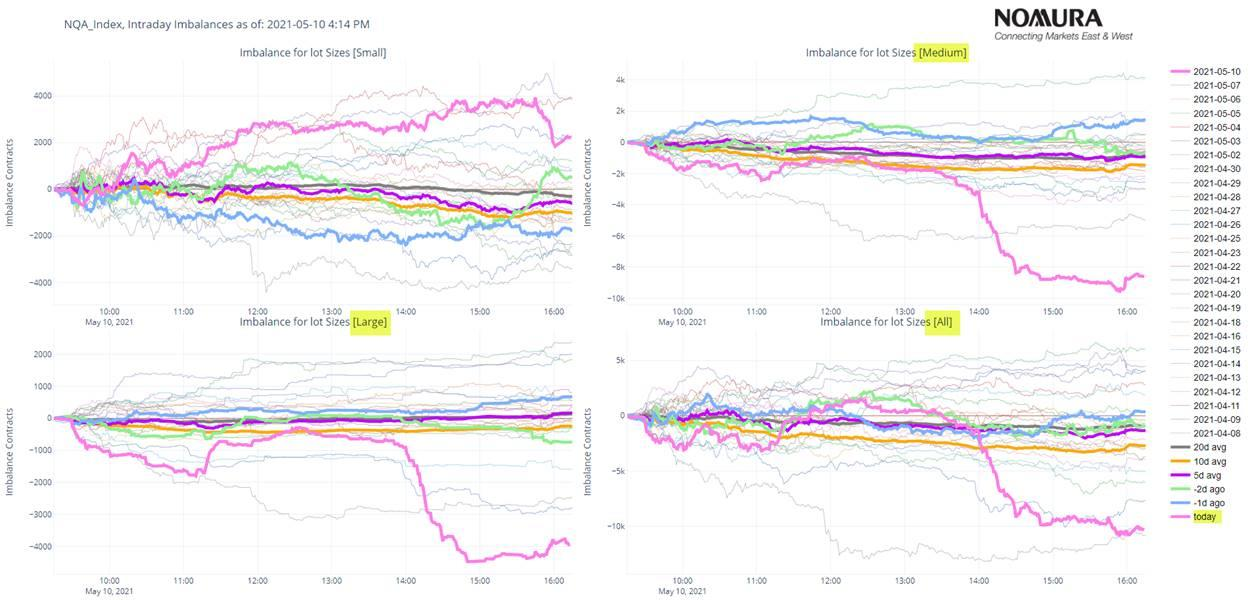

Nomura's “futures imbalance” monitor showedenormous sell pressure all day in NQ futsacross all lots sizes (the largest in at least 1m), butparticularly in our medium- and large- lot buckets, proxies for large HFs and Asset Managers aggressively selling / shorting...

Nomura's Charlie McElligott warns that the monstrous ~$20B ARKK active ETF is getting absolutelytorched in recent weeks amid a negative feedback loop from the mega-high growth / high multiple / “unprofitable” single-names.

Critically, he explains,the ETF itself now acting “shadow leverage” pressuring this selloff,especially with their dubious risk management practice of heavily concentrated positioning into what are extraordinarily illiquid names.

Along with the inherently-extreme interest rate sensitivity within these hyper-growth / high-valuation names, this has made ARKK a popular downside play / hedge in the options space, with Dealers essentially max “short Gamma” near this current $98-100 level, while net Delta across options is ~ $-2B and essentially the low net Delta reading since start 2020.

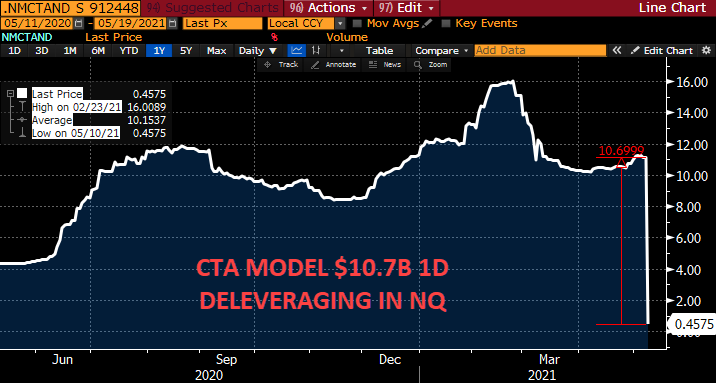

But that is not the only driver of the chaos asthe Nomura QIS CTA Trend model showed massive deleveraging in Nasdaq yesterday into the down moveafter the 3m window “sell trigger” was breached and flipped “short” (now joining the 2w and 1m windows as “short,” although neither of those has any signal loading), which overall turned the multi-year legacy “+100% Long” signal across all horizons down to just “+4.1% Long,” and implying ~$10.7B of notional selling in NQ futs in the deleveraging.

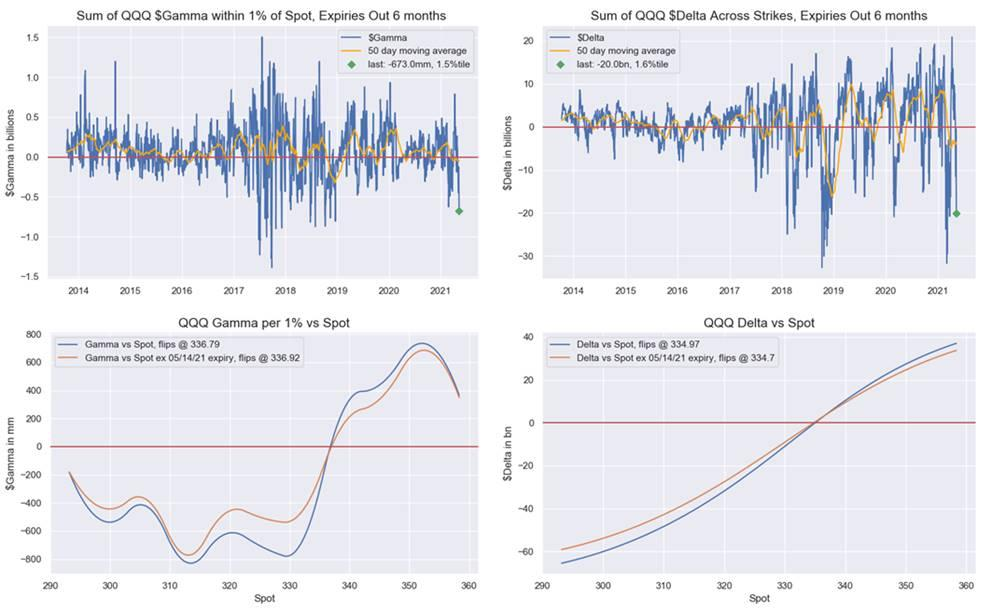

And that was exaggerated from a “flows” perspective by the previously warned-about deep Dealer “short Gamma vs spot” in QQQswe highlighted in recent notes as the center of Equities risk, which meant “accelerant” (delta hedging) flows into the selloff, with a now extremely negative $Gamma reading -$673mm (1.5%ile), while net Delta exploded lower to -$20B (1.6%ile).

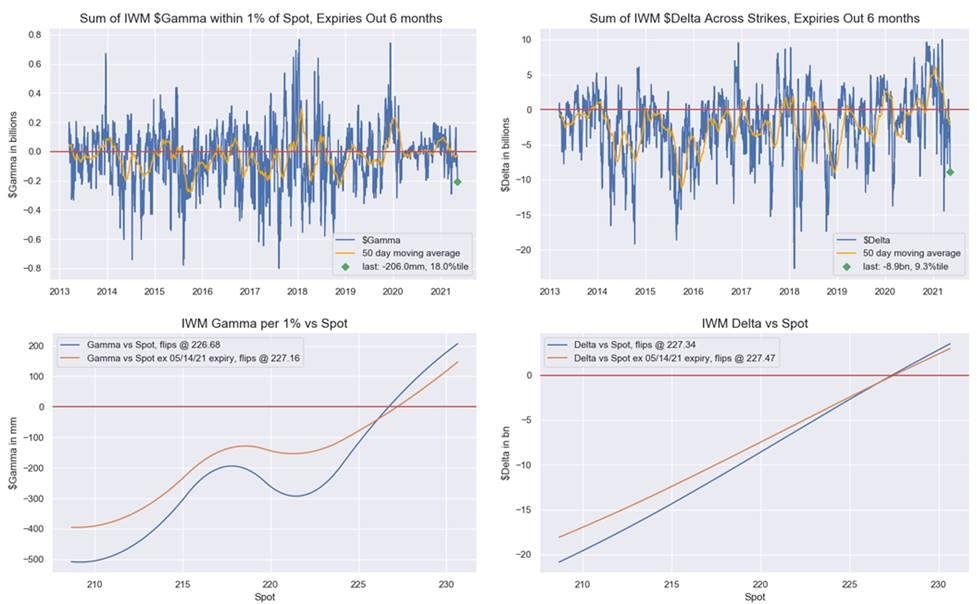

And Small Caps suffered the same asIWM options too showing Dealers DEEP “short Gamma vs spot”still (flips way up at 226.68) and overall $Gamma -206mm (18%ile), while $Delta is -$8.9B (9.3%ile) and negative until 227.34.

The question - amid this morning's panic-bid in IWM and QQQ - is it over?

We suspect no, as that ARKK Gamma vicious circle doesn't appear to be disappearing anytime soon.

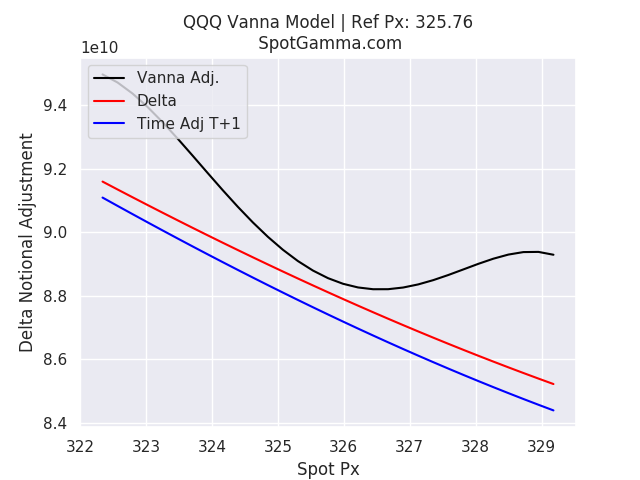

The dramatic rebound this morning is explained by just how much more “skew” there is in the QQQ model.

As SpotGamma explains,this supports that view of much larger volatility, both in dealers selling as Nasdaq moves lower and buying if Nasdaq rises.