It seemednothing could go wrongfor Chinese electric-vehicle stocks in 2020. Now it feels like nothing can go right. And despite urging from analysts to buy shares, these once highflying stocks justwon’t go up.

The recent trading action is either a huge opportunity forEV bulls, or it showsthe bearsmay have been right and Chinese EV stocks like NIO and XPeng simply got too expensive. But while investors are staying away, Wall Street analysts are doubling down on these stocks.

NIO(ticker: NIO) stock skyrocketed about 1,100% in 2020. Its growing deliveries and new product launches helped convince investors that EVs are the future of personal transportation, and that NIO will be a long-term winner in the market. That left shares trading at roughly at 16 times estimated 2021 sales at the start of this year.Tesla(TSLA) stock, for comparison, started out this year trading at about 12 times estimated 2021 sales.

NIO shares, however, are down about 20% year to date. And they are struggling to break out of this funk.

This week, for instance, should have been good for all EV stocks. Tesla’s first-quarter deliveries, reported onApril 2, blew past analyst expectations, showing that EV demand is still strong and that the global automotive microchip shortage may be less of a problem than feared. The sector saw gains early this week on the news, but that quickly faded. Then a convertible bond sale announced byLi Auto(LI) drove all three the Chinese EV stocks lower Wednesday.

Even though shares are rebounding Thursday, NIO stock is still down about 3% for the week, compared with a roughly 2% gain for theS&P 500and theDow Jones Industrial Average‘s 1% gain. NIO peersXPeng(XPEV) and Li Auto are down about 4% and nearly 9% for the week, respectively. Tesla stock has risen about 3%.

There are quite a few issues that might be shaking confidence in these stocks. For one,higher interest rateshave hurt valuations of many high-growth stocks.

The automotivechip shortageis another problem. The global semiconductor industry has gotten caught ramping up a new chip generation while ramping down an old one during a global pandemic. The result is there aren’t enough for cars, and many auto makers have shut plants while waiting for the supply situation to improve.

Capital raisingfrom companies—includingQuantumScape(QS) and Li—is affecting trading, too. Investors don’t like to see their stakes diluted with new shares. In addition, a capital raise by any company is a small signal that company management is happy with the current stock price. Management teams, like investors, don’t like to sell low.

Even Tesla’s success might be a new problem for the Chinese EV producers. Part of Tesla’s delivery beat was strong sales of its newChinese-built Model Ycrossover vehicle. With so many EVs coming out in numerous markets across the globe, growth is a little harder than it was in 2020.

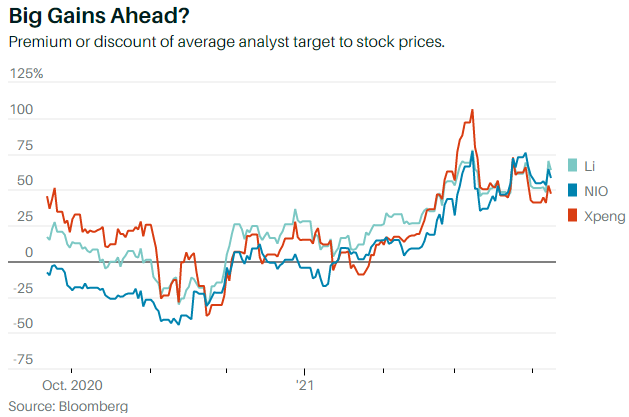

One group that isn’t worried about the Chinese EV stocks, however, is brokerage analysts. They are very bullish and have raised their price targets for all three stocks in 2021.

Such large expectations for stock gains aren’t typical on Wall Street. The average implied gain for stocks in the Dow Jones Industrial Average is typically less than 10%. But analysts really like these three Chinese EV stocks: More than 70% of the ratings on the trio are Buy. TheaverageBuy-rating ratios for stocks in the S&P 500 and Dow is less than 60%.

Analysts are staying bullish, even as investors want to seem more than just strong EV demand.