The Apple Maven continues to think that now is a good time to own Apple stock. We present another reason why this could be the case – think lower risks, rather than higher potential returns.

Apple stock continues to climb towards all-time highs, levels not seen since around six weeks ago. Even though the opportunity to buy the dip has all but vanished at this point, as the drawdown narrows to less than 5%, the Apple Maven still thinks that now is a good time to own AAPL shares.

Today, we present one more reason that justifies owning the Cupertino company’s stock now. Rather than higher potential returns, we look at the bullish case from the perspective of lower risks.

Volatility drops

When it comes to investing, the Apple Maven sees the two sides of the coin: risk and return. Much attention tends to be directed at the latter: will gains be rich going forward? Arguably not enough time is spent discussing the risk that needs to be assumed to capture the higher expected returns.

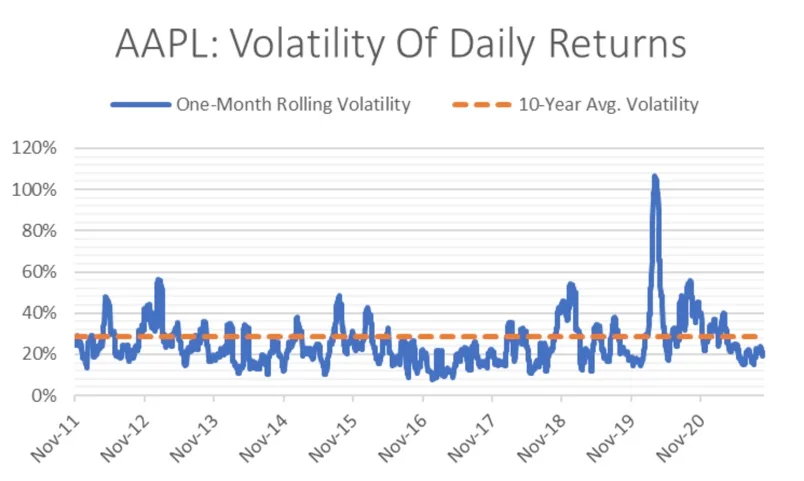

One common measure of risk is volatility: in other words, how much the stock price tends to swing from period to period (say, day to day), measured statistically by one standard deviation. The lower the number, the better. AAPL’s volatility over the past decade has averaged a bit more than 28%, which is consistent with the company’s profile as a higher-growth, mega-cap tech name.

Throughout most of 2020, Apple stock’s rolling one-month volatility stayed above this long-term average – and even reached peaks of more than 100% during the thick of the COVID-19 crisis! But lately, jittery market action has given way to steadier, more predictable price movements. See chart below.

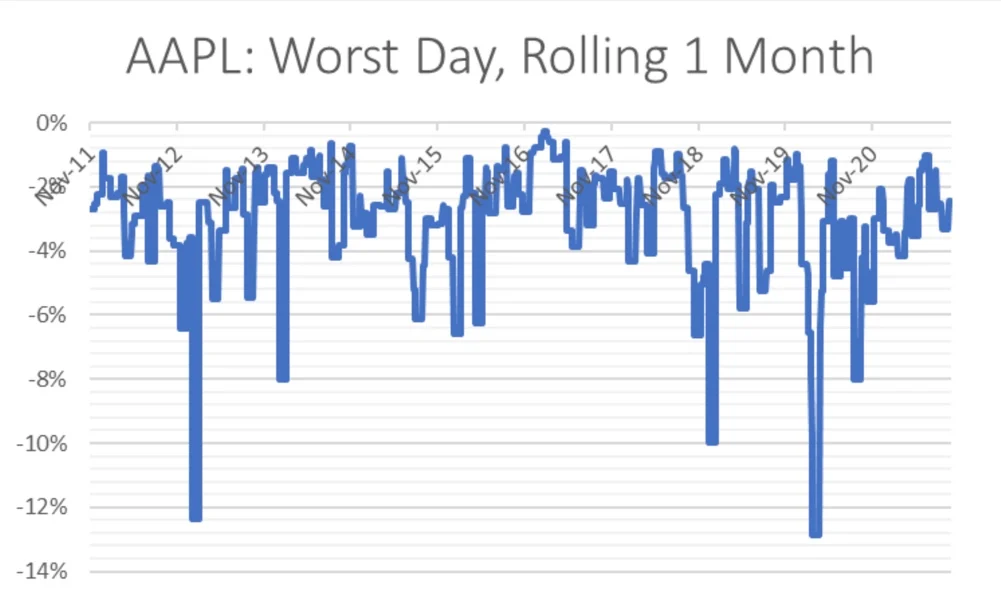

Another way to think of risk is to consider the worst day of performance over a given period. Considering a rolling one-month window, Apple stock has produced steepest daily losses of -3.2% over the past ten years, on average. But in the past month, that figure dropped to -2.5%.

The chart below shows that the worst daily declines in Apple shares (again, on a rolling one-month basis) have been moderating lately. In fact, since late Q3 of last year, the figure has declined consistently from -8% in September 2020 to just short of -4% in the summer of 2021 to better than -3% now.

Why less risky?

There are several possible reasons why investing in AAPL has become less risky lately. First, the company has proven that it can execute very well prior to, during, and after the thick of the pandemic. When some tech companies failed to deliver great results without the stay-at-home tailwinds (think Amazon in Q2), Apple has managed to wow investors each quarter.

COVID-19 dominated the conversation during most of 2020. Global economies recovering from the pandemic has now become a major concern for investors in 2021. Nearly agnostic to it all is Apple, which helps to justify lower stock price volatility in the recent past.

The other plausible justification is a bit less clear, if not more controversial or contrarian. The Apple Maven has argued that treasury yields (i.e. longer-term interest rates) have climbed a bit too much, too fast. As the market ponders whether the risk of hawkish monetary policy may have already been priced into assets, it is possible that Apple stock has benefited through reduced volatility in the past weeks.