Amid global supply chain disruptions and trillions in liquidity to support consumption, it is perhaps unsurprising that import and export price inflation is soaring.

However, the scale of the moves is notable with import prices rising 1.2% MoM (+0.9% exp) and export prices rising 2.1% MoM (+1.0% exp).

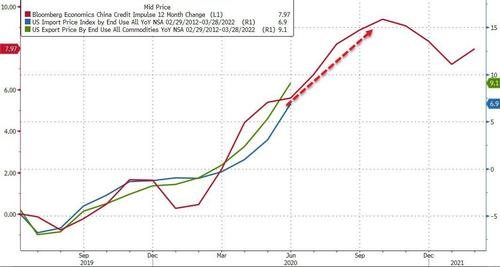

Sparkingthe hottest inflationary prints in a decade (import prices +6.9% YoY, export prices +9.1% YoY)...

China's decade-long export of deflation has abruptly stalled in recent months...

Perhaps more worrisome is that if historical relationships between China's Credit Impulse and trade inflation are anything to go by, import and export prices are set to soar even further

Still, nothing to worry about -Mr.Powell has 'tools'.