AMD Stock Surged to a New High by a Big Deal with Meta

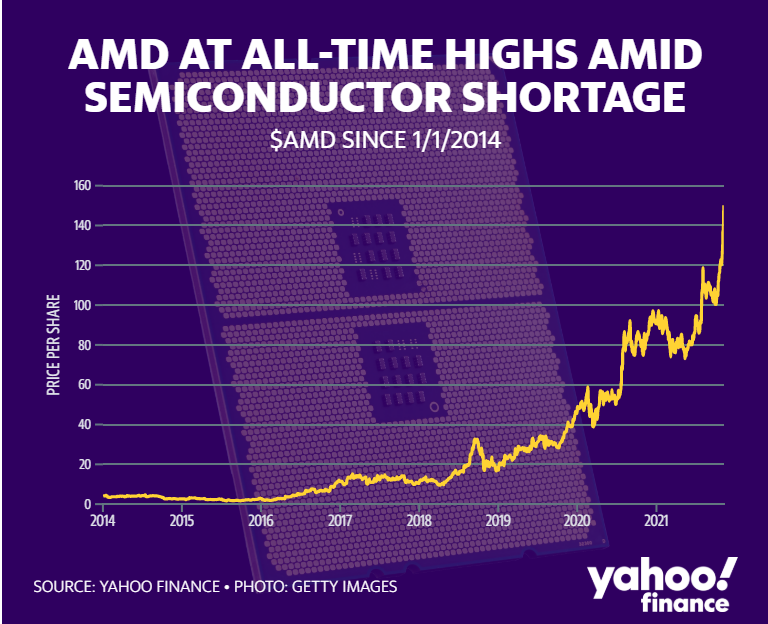

The reasons why $AMD(AMD)$ stock surged to a new high:

- Chipmaker AMD just scored a big deal with Meta

- AMD's first Zen 4 CPUs include a 128-core chip built for the cloud

Advanced Micro Devices AMD is about to enter the metaverse. According to Yahoo Finance, "The chip giant said its EPYC chips were selected by $Meta Platforms, Inc.(FB)$ to help power its data centers at its virtual Accelerated Data Center Premiere event Monday. AMD explained the two companies worked together to develop a high-performance, power-efficient processor based on the company's 3rd Generation EPYC processor."

The company's third quarter performance helps to explain the stock's meteoric ascent. Sales rose 54% from a year ago to $4.3 billion. Earnings per share surged 134% year-over-year.

On the other hand, AMD has unveiled its first processors based on its new Zen 4 architecture. AnandTech notes AMD has outlined its early Zen 4 roadmap during a virtual data center event, and the first two CPU families are Epyc chips aimed at servers and other heavy-duty computing tasks.

The first, nicknamed Genoa, is built for general-purpose computing and packs up to 96 cores (thanks in part to a 5nm process) as well as support for DDR5 memory and PCIe 5.0 peripherals. It arrives sometime in 2022, and partners are sampling chips now.

Another one, Bergamo. It's designed for cloud computing and emphasizes core density — AMD is promising up to 128 cores in a single CPU. The design relies on a modified Zen 4c architecture (the C is for "cloud") that offers similar functionality, but optimizes cache and power consumption to boost the core count and offer as many processing threads as possible. Bergamo doesn't surface until the first half of 2023, but it may be useful for internet giants juggling many simultaneous users.

So, are you interested in semiconductor stocks?

Which SEMICONDUCTOR stocks do you prefer?

$NVIDIA Corp(NVDA)$ $AMD(AMD)$ $Taiwan Semiconductor Manufacturing(TSM)$ $Intel(INTC)$ $Micron Technology(MU)$ $ASML Holding NV(ASML)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

$NVIDIA $GLOBALFOUND

AMD not only manufactures it’s on chip but also tests it’s owned chip. F2B

Spent huge amount on R&D.

One of the BEST Employer in the entire world.

Above is FYI.