Critical information for the U.S. trading day.

Tuesday is looking dicey for stocks, notably the technology space, as inflation jitters continue to ripple across markets. The sector has been bearing the brunt of concerns that higher inflation may prompt an early end to the Federal Reserve’s COVID-19 pandemic-driven accommodative stance.

After last week’s downside jobs surprise, some fear Wednesday’s consumer price datacould also deliver a nasty shock. Not helping are fresh Chinese data on Tuesday showingsurgingfactory-gate prices, though the consumer side was subdued. That is as investors continue to monitor fallout from a downed U.S. energy pipeline.

Inflation is the “worst-case scenario” for this ticking-time-bomb market full of complacent investors, warns ourcall of the dayfrom Thomas H. Kee Jr., president and chief executive of Stock Traders Daily and portfolio manager at Equity Logic.

“Arguably, the ONLY reason stimulus has even been possible is because there has been no inflation. If inflation comes back, all of the safeguards investors have been given (free money from stimulus) will be dissolved and won’t be able to come back to save the day,” Kee told MarketWatch on Monday in an interview via LinkedIn. He said recent jobs data indeed suggest price rises will be “more serious than previously thought.”

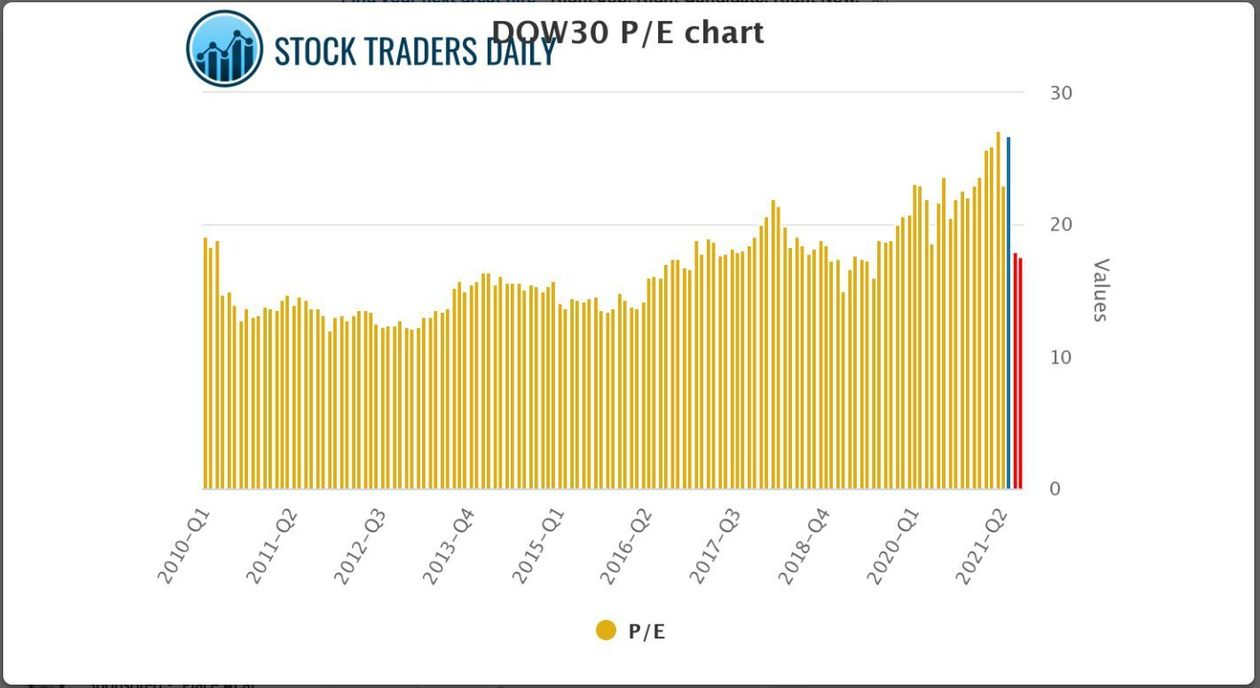

Investors are disregarding the fact that stocks are very expensive right now, said Kee, wholast Novemberpredicted a 25% drop for the Dow Jones Industrial AverageDJIA,-0.10%by year-end based on high price/earnings multiples.

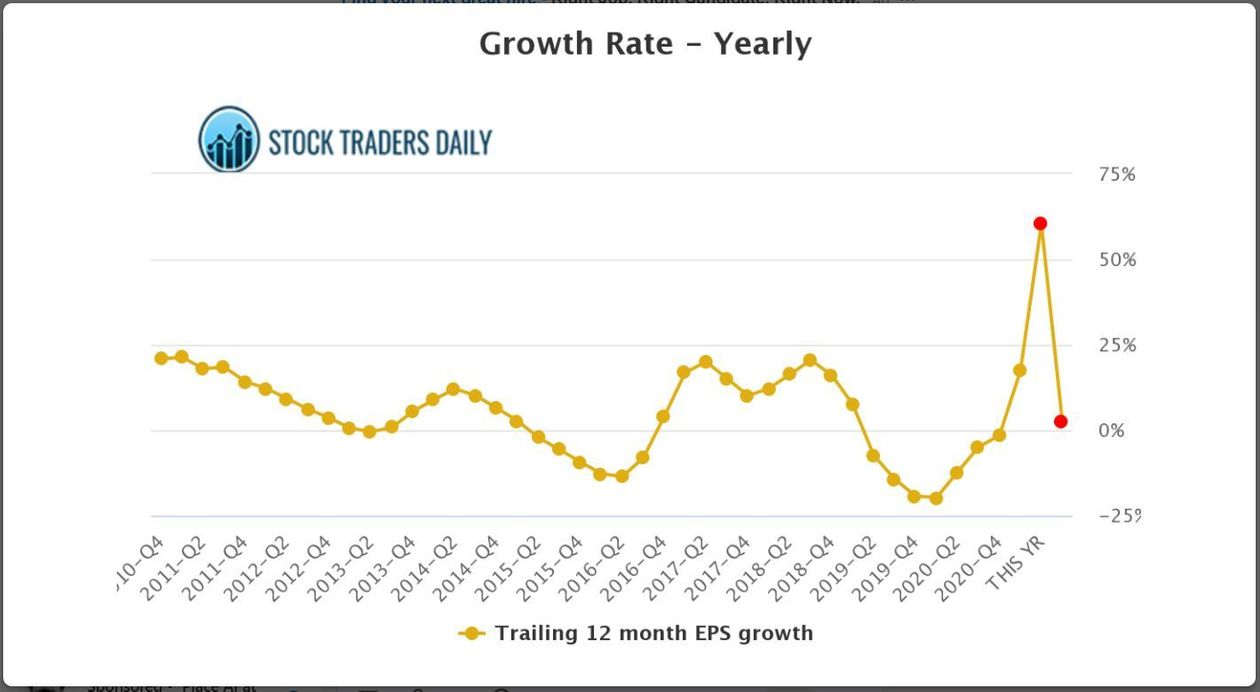

Last year, he expected Dow earnings-per-share growth at 32% for 2021, but now sees it surging to 62%, before collapsing to 2.42% in 2022.

And the price/earnings to growth ratio, which adds in future earnings growth, for the Dow next year is “over 7, and normal fair value is 1.5. It is way overvalued based on that,” said Kee.

He advised investors continue rotating between the SPRD S&P 500 ETF trustSPY,-0.99%and cash. Kee suggested last year staying that course until signs of reversals or that investors were getting worried about central bank stimulus stopping. No signs so far, he said.