Palantir Technologies Inc. (NYSE:PLTR) today announced financial results for the third quarter ended September 30, 2021.

Q3 2021 Highlights

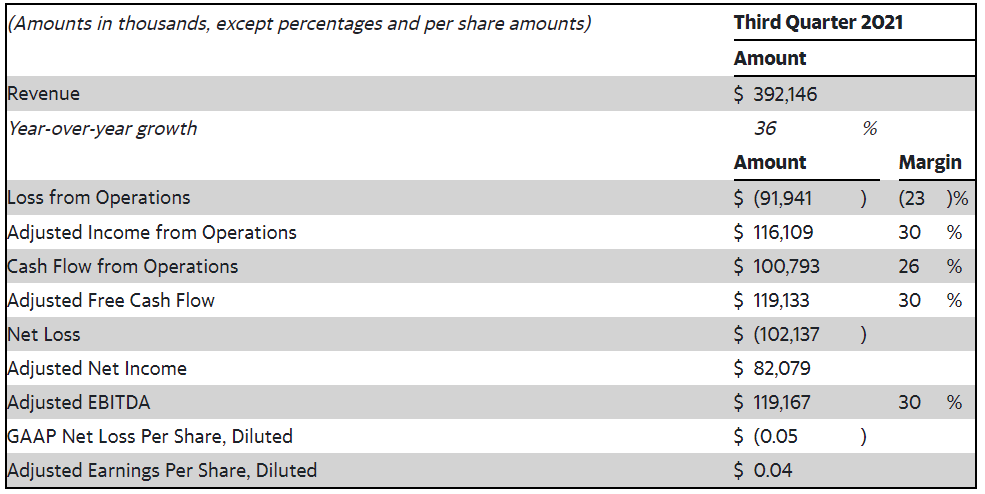

- Total revenue grew 36% year-over-year to $392 million

- Added 34 net new customers in Q3

- Commercial customer count grew 46% quarter-over-quarter

- US commercial revenue grew 103% year-over-year

- Cash flow from operations of $101 million, representing a 26% margin

- Adjusted free cash flow of $119 million, representing a 30% margin

- Closed 54 deals of $1 million or more, of which:

- Total remaining deal value grew 50% year-over-year to $3.6 billion

- GAAP net loss per share, diluted of $(0.05)

- Adjusted earnings per share, diluted of $0.04

Q1-Q3 2021 Highlights

- Total revenue grew 44% year-over-year to $1.1 billion

- Commercial customer count increased 135% since December 31, 2020

- Cash flow from operations of $240 million, representing a 22% margin

- Adjusted free cash flow of $320 million, representing a 29% margin

Q3 2021 Financial Summary

Outlook

For Q4 2021, we expect:

- $418 million in revenue.

- Adjusted operating margin of 22%.

For full year 2021:

- We expect revenue growth of 40% to $1.527 billion.

- We are raising our outlook for adjusted free cash flow to in excess of $400 million, up from in excess of $300 million.

Per long-term guidance policy, as provided by our Chief Executive Officer, Alex Karp, we continue to expect:

- Annual revenue growth of 30% or greater for 2021 through 2025.

Palantir shares once rose nearly 5% in premarket trading.