On Wednesday, July 28, drug manufacturer Tilray will report fiscal fourth quarter earnings results. Wall Street Memes discusses whether this may be a good buying opportunity.

Drug manufacturer Tilray, a Canadian-based company engaged in research, cultivation, and distribution of medical cannabis, is about to report its fiscal fourth quarter results.

The stock has been popular among Redditors in 2021. With earnings day around the corner, the question now is whether TLRY might be a good buy at current prices.

The cannabis market

In the United States, a total of 34 states plus the District of Columbia consider marijuana legal for medicinal use. Among these, 16 have approved recreational use,according to the latest data.

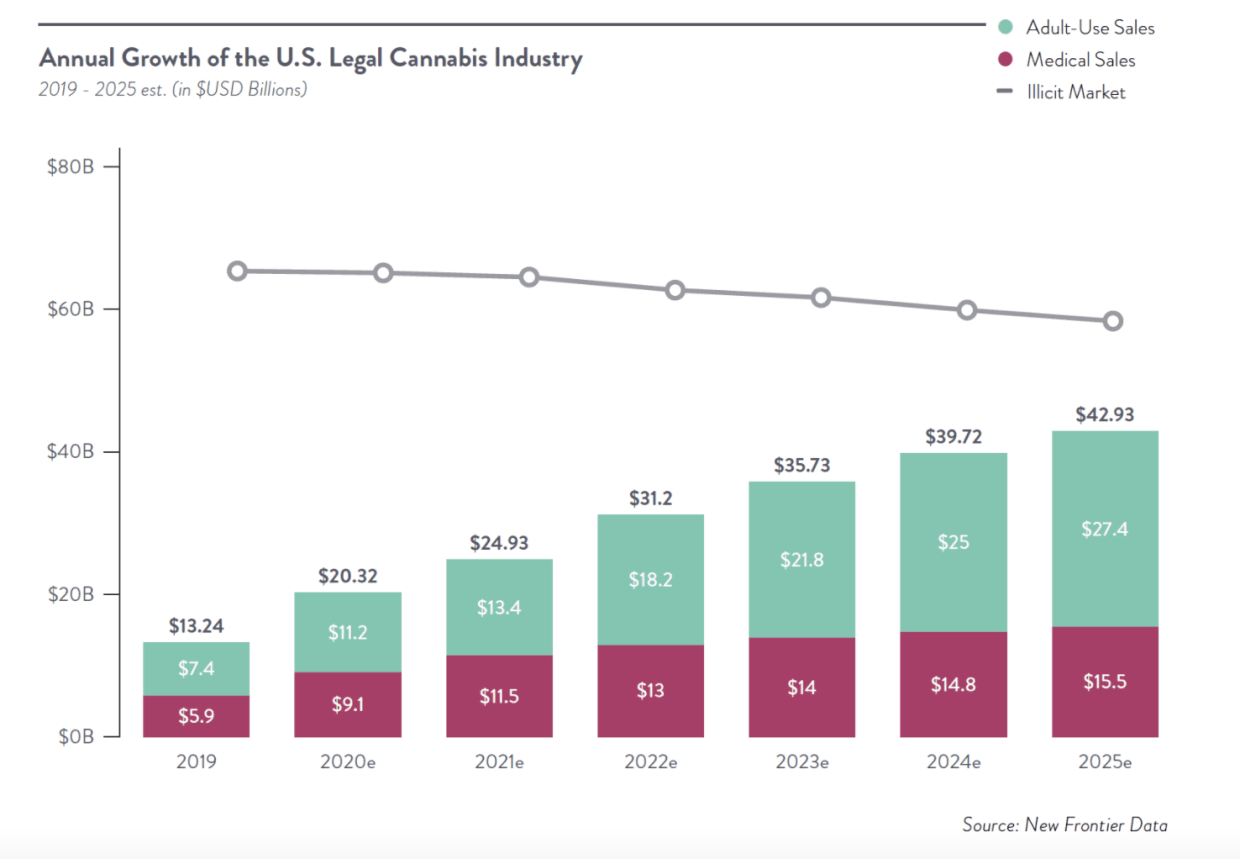

In 2020, the cannabis market was estimated to be valued at $20 billion by New Frontier Data, and it is projected to reach $43 billion by 2025. Growth seems to be fueled by social acceptance of cannabis and the development of a regulatory framework for production.

Tilray + Aphria merger

Tilray has been trading publicly since December 2020, after merging with Aphria. Following the deal, TLRY now has a market cap of close to $6 billion – one of the largest cannabis companies today, alongside peer Canopy Growth.

The Tilray-Aphria merger was justified by expected benefits that included:

- market leadership in Canada

- foothold in Europe and better positioning in the U.S.

- lower production costs and synergies

Wall Street's take

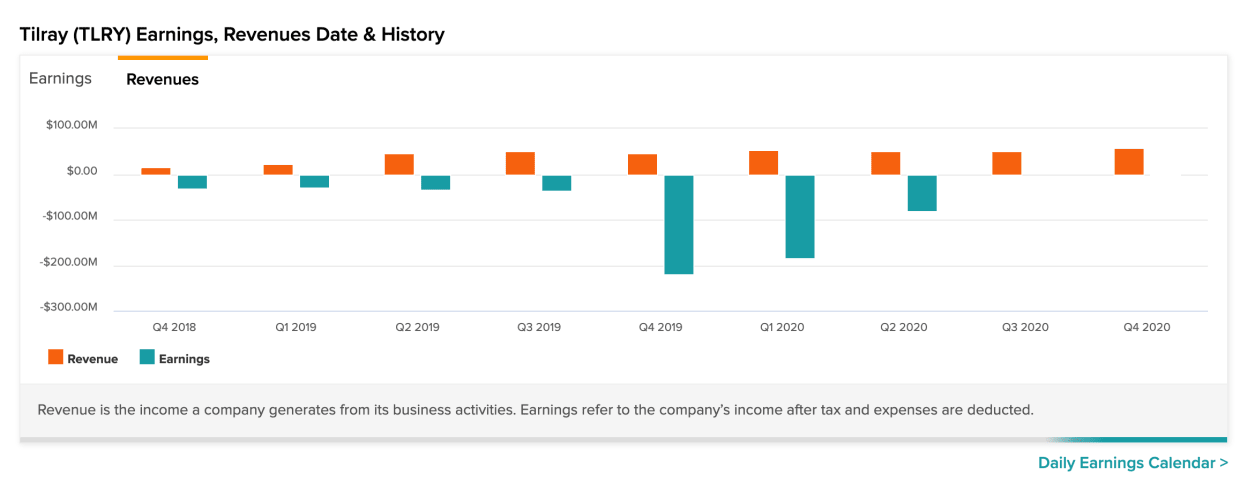

In the past several quarters, Tilray has been making good strides on its P&L. In 2020, the company reported progressively better revenue that reached $210 million for the year. It also managed to reverse a sharp net loss position that had been accumulating since prior to last year. See below:

Analysts currently rate TLRY as a moderate buy, with an average target price of nearly $21 for a potential upside of 52%. The merger with Aphria weighed positively for most analysts.

Despite the encouraging metrics, some of Wall Street’s commentary around the company and stock has been cautious lately. Last month, Cowen & Co.’s analyst maintained her buy recommendation, but stated the following about Tilray:

"We are taking down our revenue and EBITDA estimates, as we expect COVID challenges in Canada to remain a headwind. In addition, TLRY faces tough market share comps, where it has retraced from peak levels to stabilize following the completion of the merger with Aphria.”

Alliance Global Partners has a neutral recommendation on TLRY. Less optimistic, the analyst has lowered the target price from $32 to $18.Accordingto him, the merger with Aphria is beneficial for the stock, but the price is fair at current levels.

Reddit popularity

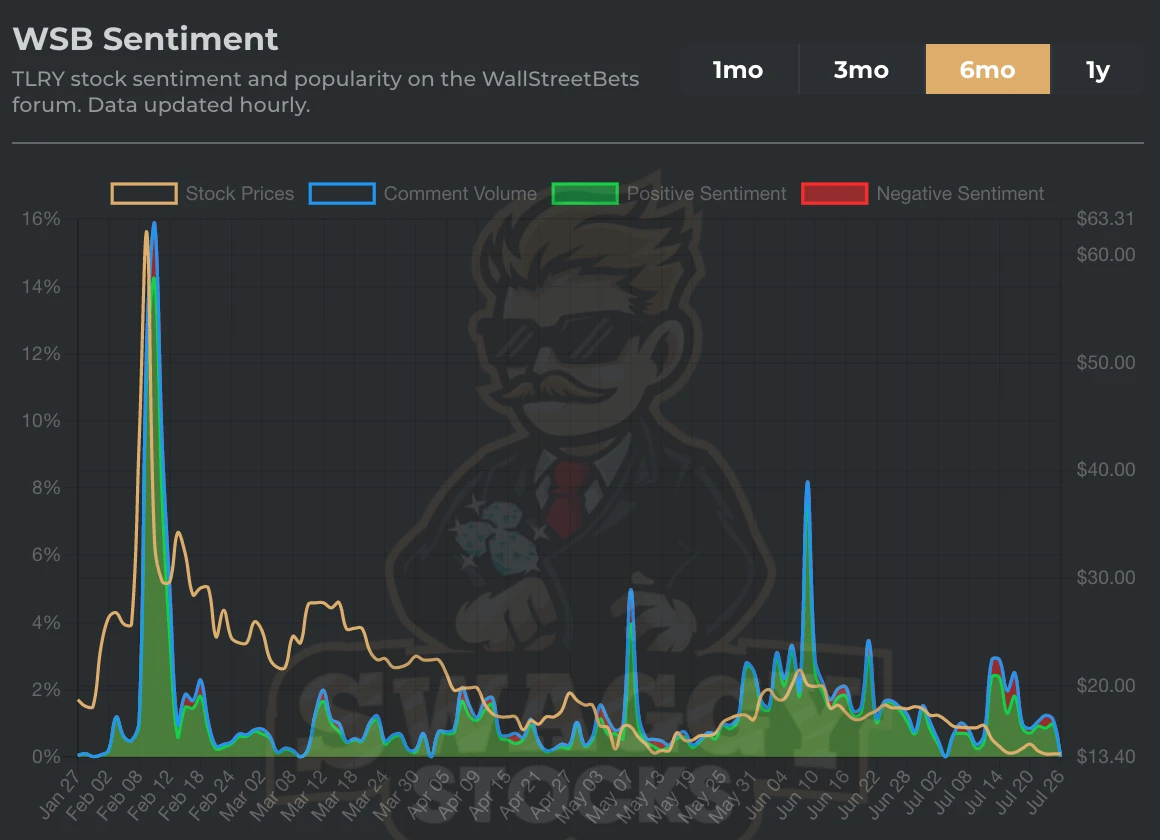

Tilray stock witnessed an eye-popping rally in February 2021. Shares climbed more than 670% between early January and early February, before pulling back sharply.

The drivers of bullishness were (1) good earnings results, (2) favorable developments in cannabis regulation, and (2) the signed agreement with Grow Pharma to distribute medical cannabis for patients in the U.K.

Reddit forums certainly seem to have played a role as well. Meme mania picked up steam in late January, at first with GameStop. Soon enough, other stocks like TLRY also benefited. See below the share price history, alongside the volume of comments on WallStreetBets.

Wall Street Memes’ take

The cannabis industry is very sensitive to regulatory factors. Lack of positive news regarding new cannabis regulations can lead to prolonged periods of malaise in stock price, like the current one. In addition, Tilray faces the usual integration risks, following the recent merger.

At the same time, opportunities continue to exist as medicinal and recreational use of cannabis in the U.S and elsewhere globally expand. Judging by stock ratings and price targets, Wall Street analysts still seem optimistic about the stock. Lastly, with the Reddit crowd paying attention, TLRY could potentially become the target of a meme attack again in the future.