Amazon shares have been a relative loser this year, but stocks have taken a pause in the past weeks. Is this the time for FAAMG stocks to reclaim their role as market outperformers?

Amazon shares have been a relative loser this year, but stocks have taken a pause in the past weeks. Is this the time for FAAMG stocks to reclaim their role as market outperformers?

Amazon stock remains a loser in the market so far in 2021. This has been the year to bet on the reopening trade, including those stocks that benefit from a rise in consumer firepower, inflation and even interest rates: brick-and-mortar retail, materials and commodities, financial services, etc.

In the past couple of weeks, however, the stock market seems to have taken a pause, climbing little and not picking sides in the value vs. growth debate. Could this be a pivotal moment for AMZN stock and its peers? Will the FAAMG group finally rebound?

Performance in 2021: sleepy

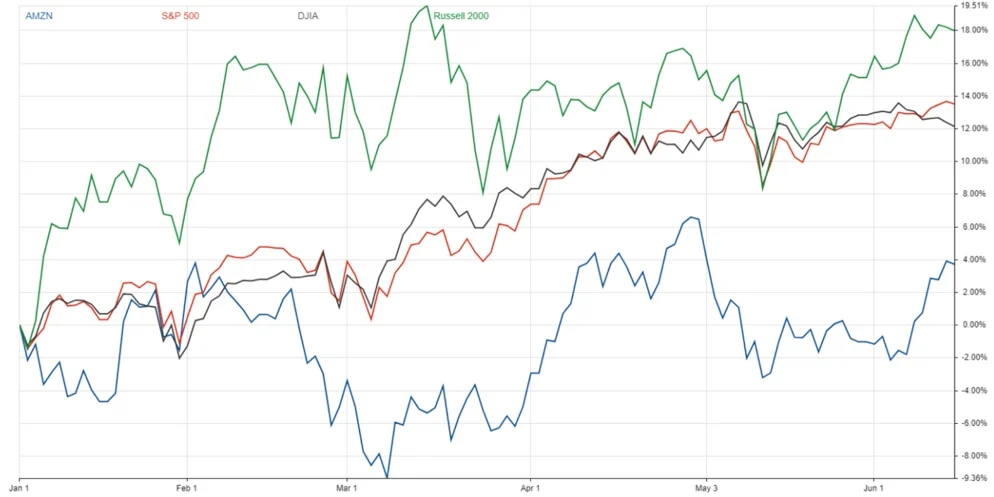

The chart below shows how far behind Amazon has fallen compared to the S&P 500, the industrials-rich Dow and, even more so, the small-cap Russell 2000 index. The 4% return in nearly six months is three to four times worse than the stock’s average performance since the 1997 IPO.

To be fair, the weakness experienced this year needs to be put within the context of the past 18 months. The 2020 pandemic accelerated trends in online shopping and cloud adoption, both of which are highly bullish for Amazon. Last year, AMZN returned nearly 80%, four times as much as the S&P 500. Now, shares seem to be taking a timeout.

The key is probably macroeconomics

A CNBC panel has recently had an interesting conversation about Amazon stock. Fair points were made about business fundamentals and valuations:

- Amazon’s share of US e-commerce flirted with 40% in 2020, an impressive number;

- Amazon should surpass Walmart as the largest US retailer next year;

- Only 15% of the workloads are in the cloud – a growth opportunity for Amazon Web Services;

- The MGM deal should attract attention, traffic and purchases to the Amazon ecosystem;

- On the bearish side, P/E is still high, maybe even relative to earnings growth potential.

But in the end, probably none of the above will mater to Amazon stock and the FAAMG group in the foreseeable future. The single most important variable that will likely determine what happens to tech growth for the rest of the year, in my view, is the macroeconomic landscape.

There is little doubt that the global (and the US, even more so) economies are on a path to recovery. This should be good news for companies and stocks across the board. The question is whether post-pandemic growth will push inflation and interest rates much higher than where they currently are.

If so, AMZN and FAAMG in general are likely to continue underperforming. This is the case because faster-growing companies rely on long-term earnings and cash flow to support their stock prices. When inflation and yields are high, financial results that are expected to be delivered far out in the future are discounted more heavily to present value.

For these reasons, pay attention to inflation data and the Federal Reserve’s decisions around monetary policy – the next chapter will play out on Wednesday, June 16. They may be determinant in the direction of Amazon stock and other FAAMG names over the next few months.