Summary

- Microsoft's Azure continues to gain market share in the burgeoning cloud infrastructure services market. However, Amazon's AWS remains in the No.1 position.

- Although the cloud wars are heating up, both Azure and AWS are performing exceptionally, growing at 51% y/y and 37% y/y, respectively.

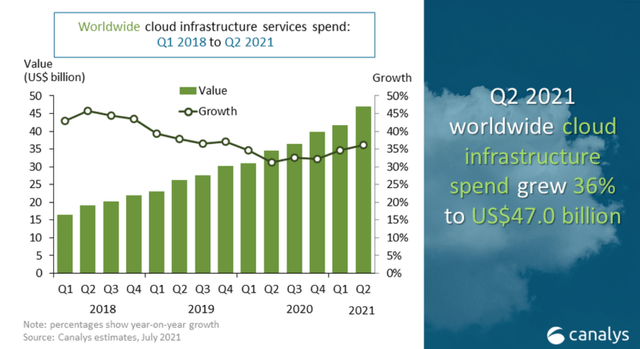

- The global cloud services market is poised to grow at a CAGR of ~15.8% until 2030 to become a $1.6T market. Therefore, cloud providers still have a long growth runway.

- In this article, I share a comparative financial analysis for Microsoft and Amazon to determine the better buy.

Introduction

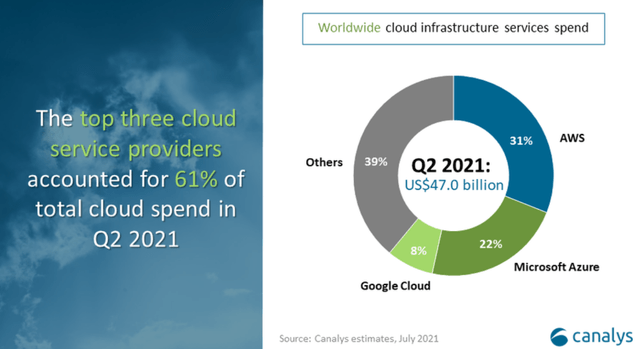

Microsoft (MSFT) and Amazon (AMZN) are competing for the coveted No.1 spot in the cloud infrastructure services market, which is projected to grow from $325B in 2021 to $1,620B (or $1.6T) by 2030, according to areportby Allied Market Research. In Q2, Amazon's AWS revenues grew at 37% year-over-year (marked acceleration) as it continues to lead the cloud infrastructure services market with a 31% market share. However, Microsoft's Azure is outpacing AWS's growth and now commands a market share of 22%.

In the last year or so, the coronavirus pandemic has led to increased cloud infrastructure services spending as workload migration and cloud-native application development accelerated. Naturally, Azure and AWS have emerged as prime beneficiaries of this transformational shift toward the cloud. Although the coronavirus pandemic has receded in previous months, businesses have continued to embrace the cloud, as evidenced by the $5B sequential (q/q) growth in cloud infrastructure services spending in Q2 2021.

Both Microsoft and Amazon are well-diversified big tech giants. However, the cloud opportunity is critical to their future successes. Today, Microsoft's Intelligent Cloud business makes up nearly ~37% of total revenues and ~40% of Microsoft's operating income, and these figures are expected to grow even further in the coming years. In relation to Amazon, AWS's revenues are a small fraction (13% in Q2 2021) of total sales. However, AWS contributes the majority of Amazon's operating income (~60%). And so, I'm not surprised with how ugly this battle is turning out to be. In recent times, we have witnessed dramatic instances such as Amazon's lawsuit for the $10B Jedi contract being awarded to Microsoft,Microsoft's protest to Government Accountability Office in relation to the $10B NSA contract awarded to Amazon, and a top AWS executive - Charlie Bell (once expected to be a successor to Andy Jassy as AWS CEO) -moving over to Microsoft. The competition between Amazon and Microsoft is fearsome. However, I can see ample room for multiple winners in the cloud services market.

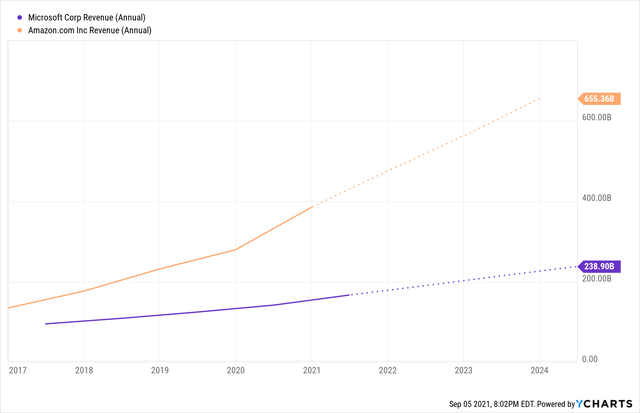

With massive cloud services growth on the horizon, I expect both Microsoft and Amazon to deliver double-digit revenue growth over the coming decade. Several analysts have projected the cloud services business to become a commodity. However, profitability metrics for AWS and Microsoft's Intelligent Cloud show that it's clearly not a commodity business (at least for now). Azure has been gaining ground on AWS, but it's too soon to tell which of these tech titans will lead the cloud services market over the coming years.

Over the last 12 months, Microsoft has significantly outperformed Amazon in terms of creating shareholder wealth, as can be observed in the chart below. I attribute Microsoft's outperformance to a multitude of factors, including but not limited to stronger momentum in the cloud, the existence of a massive capital return program, and robust free cash flow generation.

In today's article, I will share a comparative financial analysis to determine the better buy among Microsoft and Amazon. Furthermore, we will estimate the fair value and expected returns for both of these blue-chip companies based on the financial statement analysis conducted in this note.

Comparative Financial Analysis: Microsoft vs. Amazon

I think it's too early to call the cloud services market, and the winners will only be evident in due time. However, it's very likely that Amazon and Microsoft will be dominating this market in 2031. Now, Amazon and Microsoft may be competitors in the cloud, but they happen to be two very different companies with varied core competencies: Amazon - e-commerce, Microsoft - business, and consumer software. Let's carry out a comparative financial analysis to determine the better buy among Microsoft and Amazon.

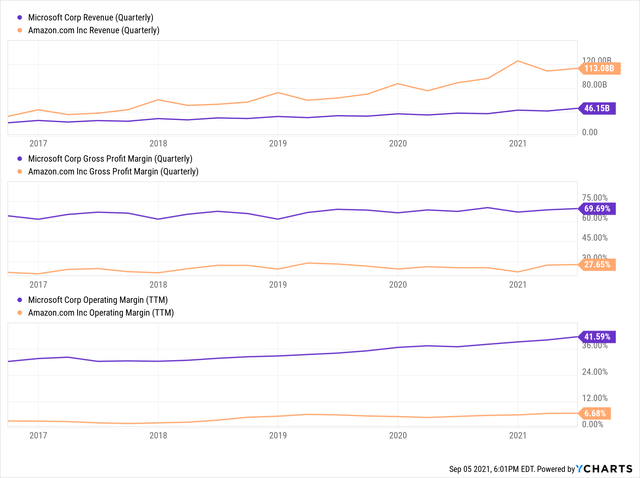

In essence, Microsoft is a high-margin software and services business, while Amazon is a low-margin retail business with some higher-margin business lines such as AWS and Advertising. Since both Amazon and Microsoft are over-covered stocks, I don't think discussing their revenue mix would be of much value. However, let's look at the free cash flow generation of these blue-chip giants to understand their current business momentum.

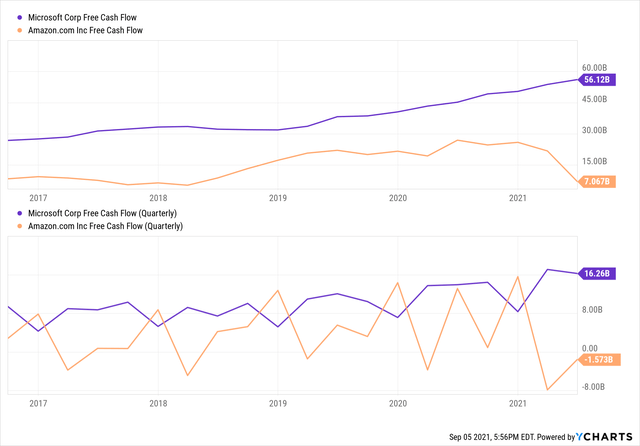

After receiving a massive pandemic boost, Amazon's free cash flows have turned negative in the last two quarters as the company invests massive amounts of capital (capex spending) in driving future revenue growth. In Q2, Amazon missed revenue estimates by ~$2B, which is further evidence of Amazon losing business momentum. On the other hand, Microsoft's business momentum remained strong in Q2 as the company beat revenue expectations by ~$2B while generating record amounts of free cash flow over the last 12 months. Therefore, it's fair to say that Microsoft is outperforming Amazon for the time being.

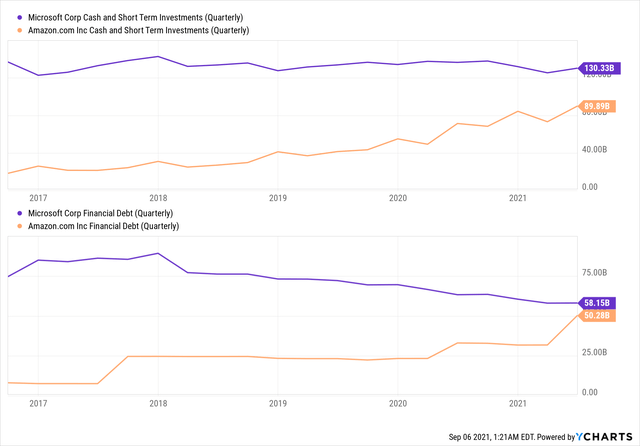

At the end of Q2, Microsoft had nearly $130B of cash and short-term investments on its balance sheet vs. financial debt of $58B (down from ~$90B debt in Dec'17). Over the last five years, Amazon's cash reserves have been building up, which now stand at ~$90B. However, the e-commerce giant has been increasing its debt load too, which has grown to $50B in Q2 2021.

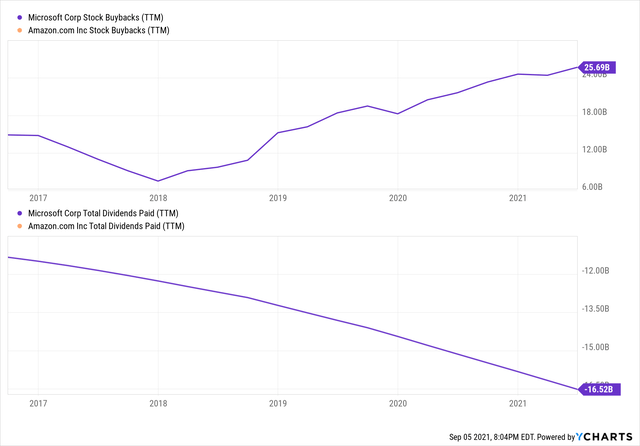

In terms of balance sheet strength, Microsoft is clearly in a better position compared to Amazon. Moreover, Microsoft's free cash flow generation is superior to Amazon right now. As you can see below, Microsoft is using its financial strength to execute a massive capital return program that consists of stock buybacks and dividends. Although Amazon lacks a capital return program today, it's only a matter of time before Amazon boasts one of the largest capital return programs among big tech companies. Therefore, Microsoft's advantage in this department may be short lived.

While Microsoft returns the majority of its operational cash flows back to shareholders, Amazon is investing billions of dollars to drive future revenue (and, by extension, free cash flow) growth. In my opinion, Amazon will continue to outpace Microsoft's revenue growth over the next decade. As Amazon's faster-growing, higher-margin business lines, AWS and Advertising, contribute a larger share of Amazon's revenues over the coming years, its margins are expected to head higher. Hence, Amazon possesses the greater potential for revenue growth and margin expansion compared to Microsoft. To learn more about AWS and Amazon's Ads business, you may read the following notes:

- Amazon Web Services - Amazon: Here's What You Should Be Monitoring

- Digital Ads - Amazon: The 'Other' Segment May Be Worth More Than AWS

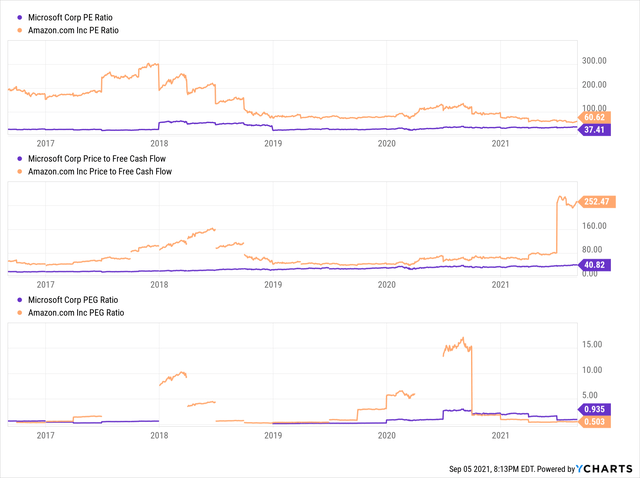

Although Amazon appears to be more expensive than Microsoft based on backward-looking trading multiples such as Price-to-Earnings and Price-to-FCF ratios, it's relatively cheaper than Microsoft when we factor in future growth as indicated by the PEG ratios.

In summary, Microsoft is currently performing better than Amazon. However, Amazon's future appears to be a lot brighter than Microsoft. Since the stock markets are forward-looking, I would expect Amazon to outperform Microsoft over the coming years if their relative valuations were identical. With that being said, let us now calculate the intrinsic value of both Microsoft and Amazon along with future expected returns for these tech giants.

Evaluating the Fair Value And Expected Return of Microsoft And Amazon

To find the fair values of Microsoft and Amazon, we will employ our proprietary valuation model. Here's what it entails:

In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

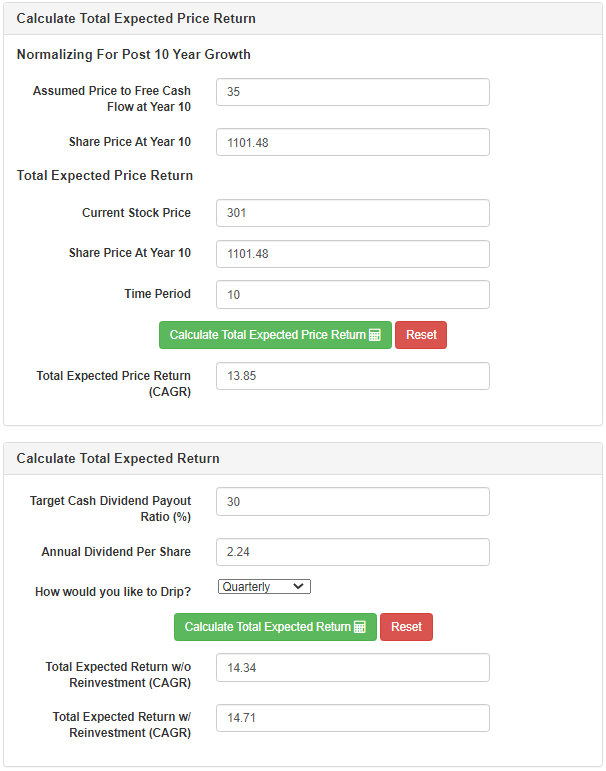

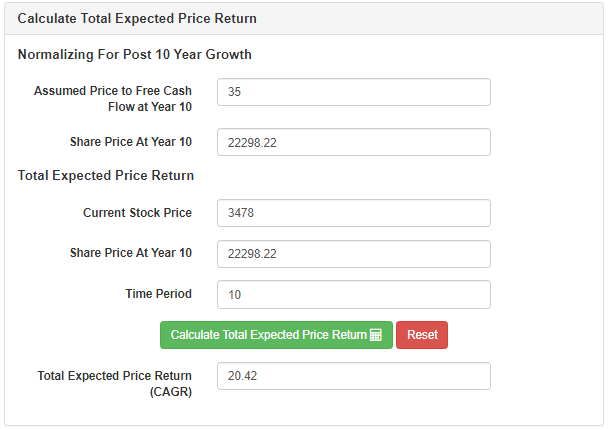

In step 3, we normalize valuation for future growth prospects at the end of the 10 years. Then, we arrive at a CAGR using today's share price and the projected share price at the end of 10 years. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

- In step 4, we account for dividends.

Assumptions:

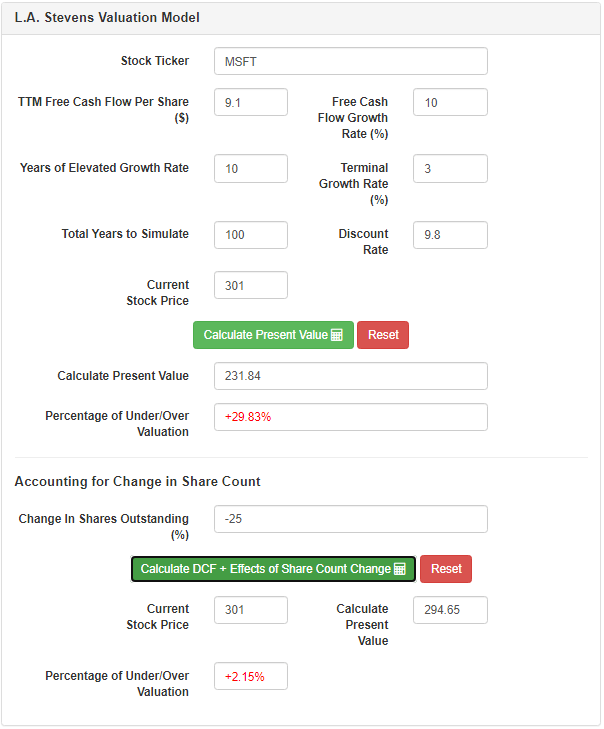

Microsoft |

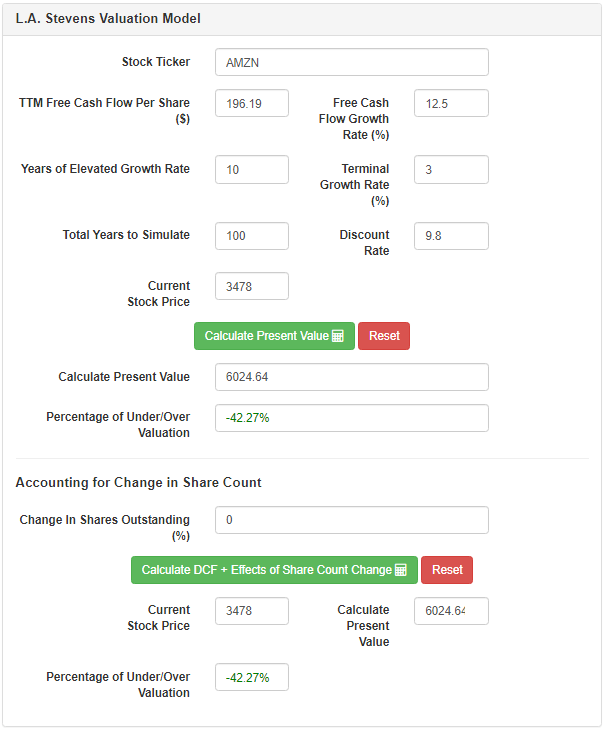

Amazon |

|

Forward 12-month revenue [A] |

$195 billion |

$515 billion |

Potential Free Cash Flow Margin [B] |

35% |

20% |

Average diluted shares outstanding [C] |

7.5 billion |

525 million |

Free cash flow per share [ D = (A * B) / C ] |

$9.1 |

$196.19 |

Free cash flow per share growth rate |

10% |

12.5% |

Terminal growth rate |

3% |

3% |

Years of elevated growth |

10 |

10 |

Total years to stimulate |

100 |

100 |

Discount Rate (Our "Next Best Alternative") |

9.8% |

9.8% |

Results:

1) Microsoft:

2) Amazon:

Summary of Results:

| Current Price | Fair Value | Undervalued (-) or Overvalued (+) | 2031 Share Price Target | Total Expected CAGR Return | Rating | |

| Microsoft | $301 | $295 | +2.15% | $1101 | 14.71% | Modest Buy |

| Amazon | $3478 | $6024 | -42.27% | $22298 | 20.42% | Strong Buy |

As you can see, Microsoft is slightly overvalued, and investors buying in at $301 can expect to generate CAGR returns of ~14.71% over the next decade, which is slightly below our investment hurdle rate of 15%. Since Microsoft's business fundamentals are robust, I rate it as a modest buy at this price. On the other hand, Amazon's business is facing near-term volatility, and business momentum looks shaky. However, Amazon's stock is deeply undervalued, and this is an opportunity for long-term investors to generate significant alpha. As Amazon's expected CAGR returns are much greater than my hurdle rate, I rate Amazon a strong buy. If I were to choose between Microsoft and Amazon based on business momentum (cloud and otherwise), I would have to go with Microsoft. However, Amazon's stock is massively undervalued while Microsoft is fairly valued. Considering the risk/reward available, I think Amazon is the better buy here.

Key Takeaway: I rate Amazon a strong buy at $3,478 and Microsoft a modest buy at $301. Amazon is a better buy than Microsoft at this point in time.