he United States economy is recovering fast from the economic recession generated by the COVID-19 virus. Thanks to the successful vaccination campaign currently ongoing, the U.S. is on track to reach herd immunity in three months’ time.

Naturally, this leads to the economy at risk of overheating. If the $1.9 trillion fiscal stimulus delivered in the first quarter of the year was not enough, Congress is about to approve another $2.4 trillion this year.

Dubbed the “American Jobs Plan”, public investment will increase inflation expectations and boost productivity. It is focusing on a combination of long-term projects in areas such as green energy initiatives, education, healthcare, and infrastructure.

Bond Market Puts Pressure on the Fed

Three forces dominate financial markets at this point in time. One is the U.S. Congress and the speed of releasing fiscal stimulus. Another is the vaccination campaign that will lead to herd immunity faster than rival economies. Finally, there is the Fed willing to remain accommodative while the economy recovers.

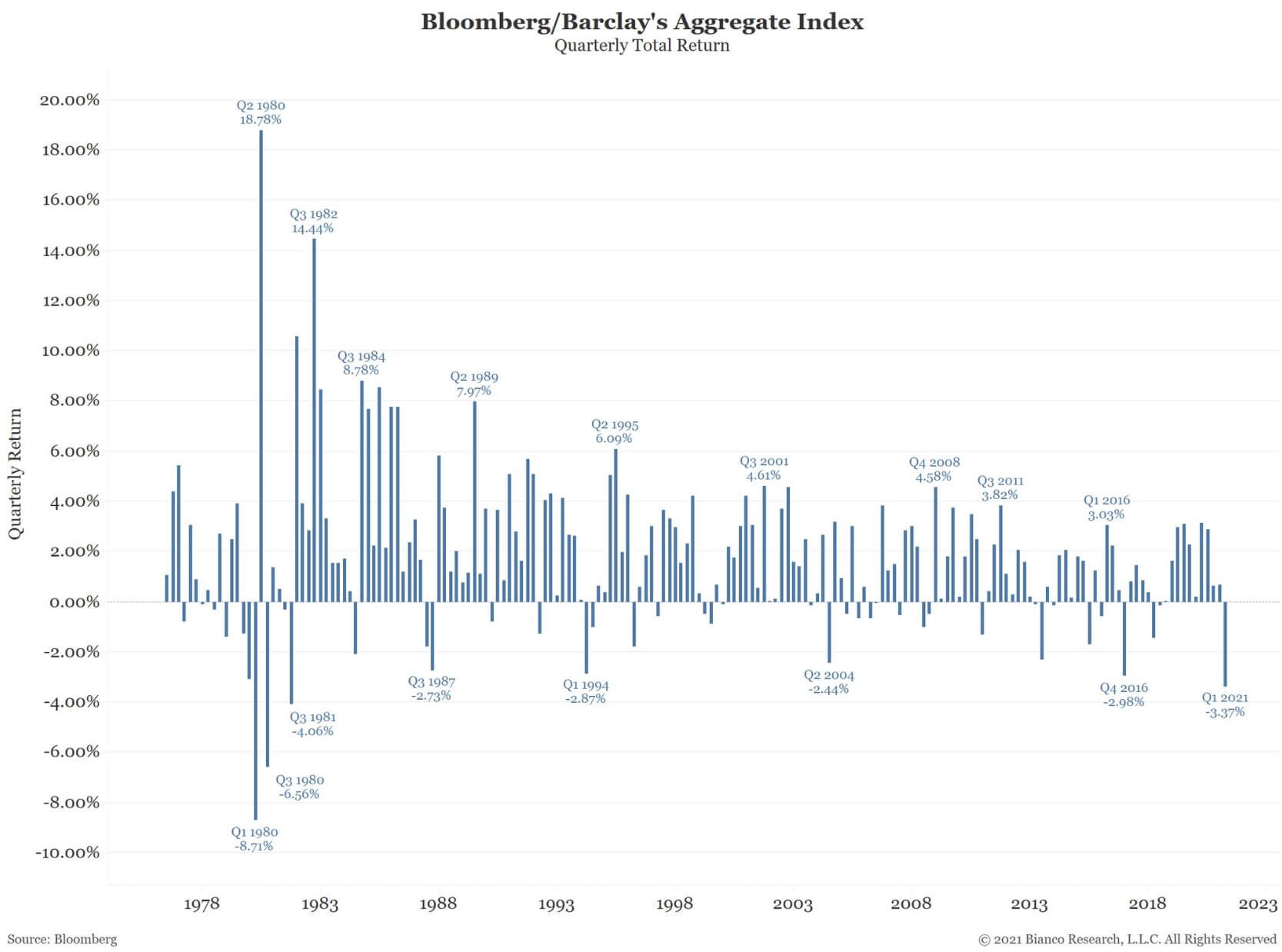

In the middle, there is the bond market. The Bloomberg/Barclays U.S. Aggregate Bond Index represents intermediate-term investment grade bonds traded in the United States.

Declining bond prices mean higher yields, and if the trend continues in the second half of the year, the Fed will break. Make no mistake that the market will put pressure on the Fed as long as the bond market remains in pain.

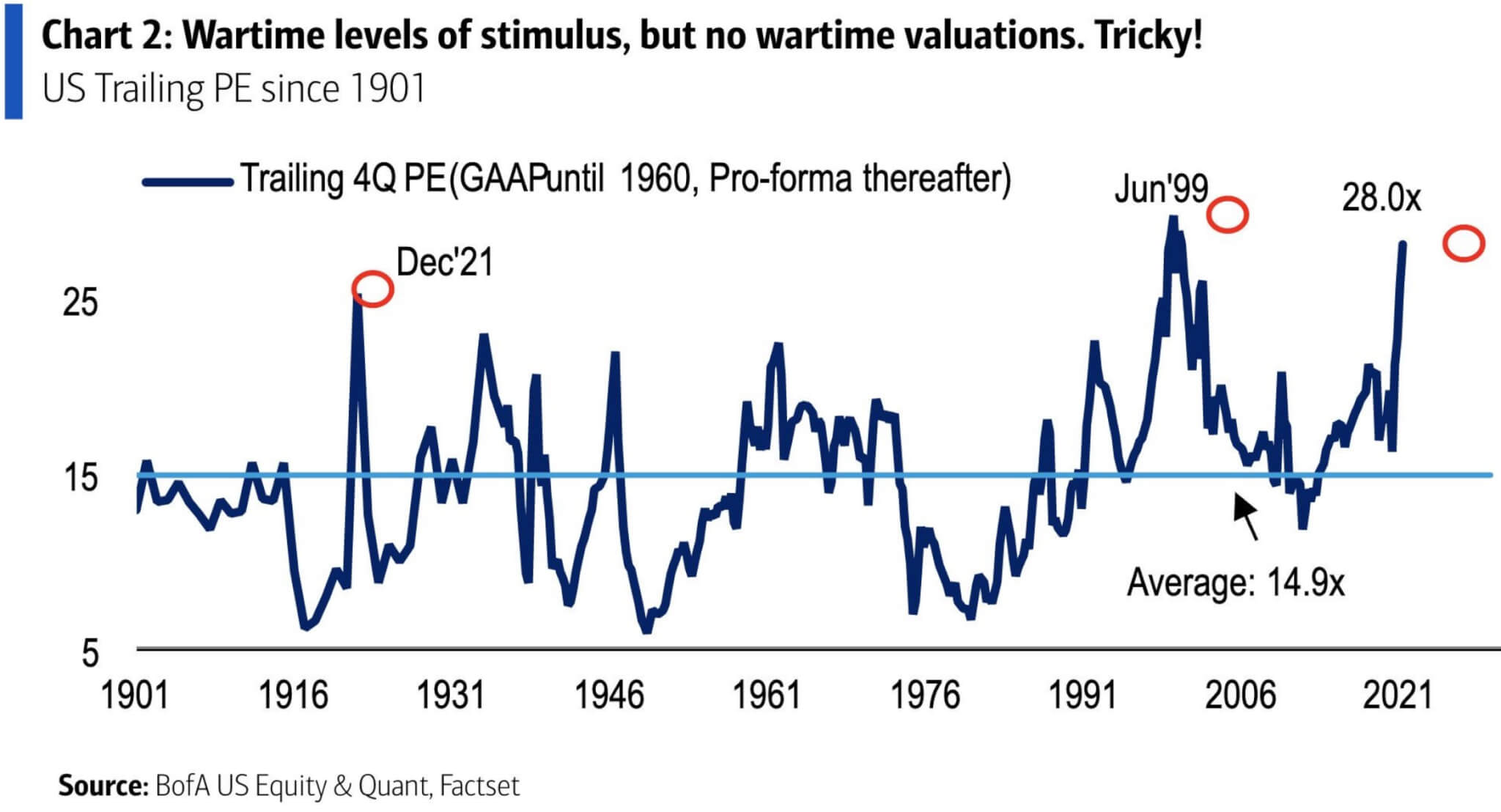

The dilemma facing the United States policymakers is how to find a balance between fiscal and monetary stimulus, so that the bond market is not depressed and the economy to avoid overheating. One way to do it is to simply let the yields rise and thus, the financial tightening that comes along will compensate for the Fed’s lack of action. However, that will play out only if the stock market remains at current levels.

To sum up, the next few months are extremely important for the market participants – we may be at the start of new trends that will influence financial assets for the rest of the year.