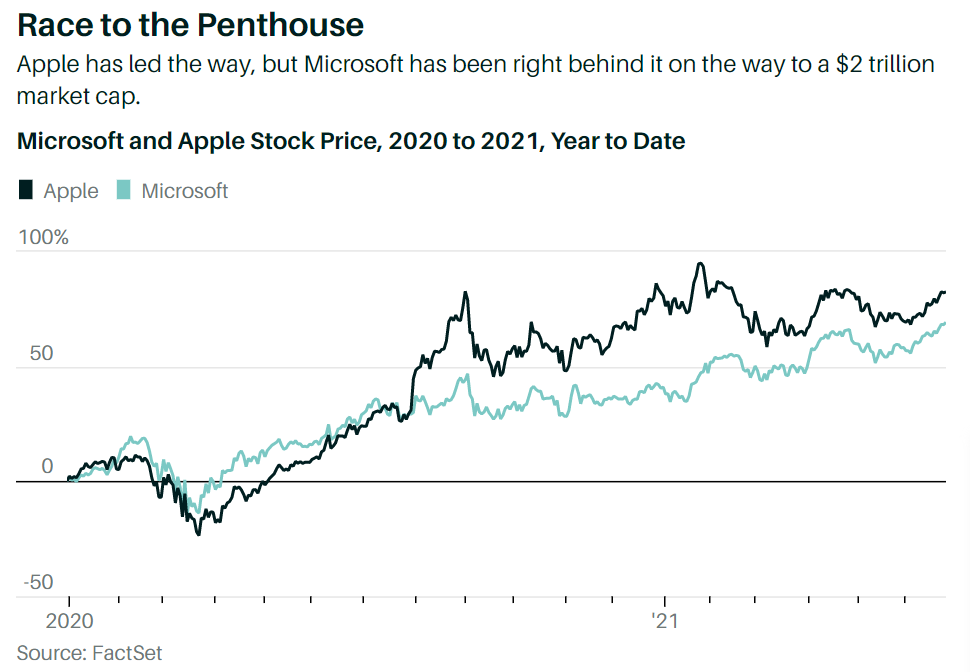

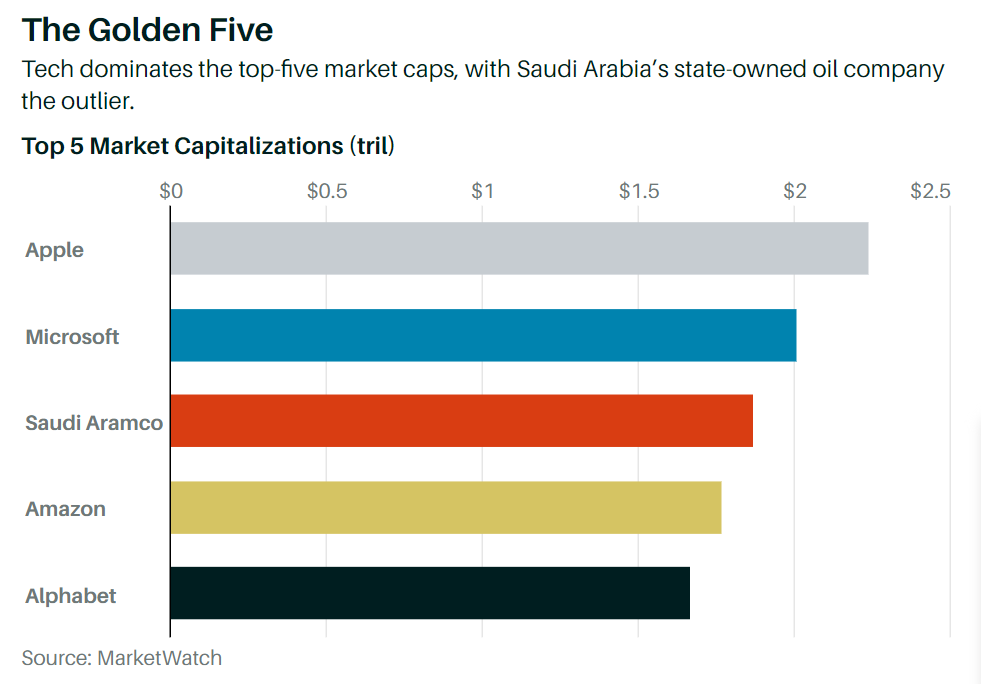

Microsoft is now the second company to boast a $2 trillion market capitalization, following Apple,which breached that level last August. And Microsoft may go higher yet.

Wedbush analyst Daniel Ives this past week reiterated his Outperform rating on the software giant, lifting his price target on the shares to $325 from $310. That represents a potential gain of more than 20%, which would take the company’s market value to $2.4 trillion. His enthusiasm for the stock is driven by Microsoft’s cloud business, Azure.

On Wednesday, Microsoft shares inched up 0.1% to $265.79, a new high, boosting its market cap to $2.004 trillion. (Apple is at roughly $2.2 trillion.) Ives notes that June channel checks find improving demand for Azure. “The Azure cloud growth story is hitting its next gear of growth,” he writes. “We are seeing deal sizes continue to increase markedly as enterprisewide digital transformation shifts are accelerating with CIOs all focused on readying their respective enterprises for a cloud-driven architecture.”

Wall Street concerns that cloud growth will moderate coming out of the pandemic run counter to the deal activity Microsoft is seeing, Ives writes, noting that June-quarter results appear to be “robust.” He thinks Microsoft is still only about 35% into the conversion of its installed application base into the cloud.

Ives sees continuing global “digital transformation” as a $1 trillion opportunity, and says Microsoft will disproportionately benefit. “Microsoft remains our favorite large-cap cloud play and we believe the stock will start to move higher over the coming quarters...,” he writes. “The growth story at Microsoft is not slowing down.”