There are multiple ways to invest like The Oracle of Omaha.

Warren Buffett stands as one of history's most successful investors. His incredible market-beating tenure as CEO of Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) and the market-beating investment choices he has made during that time have earned him the moniker The Oracle of Omaha, and it's not hard to see why Buffett's investing advice and stock moves are so closely followed.

With a combination of uncertainty and opportunity currently on the stock market horizon, there are good reasons to turn to one of the investing world's all-time greats for some potential insight.

Make your picks with the long term in mind

Warren Buffett has famously said that his favorite period for owning a stock is "forever." That doesn't mean that he never sells shares, but his long-term approach to investing has been a huge part of his success through the years.

Under Buffett's guidance since 1965, Berkshire has notched average annual growth of 20.3%, absolutely crushing the return for the broader market over the same time period. The conglomerate ended last year having outperformed the S&P 500 index by roughly 2,700,000% since Buffett assumed leadership of the company, and his steady, quality-focused approach to investing played a big role in that.

Investors should be concentrating on high-quality businesses with competitive advantages and ongoing opportunities that position their portfolio to thrive over the long term. This bit of wisdom is summed up by one of Buffett's most frequently quoted bits of wisdom: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

While backing cheap stocks that have struggling underlying businesses or chasing volatile pricing swings can sometimes result in big wins, these successes are difficult to repeat consistently. Timing the market is incredibly hard. Investing in strong companies with a buy-to-hold approach will put you on the path to superior performance over the long term.

What moves have Buffett and Berkshire been making?

If you want to extend the goal of investing like Buffett beyond simply incorporating his approach to analyzing, buying, and holding stocks, then looking at Berkshire Hathaway's recent moves will show you how to do that. Berkshire is required to file a disclosure of its holdings each quarter in a document known as a 13F. Investors can reference these documents in order to see which stocks Buffett's company has bought and sold across the previous quarter.

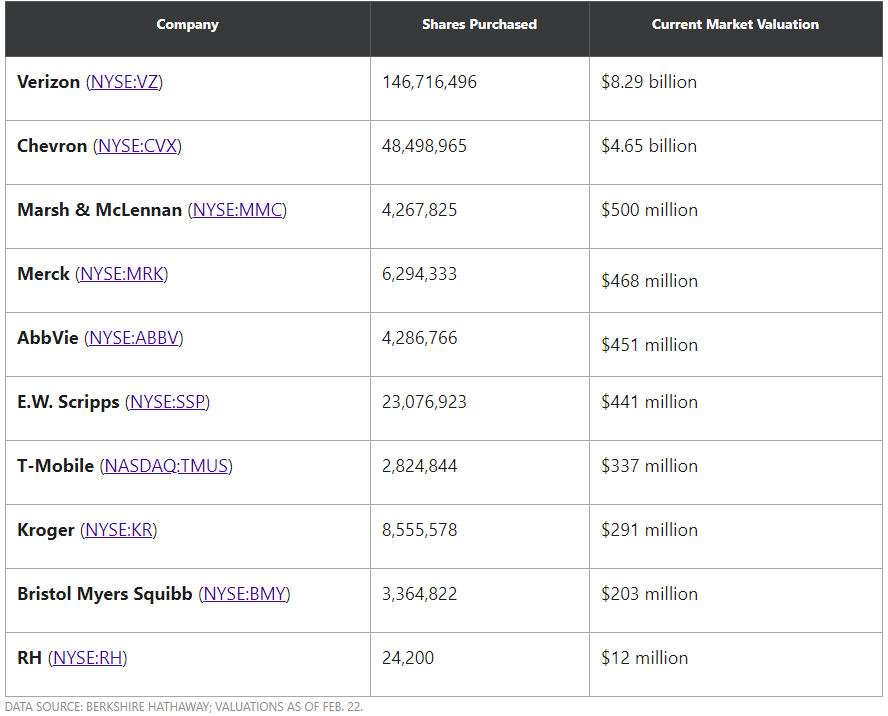

There are a couple of different ways that investors can go about replicating its investment strategies. One of these is to follow Berkshire's biggest recent buys. The table below shows thestock purchasesdetailed in its most recent 13F filing, which was published on Feb. 16 and represents the company's positions as of Dec. 31, 2020.

Of the recent purchases, Verizon, Chevron, Marsh & McLennan, and E.W. Scripps were entirely new additions to the Berkshire portfolio, while the firm increased positions in the other companies on the list.

Investors can also replicate Buffett's approach by building positions in Berkshire's biggest overall stock positions, includingApple,Bank of America,Coca-Cola,American Express, andKraft Heinz. Looking at the overlap between the company's biggest recent buys and largest overall holdings, Berkshire's highest-conviction stock pick in the last quarter appears to be Verizon. It made a huge purchase of the telecom giant's stock in the fourth quarter, quickly making it the company's sixth-largest overall stock holding.

One more way to invest like Buffett in 2021

The other obvious way to invest like Buffett is to buy Berkshire Hathaway stock. The company invested more in buying its own shares than any other stock or asset over the trailing-12-month reporting period. That's a strong indication Buffett believes his company's shares are undervalued.

Berkshire Hathaway stock gives investors a simplified avenue to building a diversified position in a wide range of holdings. In addition to its publicly traded stocks and real estate ventures, the company also has full ownership of businesses including GEICO, See's Candies, and Duracell, among others.

While Berkshire's somewhat conservative approach has meant that it's lagged broader-market performance in recent years as high-growth tech stocks have scored big wins, the investment firm has one of the best management teams in the financial industry.

The market could be primed for substantial volatility through the rest of the year, and keeping an eye on the evolving strategies of one of history's most-successful, value-focused money men continues to be a good idea. Investors will be able to get an even closer look at Buffett's thinking when Berkshire publishes its annual shareholder letter at the end of this month.