Apple has had its worst day of trading since October, and shares could soon enter bear market territory. However, two price patterns suggest that this could be a good time to buy the stock.

On Monday, March 8, Apple stock had its worst day of trading since October 2020: down 4.2%, despite lack of company-specific news. My fears over the market cap dipping below $2 trillionfor the first time since November were also confirmed, maybe more quickly than I could have anticipated.

Apple stock is now nearly 19% off the peak of less than 30 trading days ago, and one inch away from bear territory. Investors must be feeling uneasy about holding shares during this uncomfortable pullback.

But I believe that shareholders also have reasons to be optimistic.

History says: buy Apple

Of course, a successful investment in Apple depends primarily on the company performing well and delivering above-consensus financial results going forward. In that regard, Apple’s business seems to be in very good shape, at least judging by the company’s most recent earnings report.

So, I turn away from business fundamentals for now and focus on price action. Historically, the best strategy has been to buy Apple when it is well off its peak. Recently, I came across yet another piece of evidence to support this idea.

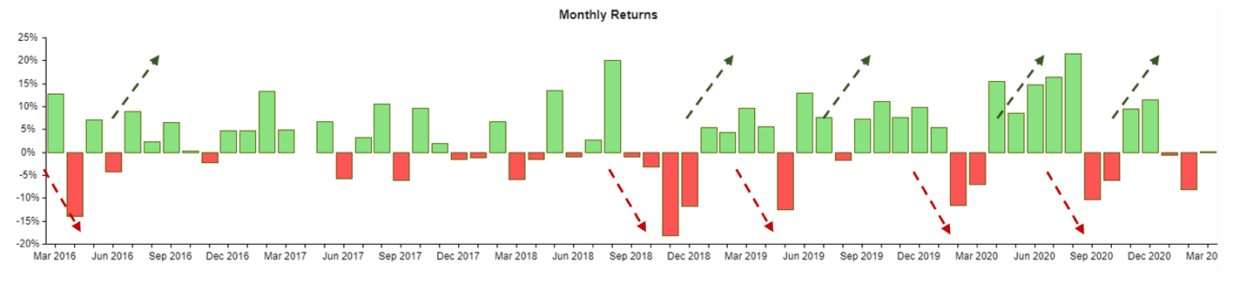

Over the past five years, Apple stock has produced monthly returns that have swung from a low of -18% in November 2018 to a high of 21% in August 2020. Although it may be hard to anticipate with much precision when the stock will perform best, there seems to be somewhat of a pattern.

The graph below shows that steeper monthly losses in Apple shares tend to be followed by periods of strong stock performance. Notice the dotted arrows:

Below are some numbers to help illustrate the point.

Since 2016, Apple has produced an average three-month return of 3.5%, with worst decline of -11% in the fourth quarter of 2018. But an investor who waited to buy shares only after two months of material losses (defined here as -3%) in the previous three periods earned an average three-month return that was nearly twice as high, at 6.7%.

March is shaping up to be a bad month for Apple, after January saw shares tank and February failed to impress. Judging only by the pattern described above, this could be a good time to jump in.

Calendar pattern says: buy Apple

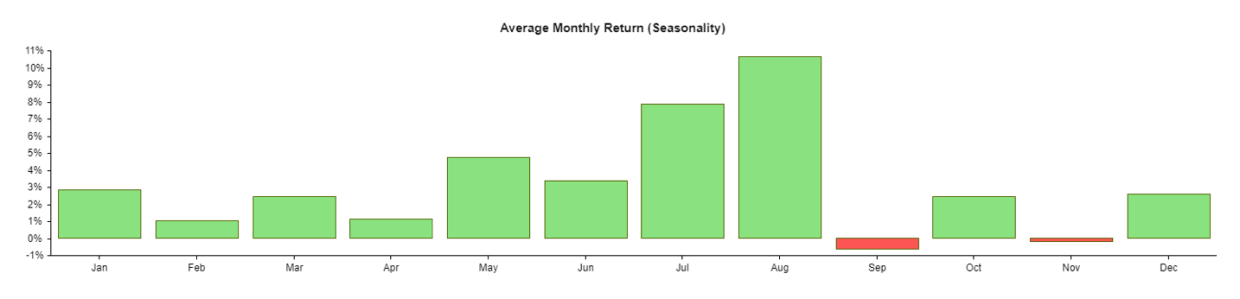

The second reason to buy Apple now has to do with annual patterns in stock returns. The graph below tells a compelling story.

Notice that the average monthly gains in Apple shares over the past five years have been best in the summer months of July and August. Prior to this period, the returns improve slowly throughout the spring, as the stock recovers from an underwhelming holiday quarter.

There is some logic to this pattern. September tends to be the month in which the new iPhone model is announced, a few weeks ahead of Black Friday. At that point, investors have likely already bid up the share price in anticipation for Apple’s “hot season” of sales. Sell-the-news pressures begin to accumulate.

In 2021, something similar could happen. The market’s preference for small-cap value stocks over mega-cap growth ones during a year of economic recovery will eventually fizzle. At that point, chatter about Apple’s iPhone 13 will begin to surface. This could be the moment for Apple shares to finally shine this year.

Those who buy the stock at de-risked prices could benefit from the potential rebound later in 2021.