Amazon Inc announced it will be raising its Fulfillment by Amazon (FBA) fees, starting Jan. 18, 2022, which analysis suggests could raise $3.1 billion in incremental revenue.

While the gains on the stock Friday have been muted (+0.22%) as of this writing, it's not an issue of trading volume, as the stock has traded over 3.8 million shares versus the 10-day average of 3.3 million.

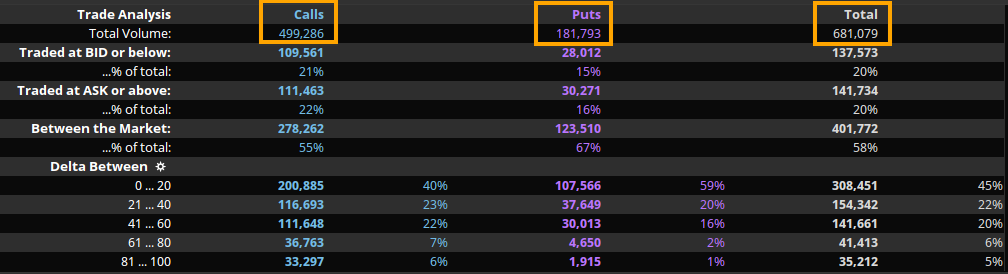

But the more unique data point is in the options market, with over 680,000 contracts traded Friday (image below).

Thus, the 681,000 contracts traded Friday represent 67% of the total options in one day. Granted, 407,000 of them are set to expire, so a good portion of the options traded could be options that are being closed or monetized.

But that doesn't account for the fact 73% of the contracts traded today have been calls, which suggests a strong bullish bias in the market.

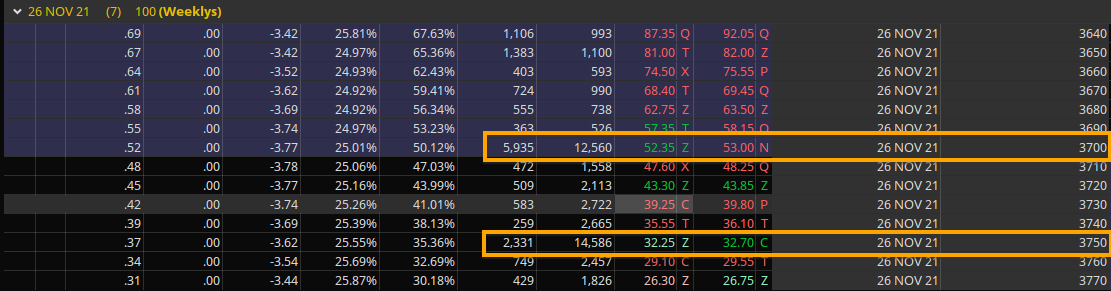

What's Next:Amazon has all-time highs just ahead near $3,770, yet the largest strike by volume for the Nov. 26 expiry is $3,75, with interest dropping off materially above here (image below).

Meanwhile, short-term option support is coming in around $3,700, with the next largest strike by volume at $3,600, which may offer support on a decent pullback should the stock fail to break the all-time highs.