Summary

- Apple is trading at lower multiples than its peers and the Nasdaq.

- Apple is making huge strides in the European as well as international markets.

- As iPhones sell, so will AirPods, Apple Watches, and Apple services such as Music and Arcade.

Thesis

Apple (AAPL) is the largest company in the world by market cap. While large-cap stocks like Apple are usually close to fair value, Apple makes a compelling case. Arguably the best investor of all time, Warren Buffet has invested over 40% of Berkshire Hathaway's (BRK.A)(BRK.B) portfolio in Apple stock. So I decided that there must be some value proposition here. After a throughout look, I came to the same conclusion as Warren Buffet. Apple stock is an excellent buy.

Apple's potential on a global scale has not been adequately factored into the share price.

Current Valuation

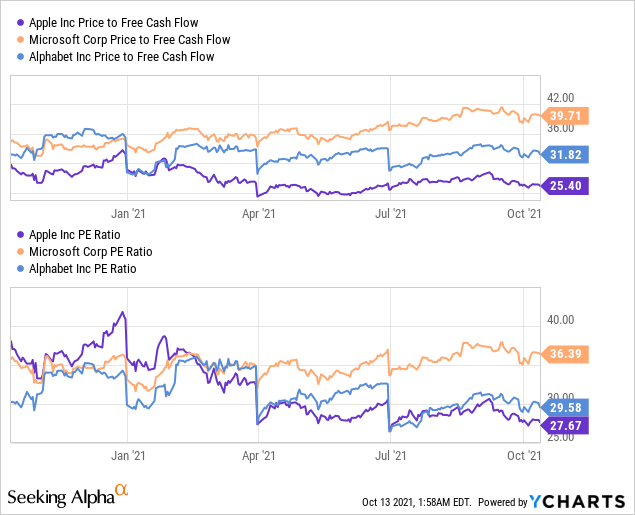

To understand if something is undervalued, we first need to understand its current valuation. To do so, I will briefly compare it to some similar stocks in both PE and P/FCF.

As you can see, Apple is valued at lower PE and P/FCF multiples than similar companies Microsoft (MSFT) and Alphabet (GOOGL). It is also trading at a lower PE ratio than the Nasdaq index (29.25).

This establishes that Apple is not being valued at a premium to reflect the massive opportunity they have with international expansion.

Apple In The US

If you are like me and from America, it may seem like everyone that wants an iPhone has one. There is a good chance you are even reading this article on Apple's signature OLED screen.

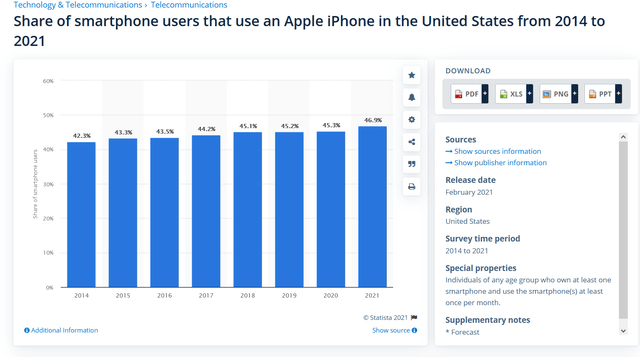

Apple's market share in the US has been growing by low single-digit percentages since 2015 and currently has a US market share of just under 50% in 2021.

I see no real reason that this will change significantly. Like I mentioned above, most people that want an iPhone already own one. When dealing with such a high market share, it is hard to grow, at least substantially.

While I will not discuss this point in-depth, it is worth noting that in 2020, only about 50% of their revenue came from iPhone, and there is considerable room to grow in their accessories and wearables, even in the US.

The International Market

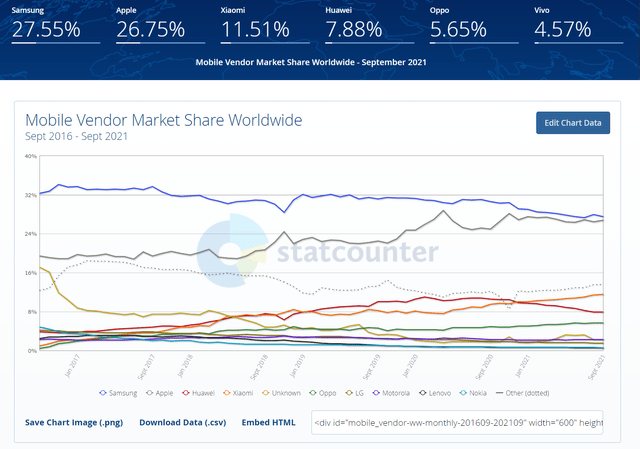

This is where I see a massive opportunity for Apple. They are already on their way to growing their global market share.

Over the last 5 years, AAPL's global market share has gone from the high teens/low twenties to over 25%. Apple is also close to overtaking Samsung as the worldwide market share leader, and at current rates, it appears the overtake will happen sometime in the next twelve months.

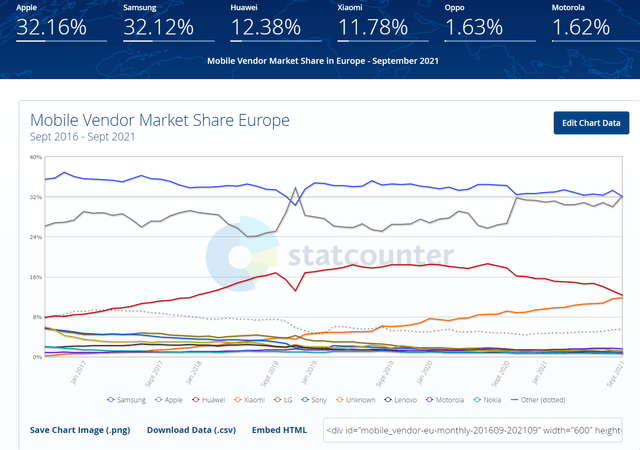

The upward trend is seen again in Europe. Here is AAPL's European market share over the past 5 years.

In this case, Apple just recently took over Samsung as the leading European smartphone vendor. With a population of around 741 million people, nearly 2x the population of the United States, taking the majority share of the smartphone market in Europe is huge.

What does that mean?

This is just the beginning, at least from a sales standpoint. Despite controlling the majority share in one of the largest continents, Apple only generated about 1/4 of its total revenue from Europe.

One of the things that makes Apple such a strong company is that their iPhones are essentially a "gateway product." Once you have an iPhone, you are compelled to purchase AirPods and an Apple Watch as physical accessories. Apple also offers iCloud photo storage, Apple Music, Apple TV, and Apple Arcade, to name a few.

The proliferation of the iPhone on a global scale opens the door for Apple with its massive product line. Investors should look behind the numbers and realize the true scope of the opportunity that lies within growing iPhone sales.

Conclusion

Apple's relative undervaluation compared to competitors, as well as massive strides in international markets, makes it an appealing investment. As iPhone sales continue to grow, accessories will be quick to follow. Apple is past the stages where you will see 100% growth in a relatively short timeline. This is a stock that you buy and hold for years, and if you are smart, sell covered calls along the way.