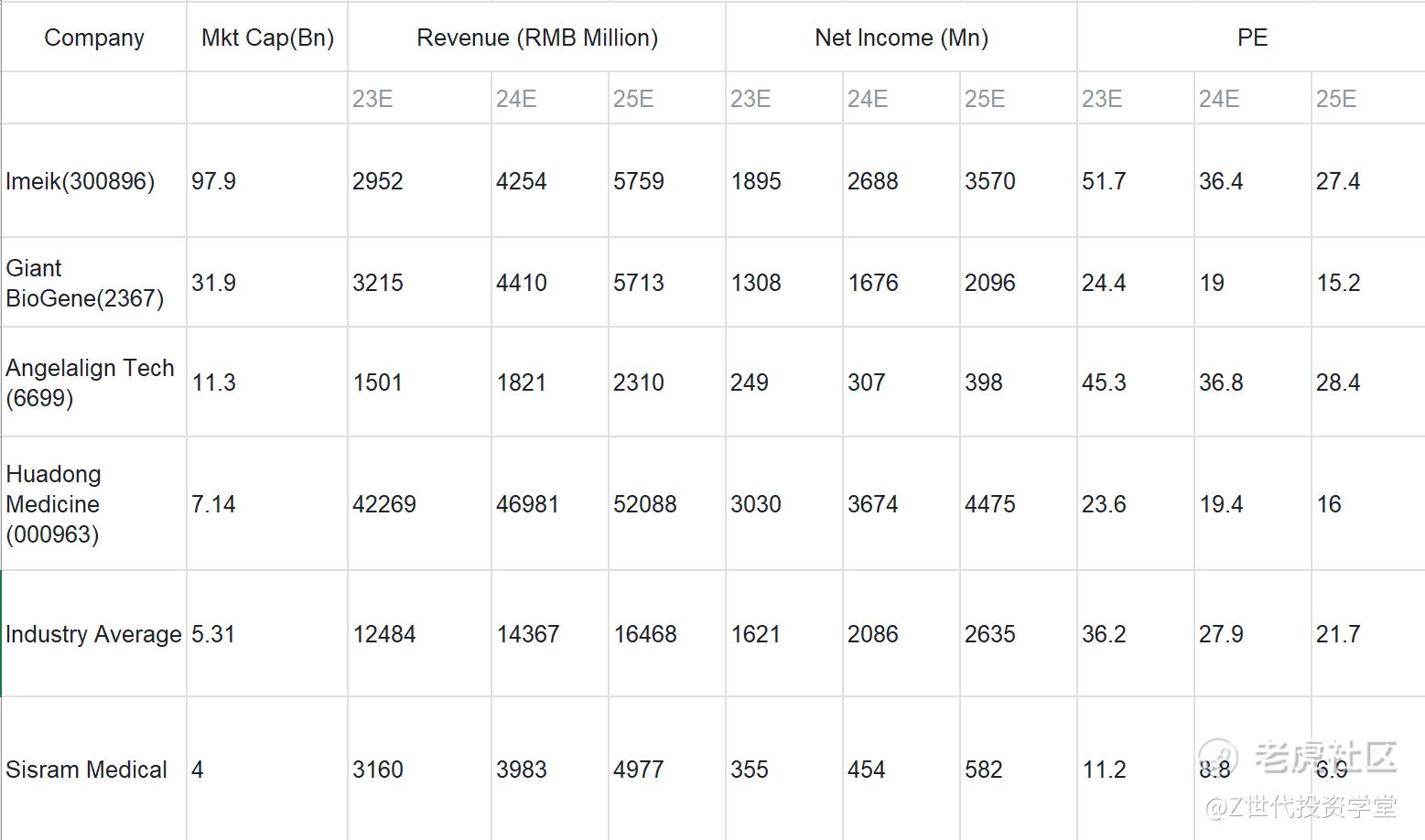

We predict that the company will achieve revenues of 445/561/701 million USD and a year-on-year growth of 25.4%/26.1%/25.1% during the period of 2023-2025. The net profit attributable to the parent company is projected to be 50/64/82 million USD, with a year-on-year growth of 24.7%/27.1%/28.2%. The current stock price corresponds to a PE ratio of 11 for the year 2023.

When comparing Sisram with upstream medical aesthetic and medical equipment consumables manufacturers such as Imeik, Huadong Medicine, Giant BioGene, and Angelalign Tech, we believe that there is still room for the company's valuation to increase. Therefore, I will initiate coverage on the company with a "Buy" rating.

7.Risks and mitigation

• Weak end-user demand: A recession induced decline in orders and demand could negatively impact on the company's revenue growth. In viewing the development of aesthetic beauty market in the United States during the 2008 financial crisis, we predict that short-term demand will be adversely affected by economic and consumer sentiments. However, in the long term, returning to work has made more consumers recognize the benefits of medical aesthetic procedures and are willing to invest in these services to enhance their appearance and confidence.

• Intensified industry competition: Increased competition can lead to a decline in the company's profitability as competitors strive to gain market share. The Hyaluronic Acid and Botox market may not perform up to expectation due to the high volume of market entry.

• Research and development risks: There is a risk of failure or delays in obtaining certifications or approvals for the company's ongoing research and development projects. This can impact product launches and the ability to bring new innovations to the market.

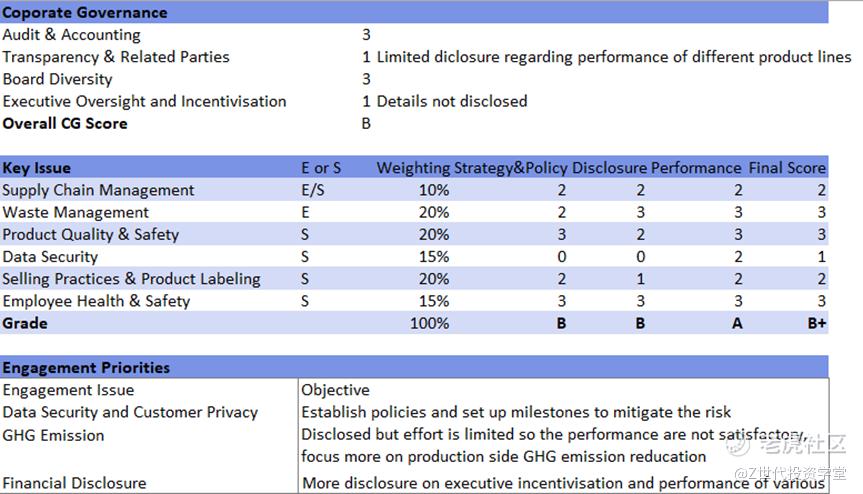

In overall, Sisram Medical has a comprehensive ESG strategy and data-driven disclosure, and satisfactory ESG performance. The highlight of Sisram’s ESG strategy is its product stewardship which encompasses various aspects including product health&safety, IP management, product design& lifecycle management, selling and labelling practices. The company’s strong emphasis on product and resilient business model forms the bedrock for Sisram’s sustainable development. While the effort on product stewardship is commendable, the company should focus more on including more metrics like data security into its ESG evaluation and increase disclosure on executive incentivization and detailed product sales performance to shareholders.

9.Conclusion

In conclusion, Sisram medical has the potential to capture the tailwind of a high-growth industry, its product matrix expansion plans, healthy financial profile, and emphasis on product stewardship will help the company to grow sustainably and resiliently. Therefore, the report initiates a BUY recommendation for Sisram Medical [1696.HK] with a target price of HKD 15.16, subject to adjustment depending on the recovery situation of the end-user consumer market.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。