Wedbush Securities managing director Dan Ives advised investors to stick with technology stocks despite the potential valuation crunch that could happen as the Federal Reserve raises interest rates.

"This is not the time to throw in the white towel on tech," he told CNBC on Friday.

Calling the current era "a fourth industrial revolution," Ives backed such stocks as CyberArk Software , Palo Alto Networks , Zscaler , NVIDIA and Apple .

"This is an opportunity, not the start of a downtrend for tech," he said.

Ives argued that a large number of tech names will see significant growth in coming years thanks to heavy spending on technologies like cybersecurity, 5G and further moves into the cloud.

He estimated that this "digital transformation" would fuel another $2T in spending over the next six to seven years.

That said, Ives warned investors that they had to be selective with their portfolios, as some stocks will lose momentum once the massive pandemic-related stimulus comes to an end.

"You have to separate the winners from the losers and the long-term winners versus the ones that benefited from the pandemic," he said.

Rather, Ives suggested investors "double down on their winners."

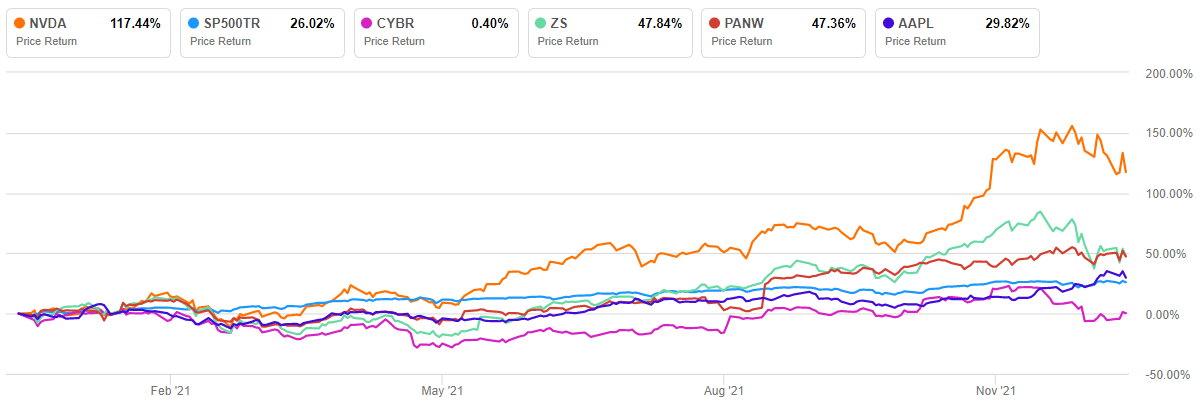

Looking at some of the stocks mentioned by Ives, NVDA has done by far the best in 2021, more than doubling over the course of the year. ZS and PANW have both risen nearly 50%. AAPL lags behind its smaller rivals, although it has rallied about 30% for 2021.

The main laggard in the group is CYBR, which is basically flat on the year: