Summary

- Intel had a mixed earnings report that sent some investors running for the hills.

- The company beat earnings and actually raised guidance for 2021, but they signaled that supply chain issues remain and profitability in 2022 will be lower.

- After the sell-off, is Intel a good value or a value trap?

The waters have been pretty rough for Intel Corp. (INTC) investors over the past few years.

It seems like every time the sun comes out...there is another storm right around the corner.

As highlighted on the earnings call last night, the next "storm" brewing for Intel is continued supply chain issues (component shortages in the PC business) and reduced near-term profitability from rising capital expenditure needs, which has sent the stock plummeting 11% this morning into the abyss.

However, buying the dips has actually been pretty lucrative in the recent past...if, of course, you were lucky enough to fade the rallies.

To be fair, Intel has had its fair share of challenges this year, despite general tailwinds in the industry (i.e., chip demand far outpacing supply).

Specifically, Intel has had some well-documented manufacturing blunders that have caused major delays and loss of some market share...mainly to Advanced Micro Devices (AMD).

This has triggered concern amongst investors that the stock may be a potential "value trap" now.

All that said, Intel is dedicated to spending $25 billion to $28 billion in 2022 and just broke ground on some new fabs.

Personally, I don't think we are anywhere near peak demand for chips and I believe that Intel's fabrication capabilities are (and will continue to be) a huge advantage for the company for years to come.

So how can we structure a trade to take advantage of the upside potential in the stock (after this pullback) while also protecting ourselves from more near-term downside (if any)?

It's a perfect situation for a "Triple Play" trade!

Intel Corp.

Sector/Industry:Technology/Semiconductors

Intel is the world's largest chipmaker. It designs and manufactures microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors. It was the prime proponent of Moore's Law for advances in semiconductor manufacturing, though the firm has recently faced manufacturing delays. While Intel's server processor business has benefited from the shift to the cloud, the firm has also been expanding into new adjacencies as the personal computer market has stagnated. These include areas such as the Internet of Things, artificial intelligence, and automotive. Intel has been active on the merger and acquisitions front, acquiring Altera, Mobileye, and Habana Labs in order to bolster these efforts in non-PC arenas.

Source: YCharts

Valuation/Upside Potential

Intel looks extremely attractive from a valuation standpoint and is currently trading at a decent discount to all of its long-term valuation metrics (hence the high Value Ranking of 10).

Specifically, Intel is trading at a nice discount to its historical P/E multiple on a forward basis (10.6x 2021 earnings).Note that the company actually just increased its guidance for fiscal 2021 earnings to $5.28 per share.

That said, as supply chain worries decrease over time, we definitely think there could be some room for margin expansion in the future.

If you put just a 12x-14x multiple on consensus forward earnings of $5.28 per share for FYE 2021, that would equate to a $63.00- $73.00 stock price (representing 25%-45% upside from current levels).

Although it probably won't get there in a straight line...

"Triple Play" Trade Analysis

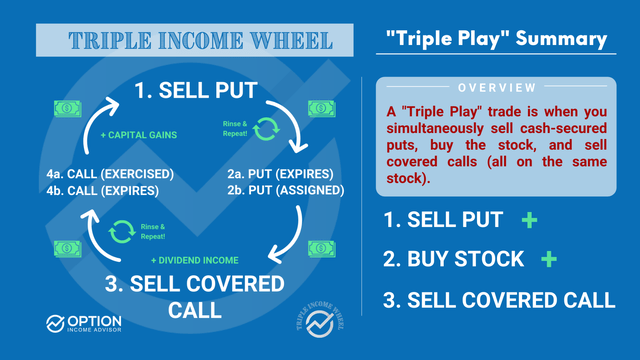

A "Triple Play" trade involves simultaneously selling a cash-secured put and a covered call on a stock that you own.

Note that if you don't currently own INTC stock, you will want to buy it before you write the covered call.

This trade will allow you to take advantage of the upside potential in the stock while also protecting some of the near-term downside (if any).

Step 1: Sell Cash-Secured Puts (50% of position size)

The first step of the Triple Play trade is to sell a cash-secured put on the stock for 50% of your target position size. For example, if you wanted to own 400 shares of INTC... you would sell 2 cash-secured put contract, which represents 200 shares of stock.

The three main data points we look at when analyzing a cash-secured put trade are:

- Premium Yield % (or Average Monthly Yield %): Measure of expected return on capital assuming that the option expires worthless (out-of-the-money).Assumes that the option is fully cash secured.

- Margin-of-Safety %: Measure of downside protection or the percentage that the underlying stock could decline and would still allow you to break even on the option trade.

- Delta: A good proxy for the probability that the put option will finish in-the-money.

Note that there's always a negative correlation between Premium Yield and Margin of Safety: The higher the Premium Yield for a given strike month, the lower the Margin of Safety.

Investors always should be honest with themselves about their risk tolerance. Selling CSPs can be adapted to suit your needs.

As discussed in the video, we like the $45.00-$50.00 range for INTC in the near term. So we like the following cash-secured put:

INTC Nov 19th $47.50.00 Put (28 days until expiration)

- Option Premium: ~$0.58 premium

- Average Monthly Yield %: 1.3% (15.6% annualized)

- Margin-of-Safety %: 4.2%

- Delta: 28

Step 2: Buy the Stock (50% of position size)

Note: At the time of publication, INTC was trading at $49.60. If you already own the stock, you can skip to Step 3.

The second step of the Triple Play is to buy the stock (50% of your target position size). For example, if you wanted to own 400 shares of INTC... you would buy 200 shares of stock.

Step 3: Sell Covered Calls On Your Stock Position (*optional*)

A covered call strategy will help generate some short-term income, maintain some upside exposure, and mitigate some downside risk.

With a covered call, you are agreeing to sell your stock at a higher price (your call option strike price) but you get to keep your call option premium either way.

As discussed in the video, since we like the upside potential in the near term with INTC, you will want to give yourself some room for the stock to run.So we would actually recommend waiting for the stock to trade a little higher before selling covered calls.

That said, if you wanted to execute the covered calls today, I would certainly consider taking less premium income to preserve more potential upside profit. For example, the $53.00 call would give you an extra 0.5% of income per month (6.0% annualized)...which would essentially triple your dividend yield on the stock!

INTC Nov 19th $53.00 Call (28 days until expiration)

- Option Premium: ~$0.25 premium

- Average Monthly Yield %: 0.5% (6.0% annualized)

- Upside Profit %: 7.4%

- Delta: 15

Conclusion

This Triple Play trade will allow you to take advantage of the upside potential in INTC stock while also giving you some downside cushion if shares trade lower in the near term. As the covered calls and cash-secured puts expire, you can rinse and repeat the Triple Play trade!