Wall Street Memes lists the three worst-performing Nasdaq 100 stocks in the last 52 weeks. Should investors take the opportunity to buy the dip?

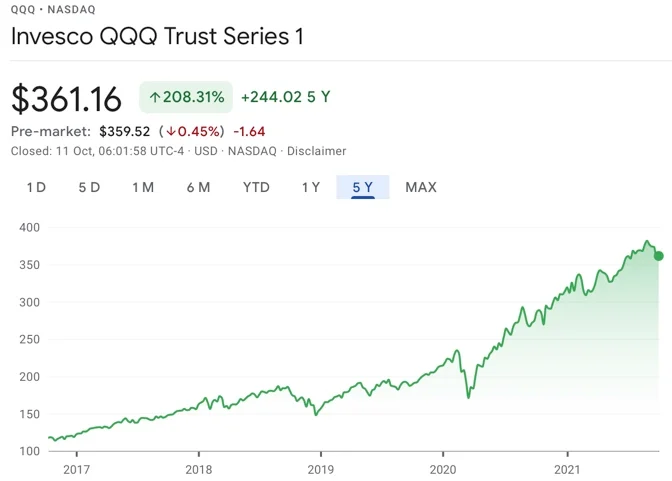

The Nasdaq 100 has risen 28% in the last 12 months. The tech-rich index includes some of the most well-known companies listed on the US stock exchange, from Apple to Amazon and beyond. In the last five years, the Nasdaq’s value has jumped an astounding 209%.

In its search for good deals, Wall Street Memes looked at the worst performing Nasdaq 100 stocks in the last 52 weeks. Could negative momentum give way to bargain hunting and turn some of these stock into winners in the foreseeable future? Below are three potential buy-on-dip ideas.

#3 Vertex Pharmaceuticals - $VRTX

The $46 billion market cap pharmaceutical company develops and markets therapies for treating cystic fibrosis. VRTX stock has been down 22% year-to-date and is currently priced at $179 at last check. Wall Street consensus on the stock is a moderate buy. Based on 13 reports in the last three months, the price target consensus of $245 suggests 37% upside potential.

Bearishness has been well presented by research company Stifel. After downgrading the stock from buy to neutral, the skeptical analyst assigned high market risk for the company’s drug pipeline, given that Vertex is a $50 billion company and its next programs are “unlikely to be narrative changing”.

On the other hand, Piper Sandler analyst recommended the stock a couple of months ago and bumped his price target on VRTX to $323 from $261. He attributed his bullishness in part to transformational drug Trikafta and convictions that the company would beat on earnings.

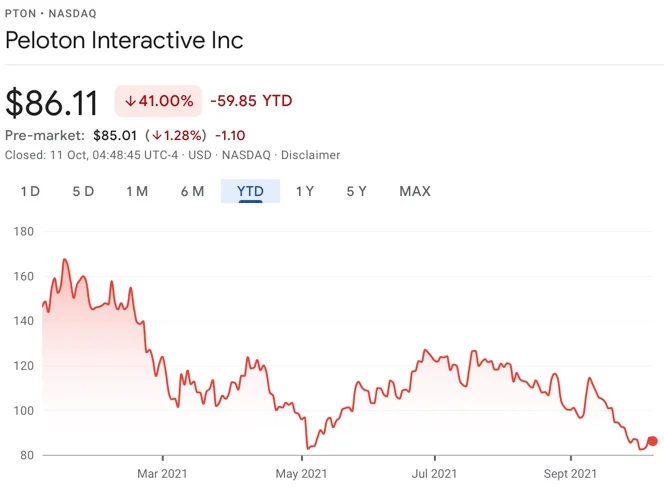

#2 Peloton Interactive - $PTON

The company, which provides interactive fitness products and subscriptions, was a pandemic darling last year. In 2021, however, the stock has been struggling.PTON stock has been down 41% year-to-date and is currently priced at $86 at last check.

Despite poor momentum, Wall Street believes that this could be a good time to invest in Peloton stock. The $26 billion market cap company has a buy consensus and a $127 price target that points at 47% upside, based on 22 reports issued in the last three months.

The bear case is explained by UBS and is backed up by analysis on valuation that is arguably stretched. Analyst Eric Sheridan has recentlyreiterateda sell rating on the stock, forecasting a $70 price on PTON for 18% downside.

"The stock’s appreciation to more than 17% over two days implies close to $1.2B of sales that the market is assigning to the opportunity based on where the stock is trading on 2023 EV-to-sales average multiple of 4.2x. Street expects 2023 connected fitness subscribers of around 5.06 million. This implies roughly $240 of spend per subscriber per year."

On the bullish side, Barclays analyst Mario Lu justified the recent miss in gross margins on higher-than-expected refunds from the Tread recall along with continued increase in shipping costs. Bullishness is reiterated due to fiscal 2022 now being seen as an investment year, as Peloton looks to plow money aggressively into both marketing and R&D – which the analyst believes to be the right long-term decision. He has a buy rating on PTON and 50% upside opportunity.

Lastly, famed investor Cathie Wood purchased a sizeable batch of PTON stock a few days ago. Wood’s Ark fund bought the dip as the company missed earnings estimates, and it currently owns 1.7 million shares of PTON that are worth $172 million.

#1 Pinduoduo Inc. - $PDD

This Shanghai-based e-commerce operator PDD saw its stock drop more than 42% year-to-date – shares are currently valued at $96 at last check. The $118 billion market cap company is a strong buy according to Wall Street and is expected to recover 42% over the next twelve months. With a consensus price target of $137 forecasted by nine sell-side analysts over the last three months, Pinduoduo is believed to be undervalued.

China Renaissance analyst Nicky Ge forecasts $150 share price and attributes PDD’s recent stock weakness partly on market expectations for 2021 gross merchandising value growth. The analyst also added the following commentary:

“Given a lackluster recovery in China’s internet retailing market in 1H21, we forecast PDD to deliver 43% and 40% YoY gross merchandising value growth in 2Q21E and 2021E, respectively, compared to 66% YoY growth in 2020.”

Two months ago, Benchmark analyst Fawne Jiang lowered his PDD price target to $156 from $176. Mixed Q2 results, headlined by an “outsized beat on earnings although revenue missed mainly as a result of 1P sales fluctuations”, were to blame. However, the analyst is incrementally more bullish on the company's long-term earnings potential and believes that investing in the next sustainable moat is strategically important for long-term growth.