After US Services PMI (and ISM) unexpectedly plunged from record highs in June, analysts expected the plunge to stop in preliminary July data (despite an ongoing downtrend in 'hard' economic data performance)... they were wrong.

While US Manufacturing picked up modestly from 62.1 to 63.1 (better than the 62.0 expected),US Services tumbled further to 59.8 from 64.6 (well below the 64.5 expected).

That is the weakest Services print since February.

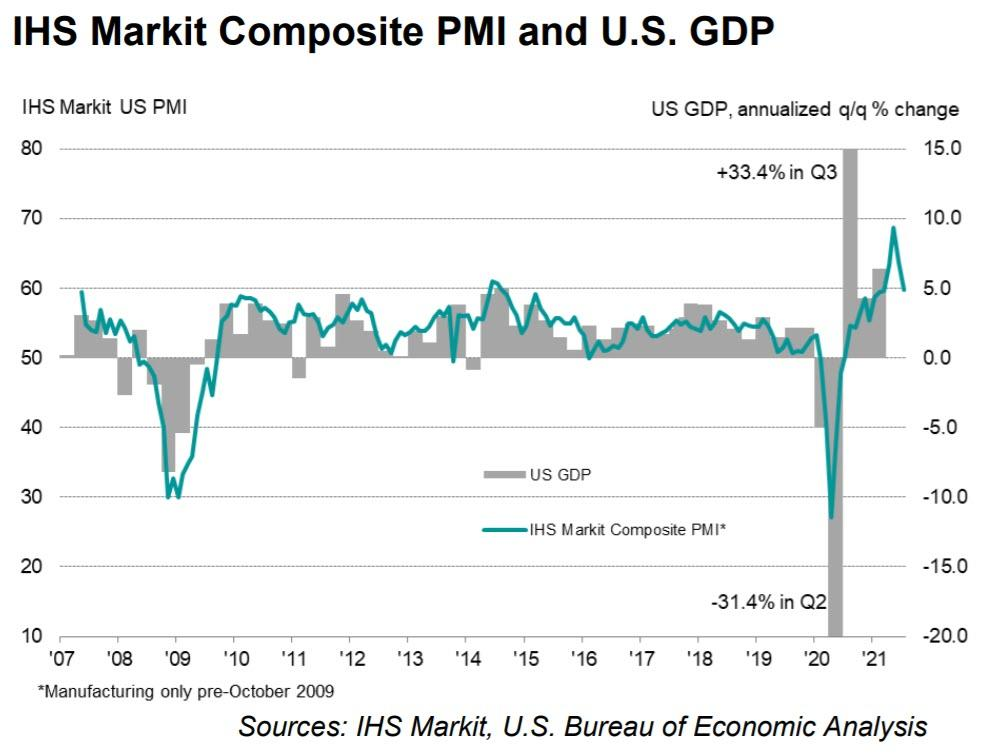

The drop in Services weighed heavily on theUS Composite which dropped to 4-month lows.

“The provisional PMI data for July point to the pace of economic growth slowing for a second successive month,though importantly this cooling has followed an unprecedented growth spurt in May. Some moderation of service sector growth in particular was always on the cards after the initial reopening of the economy, and importantly we’re now seeing nicely-balanced strong growth across both manufacturing and services.

“While thesecond quarter may therefore represent a peaking in the pace of economic growthaccording to the PMI, the third quarter is still looking encouragingly strong.

“Short-term capacity issues remain a concern, constraining output in many manufacturing and service sector companies while simultaneously pushing prices higher as demand exceeds supply.However, we’re already seeing signs of inflationary pressures peaking, with both input cost and selling price gauges falling for a second month in July, albeit remaining elevated.

“Inflationary pressures and supply constraints – both in terms of labour and materials shortages - nevertheless remain major sources of uncertainty among businesses, as does the delta variant, all of which has pushed business optimism about the year ahead to the lowest seen so far this year.The concern is this drop in confidence could feed through to reduced spending, investment and hiring, adding to the possibility that growth could slow further in coming months.”

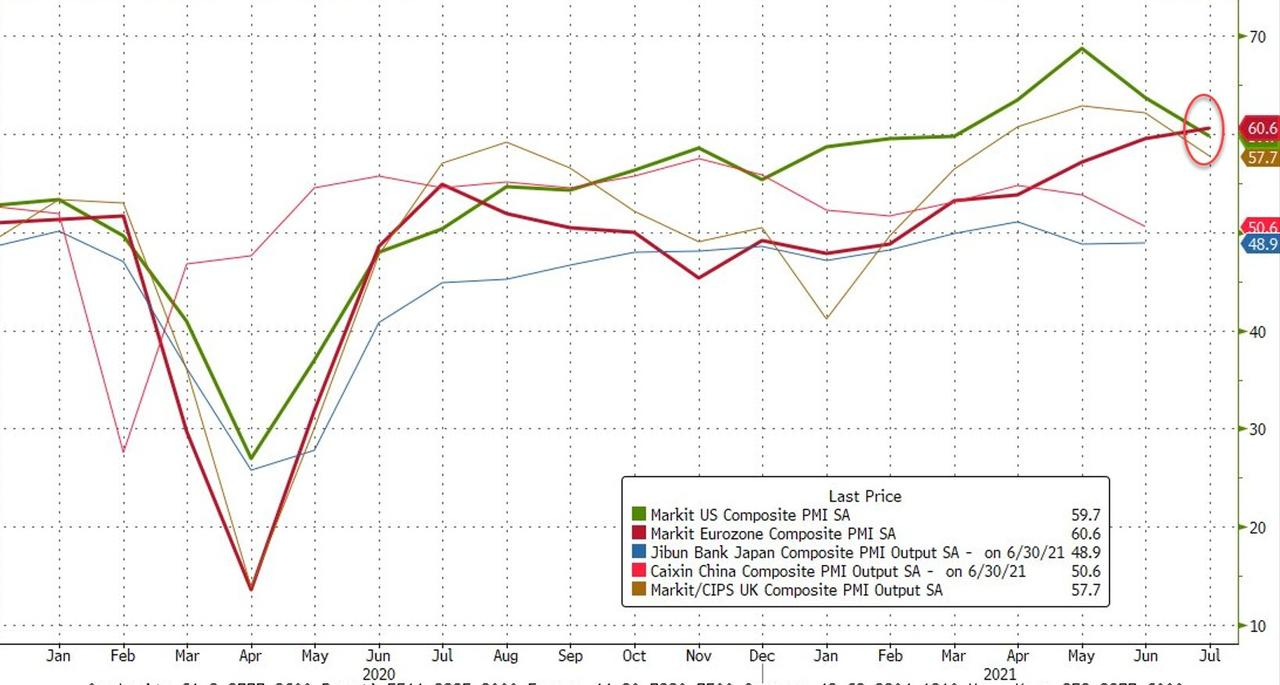

For context, the US Composite index is now running below that of Europe's...