With only two months to go in 2021, Apple stock has just breached $150 in share price, and it inches toward all-time highs once again. Today, the Apple Maven talks about what investors should expect of AAPL in November. Is now a good time to hold shares, or should investors look for opportunities elsewhere?

Thinking long term first

When it comes to AAPL, it is not a secret that I care much more about the long-term prospects than about the short-term trade opportunity. From this perspective, I continue to think that AAPL is a good stock to own at next-year earnings multiples of 26 times that I find modest, given strong fundamentals.

To be clear,investors did not seem too happy about Apple’s recent revenue miss – a rarity over the past five years at least. The infamous global supply chain issues of 2021 prevented the Cupertino company from realizing $6 billion in revenues, also putting at risk the results of the crucial holiday quarter.

But under the hood, and aside from temporary procurement and logistics challenges, Apple seems to be doing quite well. CEO Tim Cook reemphasized high demand for Apple’s products and services, which he characterized as “enthusiastic”.Average prices for devices seem to be high, and margins remain healthy.

Therefore, buying an arguably great stock at a slight discount to the early September all-time high seems sensible to me.

Seasonality is unfavorable

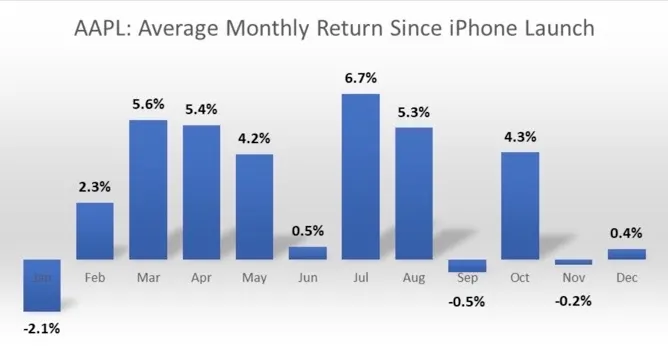

To answer the question of timing, however, one must consider short term factors. From a seasonality perspective, November is about as bad a month to buy AAPL, as the chart below suggests.

Since the launch of the iPhone, in 2007, Apple stock has produced an average loss of -0.2% in the second-to-last month of the year. Worse yet, the losses have widened to nearly -2% in December and January combined. This is probably the result of sell-the-news pressures, following the launch of the newest iPhone in the fall and amid the busy holiday shopping weeks.

In fact, the holiday season could play an important role in how Apple stock performs in November. Revenue expectations have probably been set lower, given the supply chain disruptions that the management team warned about during the earnings call. Keep an eye on official monthly retail sales data and online shopping reports to see how well consumer product companies perform in Q4.

What the technicals say

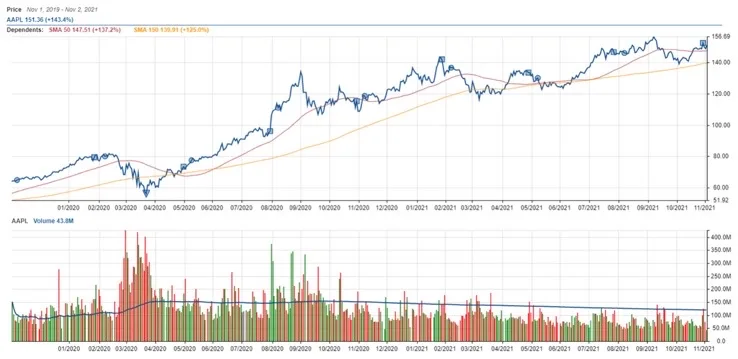

From a technical (i.e. chart-reading) perspective, the signals seem to be mixed. The first graph below shows that Apple stock currently trades just above its 50-day and 150-day moving averages, suggesting that a bit of positive momentum has started to build since right before earnings. Also, share price has consistently found support at the longer-term moving average, which is currently $140.

On the other hand, shares have been trading largely sideways within a narrow price band of $140 and $157 since the start of Q2, and the stock has yet to breach to the upside. Also, any potential bullishness of late has not been backed up by much volume. In fact, average number of shares traded recently has dipped to pre-COVID bear levels once again (second chart below).