The US IPO market is taking a breather after the holiday week, with just one IPO scheduled to raise $30 million in the first week of December.

While the calendar is quiet at the moment, several IPOs are eligible to launch on Monday, including Indian IT services provider Coforge (CFRG.RC), cloud infrastructure platform HashiCorp (HCP), luxury fashion e-tailer Rue Gilt Group (RGG), rugged apparel brand 5.11 ABR(VXI), and Florida-based insurer TypTapInsurance Group (TYTP).

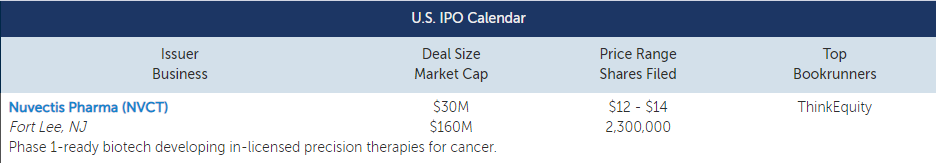

Phase 1-ready biotech Nuvectis Pharma (NVCT) plans to raise $30 million at a $160 million market cap. The company is initially focused the development of innovative precision medicines for the treatment of serious unmet medical needs in oncology. Nuvectis is currently developing two preclinical candidates, with its lead candidate expected to begin a Phase 1 trial in the 4Q21.

Street research is expected to 12 companies in the week ahead, and lock-up periods will be expiring for up to four companies. For access to Street research and lock-up dates,sign up for a free trial of IPO Pro.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 11/24/2021, the Renaissance IPO Index was down 1.1% year-to-date, while the S&P 500 was up 25.2%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Snowflake (SNOW) and Moderna (MRNA). The Renaissance International IPO Index was down 22.4% year-to-date, while the ACWX was up 7.4%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Meituan-Dianping and SoftBank.