It’s the way most ordinary Americans track the stock market, and the economy

It doesn’t get as much investor attention as the broad S&P 500 index or the sexy innovators of the Nasdaq Composite,but a closer look at the Dow Jones Industrial Average is a good reminder that the cyclical trade is what’s moving markets in 2021 — and why that matters.

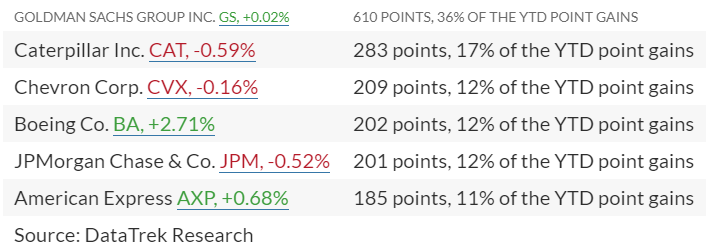

That idea comes from an analysis from DataTrek Research, published Thursday. Co-founder Jessica Rabe notes that just six of the Dow’s 30 holdings are responsible for its year-to-date gains. As of the close of business Wednesday and adjusted for rounding, they are:

What does the performance of what Rabe calls “old school, mostly ‘industrial’” stocks tell us? “They all continue to reflect confidence in reopening trades and a steepening yield curve. We remain bullish on Energy,Financials and Industrials,” she wrote.

Of course, the blue-chip Dow isn’t only made up of industrials, despite its name. Apple Inc. and Salesforce are in the index too – and are among its worst performers in the year to date, down 9.4% and 4.8%, respectively, through March 10.

“Still, the rotation into cyclicals and out of tech has been far more helpful than harmful to the Dow’s returns,” Rabe wrote. “Despite that a third of Dow names are in the red [year to date], they only account for a collective loss of 493 points to the index, or still less than Goldman Sachs’ 610 positive point contribution YTD.”

Why should investors focus on this quirky small collection of price-weighted stocks? “It is still the way most Americans track the domestic stock market,” Rabe wrote. “There are far more Google searches every day for ‘Dow Jones’ than ‘S&P 500’ or ‘stock market.'”

To whatever extent “Main Street” feels good – and goes out and spends – when “Wall Street” is doing well, it’s the performance of the Dow that triggers that, she added.